Scalping is a popular trading strategy that involves buying or shorting assets and exiting after a few minutes at a loss or a profit. The strategy differs from others where traders hold trades for hours, days, or even weeks.

In this article, we will explain how scalping works, some of the best strategies to use, and its pros and cons.

Table of Contents

What is scalping?

Scalping is one of the several approaches that you can use in day trading. In it, traders typically open trades and then exit after a few minutes.

As a result, the goal of scalping is not to accumulate too much profits per trade. Instead, traders aim to buy and exit trades with a small profit and then do it several times in a day.

For example, assume that a small trader has a $1,000 account. In scalping, the trader can decide to open trades that net a profit of $10. If they open 20 trades per day, that is a cool $200, meaning that they can easily double their money within less than a month.

Opening 20 trades per day might seem much but many scalpers open more trades than that.

Scalping vs day trading

A common question is on the difference between scalping and day trading. Day trading is a practice of opening trades and ensuring that you have closed them within a day.

A key rule in day trading is that no trade should be left open overnight. Therefore, scalping is one of the several types of day trading.

Not all day traders are scalpers though since many of them focus on opening a few trades and holding them for a few hours.

Scalping vs swing trading

Swing trading is another popular trading approach that has major differences with day trading and scalping. It is a more thematic trading style where traders look for big moves and then hold their trades for a few days. In this, they are not necessarily afraid about overnight risks.

As a result, there are several differences between scalping and swing trading. In swing trading, traders use longer charts like hourly and 30 minutes. In scalping, traders use extremely short-term charts, including a one-minute or a 5-minute chart.

The other difference between scalping and swing trading is that scalper traders focus on opening tens of trades per day while swing traders open several trades in a week.

Rules of scalping

There are several rules that traders use when using the scalping trading strategy. Some of the most popular ones are:

Use short charts

The first rule of using the scalping trading strategy is to use extremely short-term charts. In most cases, you should work with a chart that ranges from 1 minute to 5 minutes.

These charts will give you all the information you need about an asset. It is always wrong to use longer-term charts since they will always give you the wrong information.

Cut your losses

Not all your trades will be profitable in scalping. Therefore, you should always cut your losses as early as possible.

Holding the trades for so long will often have unintended consequences. For example, you might transition a trade from a scalp trade into a swing trade.

Follow the trend

Another important rule in scalping is that you should avoid going against the trend. Always follow the existing trade!

If the asset’s price is rising on a 1-minute chart, just buy it and then follow the trend. Similarly, if the price is falling, ensure that you place a short trade.

Multi-timeframe analysis

The other rule is that you should ensure that you look at other chart timeframes before entering and exiting your trades.

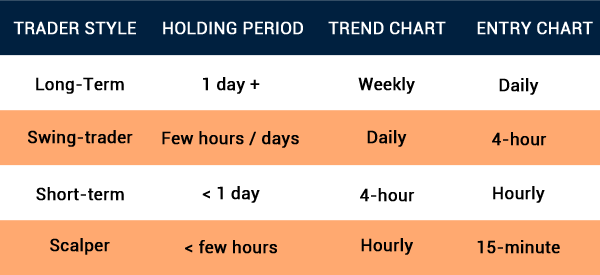

In another article, we looked at the rule of three, which should be your guide. It simply means that you should look at several charts before you open a trade.

In most cases, scalpers look at the 10-minute chart, 5-minute chart, and 1-minute chart.

Protect your trades

The other scalping rule to remember is that you should always protect your trades. Fortunately, most brokers have tools to make this possible.

A stop-loss will stop your trade when it reaches a certain loss threshold while a take-profit will stop it when it reaches a preset profit threshold.

Know about correlations

It is always important for you to know more about correlations between assets. For example, there is a close correlation between Apple and Microsoft.

Therefore, if you open a buy trade on Apple and a sell trade on Microsoft, one will be profitable while the other one will make a loss.

How scalping works

The next question is how scalping works. Scalping works in a relatively simple approach that depends on your trading strategy. We recommend that you use the following steps to scalp well:

- Find top-moving stocks: We recommend that you use a watchlist that identifies the top-moving stocks before the market opens. In most cases, you should focus on stocks that are making big moves and those with a higher relative volume.

- Do a multi-timeframe analysis: As mentioned above, conduct a multi-timeframe analysis that to identify key support and resistance levels.

- Use indicators: In scalping, we recommend that you use a few indicators like moving average and VWAP to identify entry and exit locations.

- Look at unique patterns: Look at candlestick and chart patterns like triangles and head and shoulders to identify entry and exit locations.

- Set stops: Further, use your risk/reward analysis to set key stop-loss and take-profit levels.

