Different studies show that as many as 7 out of every 10 people are neutral or apathetic about their job.

It’s understandable.

The pandemic exacerbated much of the underlying dissatisfaction people felt with their employment. It also gave them time and space to explore side hustling to make extra money.

Since you’re reading this article, you’re likely one of the millions of people who wonder whether you could make more money and be happier doing something else. At least to start as a side hustle until you get going.

Good news! You’re in the right place to learn how to begin part-time trading without risking your full-time job. With the right approach, you might discover that short-term trading is your real passion and feel inspired to make a career trading full-time.

Either way, we’re here to help.

Table of Contents

Why Is Short-Term Trading So Popular?

In the early days of the stock market, people invested using fairly long time frames—months and years. Today, high-speed internet connections allow people to trade at a pace that would have seemed impossible just a few short decades ago.

Long-term investors are still a thriving demographic, but short-term traders are a rapidly growing group.

Today, retail investing is at an all-time high, representing as much as 23% of daily trading volume. While institutional investment firms still dominate the space, it’s never been easier for individuals to enter the market and grow their wealth.

Short-term trading is a fast-paced profession that allows people to work remotely and retain a high degree of control over their hours, earning potential, and strategic approach.

Imagine waking up in the morning, checking your phone for opening prices, and enjoying a leisurely breakfast. Afterward, you sit down at your computer, enter a few trade orders, and watch the market. You might test a new strategy in the trading simulator, close out a trade, and then eat lunch.

By the end of the day, you’ve traded half a dozen assets, made a healthy profit, and finished up in plenty of time for supper. You don’t commute, and you don’t have a boss breathing down your neck.

Of course, that’s more like a day in the life of a professional short-term trader, but the principle stands for part-time trading as well.

You don’t need a degree or a lot of expensive equipment to become a short-term trader. You need relevant knowledge, skills, a digital trading platform, and some buying power. How much money you make is entirely based on your determination to practice and improve your trading skills.

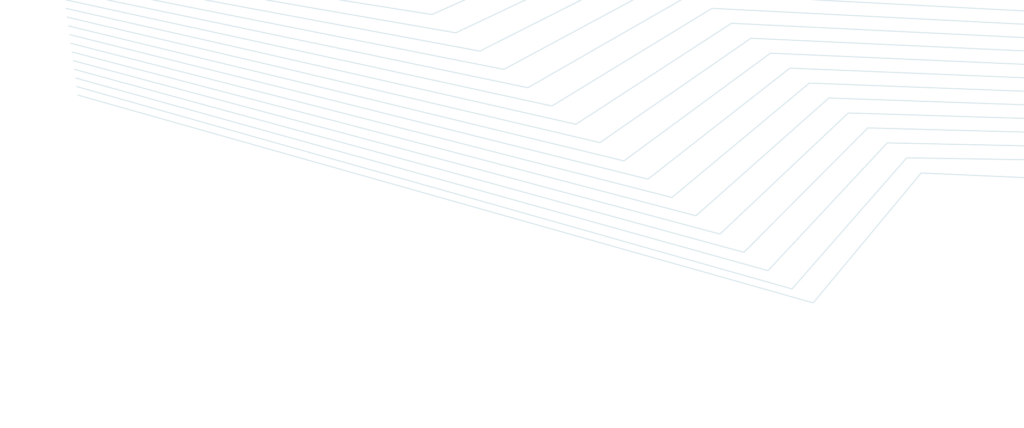

The Pros and Cons of Short-Term Trading as a Hobby

If you’ve been studying the stock market for a while, you’ve probably noticed lots of people selling courses and guides to help you make piles of cash. Let’s pop that bubble quickly: most of those claims are fraudulent.

Short-term trading isn’t for everyone and it won’t help you get rich quickly or without sustained effort. Like any profession, short-term trading has upsides, downsides, and specific requirements that may not appeal to everyone.

Although moving to full-time trading as soon as possible might sound good, it’s helpful to know that many professional traders started out on a part-time basis while they learned the ropes and built confidence.

Here are some of the pros and cons of short-term trading as a part-time pursuit.

Con 1: Additional Stress

All jobs create some stress. In part-time trading, you’re putting money on the line in addition to maintaining your full-time employment.

It can feel like holding two jobs, even though it may not look like it on paper.

Some people experience part-time trading as a source of enjoyment. They like having autonomy and extra income—it can even give them fresh energy for their full-time job. Other people struggle to manage the extra stress.

Con 2: Learning and Skill Acquisition

There’s no degree requirement for short-term trading. There’s also no test or license required to open a retail trading account and buy stocks.

However, if you want to understand how markets work and how to make money, you’ll need to invest in your education.

The best short-term traders study the fundamentals, hone their skills in a simulator, and relentlessly seek to improve their strategic advantage.

It’s a lot to add to your plate if you’re already holding down a job, in addition to your other life commitments.

Con 3: Divided Attention

If your day job demands constant attention, it may be difficult to devote enough of your focus to the markets. Short-term trading success requires detailed analysis and attention to price movement, especially when you’re first learning the ropes.

Unless you’re adept at multitasking, trying to juggle both tasks may be too challenging. Some people have jobs that aren’t highly demanding and can make it work. Only you can decide what’s right for you.

Pro 1: Low-Risk Learning

As a part-time trader with a full-time job, you’ll have the peace of mind that comes from a steady paycheck—one that isn’t tied to your trading performance. Even if you have a bad day at trading, you won’t have to wonder where your rent or mortgage money is coming from.

