Day trading is one of the most popular approaches to make money online. While the exact number is not known, it is estimated that there are millions of day traders in the United States. For example, Robinhood has over 23 million customers in the country.

More people will get into day trading in the coming years as they become more aware about the industry. However, studies show that most people who start day trading lose money. In Europe, where online brokers are mandated to state the percentage of people who fail, many of them peg the number at over 90%.

In this article, we will look at the concept of having a big dream about trading, starting small and growing your trading career.

Table of Contents

Dream big and set ambitious goals

Dream big. Start Small. Act Now

Robin Sharma

The financial industry can be highly rewarding. Today, some of the wealthiest people in the world made their fortune as either investors or traders. For example, Warren Buffett made his wealth by being a long-term investor. He is now one of the biggest shareholders in companies like Apple and Coca-Cola.

Kenneth Griffin, the 37th biggest person in the world, made his money by starting Citadel, a hedge fund and market maker. He has a net worth of over $37 billion. Similarly, James Simons, the founder of Renaissance Technologies, has a wealth of over $23 billion.

There are many billionaires who made their wealth in the investment and trading industries. While some of them came from wealthy families, many of them are self-made.

Most importantly, these wealthy people made their fortune by understanding the risks involved in the financial market.

Goal setting tips

While making money – and a lot of it – is important, it should not be your end goal. Instead, your goal as a trader or investor should be to make money and live a fulfilled life. Besides, we have seen many financially successful people who live miserable lives.

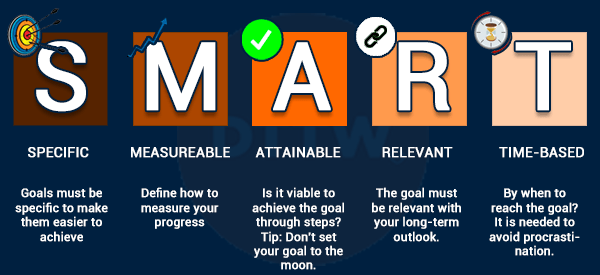

When it comes to goal-setting, you should always consider the SMART approach. First, the goal should be specific, where you know what to achieve. In this case, a specific goal could be making money and living an all-rounded life.

Second, it should be measurable. Here, you could give yourself targets on what you want to achieve. Third, it should be achievable. For example, if you have a $10,000 account, it is not ideal to set a goal of making $1 billion in 2 years.

Fourth, the goal should be relevant and time-specific. On time, always set your own timelines on when you want to achieve.

Start small

An important thing to consider is that you should always start small. Unlike in the past, it is possible to start a small account and grow it over a long time.

This trend has been made possible by companies like Robinhood and WeBull that don’t have a minimum account balance. As such, with your $10, it is possible to buy a stock and see its price rise over time.

Further, these companies have introduced fractional shares that make it possible for one to buy any shares regardless of their account balance. For example, with $100, you can buy a percentage of a share trading at $1,000.

Most importantly, many companies have introduced leverage. Leverage is a loan that traders use to amplify their trading profits.

While leverage is a good thing, it has its inherent risks. As such, while a big leverage can lead to a higher profit, it can also cause a big loss.

It is always recommended that you start small and then grow your account gradually. As you do this, focus on gaining more experience by learning important things like technical analysis, fundamental analysis, and sentimental analysis. Most importantly, ensure that you have a good and tested trading strategy.

At Day Trade the World, we recommend that our traders should focus on implementing 10,000 trades in a demo account before they move to a live trading account.

Act now

The next thing you need to do is to act now. By this, we mean that you should take your time seriously. One of the best ways to look at this is to assume that you started trading a decade ago. If you had done this, you would now be a highly experienced and profitable day trader.

If you are interested in becoming a professional trader or want to try trading, seize the opportunity, start today. Take the first step by opening a demo account, deciding if this is the right career for you, getting familiar with it, and trying to understand your gaps. The longer you postpone this step, the further away your dream will be.

There are several other things that will help you do this. First, seize opportunities as they arise. For example, if you see a good stock to buy, do so before the situation changes. Also, always be on the lookout for new opportunities.

Second, always ensure that you avoid analysis paralysis, a situation where you over-analyze and overthink. By doing so, you become unable to make a good decision.

Third, you should always be on the lookout for new trading opportunities when they arise. Some of the top things to look at are corporate earnings, breaking news, and economic data.

Make progress

Waiting for perfection is never as smart as making progress

Seth Godin

Finally, you should always work to improve yourself. On this, you should remember that no one is 100% perfect when trading and investing.

In the past, we have seen many well-known investors make huge losses. For example, Warren Buffett made a huge loss when his investment in IBM failed

Similarly, Bill Ackman lost over $4 billion when his investment in Valeant Pharmaceuticals failed. Some of the biggest investors and traders have all made big mistakes in the past.

Therefore, you should use your challenges as stepping stones to better your day trading approach. Learn from your mistakes.

Further, you can also decide to expand your trading business by opening a trading floor. A floor is a place where you have several people trading in your office and you act as the manager.

Summary

This article has looked at the concept of starting small, overcoming challenges, and growing your account gradually. As you will realize, being a successful day trader takes a lot of work, time and energy.

If you follow these tips, you will be both a highly successful day trader both financially and mentally.

External useful resources

- Should You Quit Your Job to Trade Stocks? – Investopedia