Assets you can scalp

There are many assets in the financial market that you can trade and invest in. Here are the most popular ones that you can scalp easily.

Stocks

There are thousands of stocks that you can scalp. However, we recommend that you focus on companies that have some unique characteristics. For example, focus on companies that have a higher relative volume and those that are highly liquid.

Depending on your account size, look for companies that are not so expensive. While it is possible to trade fractional shares, it does not make sense to trade shares of Berkshire Hathaway that trade at more than $491k per share. Instead, look at companies that are reasonably priced.

Cryptocurrencies

It is also possible to scalp cryptocurrencies. Like stocks, ensure that you are looking at coins that are highly traded and those that have higher liquidity.

Websites like CoinMarketCap and CoinGecko provide more information about the daily volume of cryptocurrencies. The rule is, just don’t scalp a coin because it is rising sharply.

Commodities

There are many commodities in the market. The most popular ones are silver, gold, platinum, and crude oil.

Other commodities that are offered by brokers are wheat, corn, soybeans, nickel, and natural gas. You should focus on popular commodities that have more volatility, for example you can scalp gold.

Forex

Forex is the short form for foreign exchange and is the biggest asset class in the financial industry with over $5 trillion in daily volume.

There are hundreds of currency pairs that you can scalp. However, we recommend that you focus on a few of the most liquid ones like:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CAD

Forex minors like EUR/GBP, AUD/GBP, and GBP/CHF and exotics like TRY/ZAR and BRL/TRY tends to have low volume and wide spreads that make them inappropriate for scalping.

Other assets

There are other assets that you can scalp as well. For example, it is possible to scalp exchange-traded funds (ETFs), bonds, and indices.

Ideally, the best assets to scalp should have the following qualities:

- They must have a higher relative volume. This volume makes it easy to enter and exit positions at a lower cost.

- They must be reasonably priced. Depending on your account balance, go for assets that are reasonably priced. For example, in shares, you don’t want to scalp shares trading at over $500 each.

- Catalyst: The asset needs to have a catalyst that you are focusing on. Some of these catalysts are corporate earnings and economic data.

Best scalping trading strategies

Scalpers use three main approaches in scalping, which we will look at in detail:

- Using indicators

- Using chart patterns

- Using news

Using technical indicators in scalping

There are many technical indicators you can use in the financial market. The most popular of them are:

- Moving averages

- VWAP

- Relative Strength Index (RSI)

- MACD

- Stochastic Oscillator

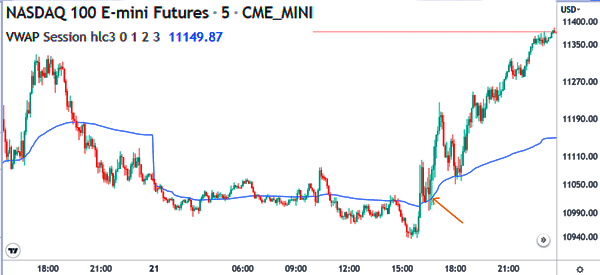

among others. However, in our experience, we have found that most scalpers use trend indicators like moving averages and VWAP to enter trades. A good example of the VWAP indicator at work is shown below.

The chart shows that a trader would have placed a short trade when the stock made a bearish cross on the VWAP. The trader would then hold the short trade as long as the price was below the VWAP.

Therefore, while it is possible to use oscillators and technical indicators like accumulation and distribution, commodity channel index, and awesome oscillator, most scalpers avoid using them altogether.

Using chart patterns

The other strategy to use is known as chart patterns. There are two main types of patterns in the market: chart and candlestick pattern.

Chart patterns are more broad-based and often take time to form. Examples of the most popular chart patterns for scalping are the head and shoulders, rising and falling wedges, triangles, and double-top among others.

The other patterns are related to candlesticks. Examples of the popular candlestick patterns are hammer, harami, piercing line, morning star, hanging man, and evening star among others.

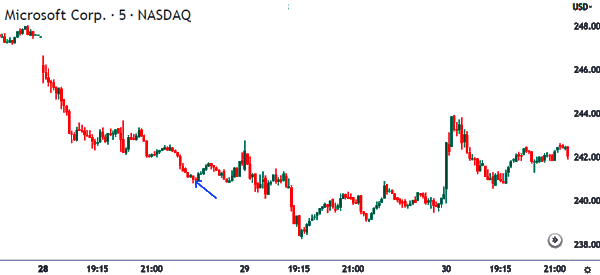

A good example of this is known as shown below. As you can see below, the morning star leads to more upside in an asset.

News trading

The other strategy is known as news trading. It is a strategy that lets people trade the latest and upcoming news.

