Goal-setting is an important concept in all industries, including day trading and investments. Historically, people who succeed the most tend to be highly experienced and profitable are those who set realistic goals.

In this article, we will look at the concept of SMART goals and how they apply in the financial market.

Table of Contents

What are SMART goals?

The concept of SMART goals is widely applied in the corporate industry where teams are mandated to set realistic goals. For example, a tiny social media company that seeks to battle a behemoth company like Facebook in a year’s time is said to be over-ambitious.

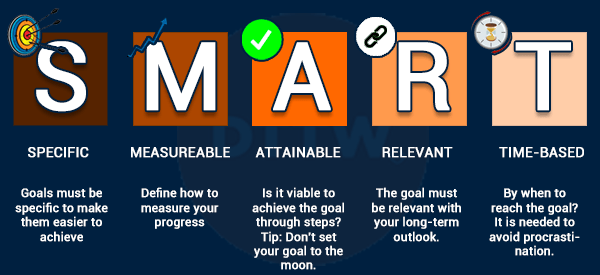

The same applies to the financial market, where traders and investors are required to set achievable goals. The goal that you set should be divided into five key parts that are summarized as SMART.

Specific

A goal should be specific in nature. This means that it should have in mind what is about to be accomplished. In line with this, the goal should be specific with the steps that are needed to achieve the goal.

Let’s see a good example of this. As a new trader, you can set a specific goal on when you want to be done with understanding technical and fundamental analysis.

Further, you want to set a specific goal on how you want to grow your account. For example, if you have a $10,000 account, you can have a goal of growing it by 5% per month.

Having a specific goal is important because it will give you a purpose for what you want to achieve. On the other hand, trading without a specific goal will often lead to losses and psychological issues.

Measurable

A good goal should always be measurable. Ideally, while having a good specific goal is important, you should be able to measure it well. For example, if you have a company, you could set a goal of achieving 10% revenue growth year-on-year.

In the same way, as a trader, you should ensure that your goals are measurable. This means that you should place a number to your specific goal.

As part of this measurable aspect, you should have a roadmap of how you want to achieve this. For example, you can have a goal of making 5% returns every month by embracing the trend-following or arbitrage strategy.

Achievable

Having a defined goal is a good thing. Achieving it is another thing. In this case, you should ensure that your goals are achievable. If you are starting trading with $10,000, there is no way you will grow the account to $1 million in a year.

Therefore, you should set a goal that you can achieve. For example, in this case ,you can set a goal of growing the funds gradually to $15,000 within a few months. As part of this part, you should have a strategy of how to achieve that goal.

Related » Dream big.. start small!

Relevant

The other part of SMART goals is that they should be relevant, realistic, and result-based. Ideally, you want a goal that is realistic. There are several ways this part matters. For example, does the goal have the right time? Also, does it seem worthwhile and are you the right person to achieve it?

Time-bound

Finally, you should set a goal that is time-bound. Without the time aspect, a goal becomes a dream.

Therefore, in this case, you should aim to achieve a certain goal within a certain duration. For example, if you have a $10,000 account, you can aim to grow it to $13,000 in three months.

Also, as a beginner, you can have a goal of learning about trading and moving from a demo account within six months.

Why the SMART approach is important in day trading

In the previous section, we have looked at what the SMART approach strategy is in day trading and investments. In our experience, people who focus on the five stages tend to perform better than those who ignore it.

For example, having goals with a specific timeline will make it easier for you to work on them. Here are the three reasons why using the strategy is important.

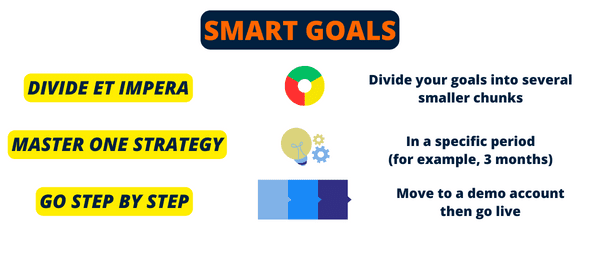

Smart goals

Goals are an important part for anyone in the financial industry. This is an important lesson that has been expressed by some of the most successful investors and traders like Warren Buffett and Jim Simmons.

Having goals is not enough. Instead, you should focus on having smart goals that are not only achievable but also realistic. There are several things that you can apply this approach to in your trading.