Part-time trading is a great way to learn short-term trading skills without heavy financial expectations hanging over your head. You should still practice smart risk management so that your side hustle doesn’t turn into a money pit.

Pro 2: Ease Into It

With more than 50 markets to choose from, you have a lot of options.

The biggest markets operate within the business hours observed by cities such as London, Hong Kong, Tokyo, New York, and Chicago, but foreign currency exchanges are open 24 hours, five days a week.

With a little bit of planning, you can choose trading windows that fit with the rest of your schedule.

Pro 3: Try It Out

The cost to get started as a short-term trader is far less than many professions and hobbies.

By choosing the right partner to help you get started, you can complete the training, learn to trade in a simulator, and even get outside funding for your trades.

If you decide that trading isn’t the career you hoped for, you’re not obligated to stick with it. And since you still have your day job, there’s nothing to stop your life from going back to normal.

5 Trading Strategies for Part-Time Trading

The principles of successful short-term trading are well-established. If you’re going to apply them as a part-time trader, you’ll need a few additional tactics to make them work for your situation.

1. Choose the Right Assets

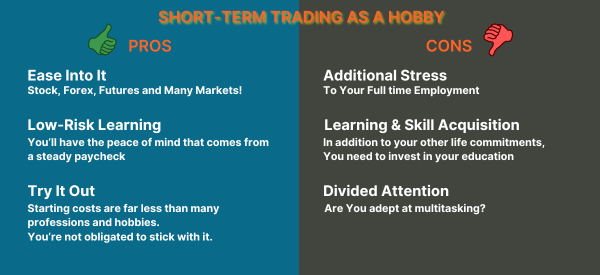

Different assets and markets operate on different time frames.

Stocks and exchange-traded Funds (ETFs) are only available to trade from 9 am to 4 pm Eastern Standard Time. The foreign currency exchange (forex) market is open 24 hours Monday through Friday. Cryptocurrency markets operate 24/7.

Compare this with your current workday. When do you have windows of time where you could focus on a market without compromising your day job?

Plan your trading sessions so that you can give as much attention as possible. Maybe you trade for an hour before and after work, or you execute trades while on break. Find a rhythm that works for you.

2. Make Your Time Count

There are three primary styles of short-term trading:

- Scalpers may only hold a trade for a few minutes, and they trade frequently within a given day.

- Day traders hold their trades for minutes to hours and always close out before the end of business to avoid overnight price volatility.

- Swing traders hold their trades for multiple days, all the way up to months in some cases. This means they can ignore daily price volatility in favor of longer-term trends.

As a part-time trader, swing trading is the most likely to fit with intermittent trading sessions because you can wait for favorable prices.

Scalping might seem like a good fit for a part-time trader because you could fit more trades into a shorter period. However, scalping is the most high-intensity trading style and requires the most precision and attention to detail. As a scalper, if you lose focus even for a few minutes, you lose money.

3. Use Pending Orders

Pending orders are a great way to set up trades that can happen while you’re doing something else. A pending order, as the name suggests, isn’t implemented immediately.

For example, if a stock is trading at $20, you can place a buy-stop at $23 and a sell-stop at $18. In this case, if the stock rises to $23, a buy order will be initiated. On the other hand, if it drops to $18, a short order will be initiated.

A good way to do this is to check out companies that publish their earnings results in extended hours. In most cases, stocks tend to either rise or fall sharply after earnings. Therefore, you could place a bracket order before the market closes.

Pending orders don’t guarantee that your order will be executed. In some cases, a lack of liquidity or demand for the asset may prevent your broker from executing the order at the price you wanted. This can result in slippage, where the price you expected is different from the price you received.

Use pending orders wisely, and you may find them very beneficial. Get sloppy and you’re likely to pay dearly for it.

4. Start With a Simulator

Sometimes referred to as paper trading, a trading simulator allows you to practice your trading skills in a realistic environment, but without using real money. It’s an absolute necessity for beginner traders, especially if you’re thinking about trading in a more serious way.

Even the most experienced traders use a simulator to test new theories and back-test strategies to validate hunches.

In fact, if you’re working with a prop firm, they may require you to prove your abilities in a trading simulator before they give you a funded trading account.

5. Start Small

Often, rookie traders jump into the trading simulator and give themselves a million dollars to start. That kind of money makes it hard to see your weaknesses because you can hide them with a big winning trade.

Whether you’re trading in a simulator or moving to the real market, we recommend starting with a modest amount of money. This allows you to practice trading discipline and risk management the way you would in real life.

You’ll feel the pain of bad trades and the euphoria of your wins. But you’ll stay grounded in the reality of how challenging it is to make enough money as a trader to replace your salary—it’s not impossible, but it’s not a cakewalk either.

As you build your confidence and competence, you can deposit more money in your brokerage account or consider using funding from a prop firm for your trades.

Part-Time Trader, Fully Committed

The best thing about short-term trading part-time is that you can build a career that works for you and your life. The work of a trader takes commitment and professionalism, even if you’re only doing it as a side hustle.

If you push yourself too hard or fast, you’re likely to burn out quickly.

There’s no rush to become a short-term trader.

We recommend that potential traders treat it as a long-term play—you can’t become a skilled trader overnight.

If you’re serious about short-term trading and willing to stay humble and disciplined, you’ll find a lucrative career waiting for you on the other side. When you’re ready to make the switch to full-time trading, we’ll be waiting for you.