First, you could divide your goals into several smaller chunks. For example, if you are new to trading, you can start your journey by reading books about the market. In this case, you can set a goal of reading at least three books about the market in a month.

In the next step, you can set a goal of mastering one of the strategies that you have learnt above. You can learn this strategy in a specific period, say a month. Finally, you can move on to a demo account and then to a live account.

There are several reasons why this strategy is important. First, it will help you avoid focusing on too much information at once.

Second, because of the set timelines, you will be in a good position to master the approach well. Further, having a smart goal will help you become a more successful trader faster.

Smart on trading plan

The other important benefit of using the SMART strategy is that it will help you create a good trading plan or strategy. It does this in several ways.

For example, the SMART approach will let you focus on the most efficient trading strategy in the market. Some of the most popular trading strategies are scalping, swing trading, trend following, and quantitative trading.

Therefore, using the smart trading approach, you will focus on the trading strategy that is more appropriate to you. For example, while quantitative trading strategy is a good one, it is not appropriate for everyone. Also, using the SMART strategy will let you create it in a shorter duration.

Some of the top things to consider when creating a trading plan are your motivation, your attitude towards risk, your personal risk management rules (to help you with this, you can develop a matrix to better assist you in your decisions), and how you will draft your trading calendar.

Smart on trading strategy

You can use the SMART approach to create your trading strategy. As mentioned, there are many trading strategies that you can use like scalping, VWAP, and swing trading among others.

In this case, you should focus on a specific strategy instead of several ones. Doing so will help you avoid what is known as analysis paralysis.

The strategy should be measurable. In this case, you should be able to know how profitable it is. Further, it should be attainable or achievable.

For example, some strategies like trend-following cannot work well when there are specific trends. It cannot work well when the market is volatile or when it is range-bound.

The strategy should be relevant. There are numerous ways to look at this. For example, some strategies work well for different financial assets. There are those that work well in the forex market and those that are good for the stock market.

Finally, the strategy should be timely. For example, if you are a day trader, you should ensure that it works well on extremely short timeframes. In day trading, your goal is to close all trades before the market closes.

As part of this approach, you can include the multi-timeframe analysis, which includes doing analysis on several periods.

SMART vs SWOT analysis

Another tool that is highly popular in decision-making is known as SWOT. SWOT is often different from SMART goals.

In this case, there are several differences between the two approaches. For one, SWOT is mostly used by companies as they seek ways to grow their competitive advantage. SWOT stands for:

- Strength – This is where a company looks at its strength in the market and looks for ways to improve it. Day traders can do the same and identify their areas of strengths and then focus on them. For example, if you are good at trend-following, you can come up with a strategy that capitalizes on it.

- Weakness – This is where a company looks at its weaknesses and works to improve them. It also looks at the external weaknesses of the competitors. Similarly, as a trader, you should look at your weaknesses and work to fix them.

- Opportunities – This is where a company works to find opportunities and then maximize them. For example, a trader can look at opportunities in undercovered stocks and other assets.

- Threats – Finally, companies look at the threats in their businesses and work to solve them. Similarly, as a day trader, you should work to identify threats in the market.

Therefore, while SWOT and SMART approaches are used in the corporate sector, they can also be used in trading and investments.

Benefits of the SMART strategy

Using the SMART strategy in day trading has a number of benefits, including:

Consistency in trading

One of the most challenging things that all traders go through is consistency in the market. On this, they struggle to achieve profitability in most of the trading sessions.

When you seriously follow the strategies championed by the SMART strategy, you will improve your consistency dramatically.

Help you with focus

The next thing is that the SMART approach will help you to improve your trading focus. This happens simply because it will help you focus on a single strategy that works. It will also give you ideal timelines to achieve your goal.

Related » Where Do New Day Traders Struggle the Most?

Avoid psychological traps

Further, the SMART strategy will help you avoid the many psychological traps that exist in the market. It does this by ensuring that you have clear goals and how you will achieve them.

Summary

Having a goal is an important part in all industries, including trading and investments. However, having a goal itself is not enough.

In fact, one of the reasons why people don’t achieve their goals is that they don’t meet the SMART criteria. For example, many people have given up simply because the goals they set were unachievable.

Therefore, using SMART and even SWOT can help you set achievable goals easily.

External useful resources

- How to use SMART goals to build your trades business – Skills Certified