The most popular news trading strategy focuses on companies’ earnings. To do this, traders use the economic calendar to anticipate the upcoming news.

For example, as shown below, Disney shares plunged sharply after the company reported weak earnings.

Best brokers for scalping: features to consider

A common question is on the best brokers you need to use when scalping. Fortunately, there are many brokers that you can use to day trade. You should consider brokers that have the following features:

- Pricing: As mentioned, scalping involves opening tens of trades per day. Therefore, you want to have a company that charges little or zero fees. Fortunately, most of the leading exchanges in the US like Robinhood, Schwab, and TD Ameritrade don’t charge commissions.

- Assets: You should consider a broker that has adequate assets for you to trade. For example, you want a company that provides all the most popular stocks, cryptocurrencies, commodities, and exchange-traded funds (ETFs).

- Easy-to-use platform: Further, you want a broker that provides a platform that is easy to use. This means that it should be easy to analyze stocks in the platform and then execute them well.

- Fast: Consider a broker that is not only fast but one that is reliable as well. As a scalper, you want a company that has little or no slippage since small market moves can impact your profitability.

Risks and benefits of scalping

Risks of scalping

There are several risks that are associated with scalping, including:

- Slippage: Slippage happens when trades are implemented at a different price compared to where it was placed. This happens mostly in highly volatile market.

- Fatigue: Unlike other strategies, scalping can lead to more fatigue since a trader focuses on more trades per day. Swing traders can make money by opening less than five trades per week.

- Trading costs: If your broker does not provide you with free commissions, then you can easily have higher trading costs compared to other strategies.

Benefits of scalping

- No overnight risks: There are usually no overnight risks when you are using the scalping strategy.

- Quick way to make money: The other benefit is that scalping is that it is a relatively easy way to make money, especially if your things are going on well.

- Easy to learn: Unlike other trading strategies, scalping is relatively easy to learn, as we have explained above.

- It can be highly profitable: Scalping can be highly profitable than other strategies when it is done right.

- React to news: Scalping is a strategy that lets traders react quickly to new news in the market. For example, if a company launches a new product, you can easily react to the news and exit before the momentum fades.

- Following the trend: The other benefit of scalping is that it lets you follow the trend using extremely short-term.

When to avoid scalping

Like other trading strategies, scalping does not work all the time. We recommend that you avoid scalping in two main times. First, you should avoid it when an asset is extremely volatile since it is possible for the trades to go against you.

Second, at times, you should avoid scalping when the market is ranging. In most cases, opening such trades will not be profitable. Instead, you should scalp when assets have made defined bullish or bearish trends.

Skills you need to be good at scalping

There are several skills that you need to be goood at scalping, including:

Patience

Patience is an important skill that you need to be good at when using all types of tradin strategies. There are several periods when you need patience in scalping. For example, if your trade is making a loss, you need to be patient as you wait for it to be profitable.

Also, you need to be patient as you wait for your preferred combination to work. For example, in the chart below, if your goal is to open a trade when the stock moves above the VWAP, you need to be patient for that to happen.

Further, you need to be patient before you start your trading career. Don’t start scalping before you have a good understanding of how trading works. Take at least four months to learn about how to trade before you move to a live account.

Discipline

The second thing that you need to have is discipline. There are several areas where discipline is needed when scalping.

First, you need to be disciplined to set a stop-loss and a take-profit for all your trades. Second you need to be disciplined to ensure that you are using your preferred trading strategy.

Third, ensure that you are setting the right trade sizes and the right leverage. A high leverage will always put your trading account at risk.

Fast decision-making

The other important skill you need to have is fast decision-making. This is important since every second matters when you are a scalper.

It is also important because scalpers aim to benefit from extremely small market movements. If you cannot analyze the asset and decide what to do in a short time, you will lose momentum. And you will have essentially wasted time.

Risk management

Risk management is the process of ensuring that you are reducing risk in the market. Some of the most popular risk management strategies to use are having a stop-loss for all your trades, using a small leverage, and paying a close attention to your trade sizes.

These are tools you can’t do without regardless of your trading style, but you must use them correctly.

For example, mismanaging your stop losses can hugely cut your possible gains.

Trading strategy

Above all, you should ensure that you have a good trading strategy. We recommend that you spend a lot of time testing different approaches before you move to a live account. In line with this, have the right focus and the tight mindset.

Scalping trading strategies

There are several scalping trading strategies that you can use in the market. The most popular ones are:

Trend following

This is a popular strategy that involves looking at an existing trend and following it. For example, if an asset’s price is rising, you should ensure that you follow it. In other words, don’t attempt to go against the trend.

A good example of this is shown below. In it, we see that Apple shares are rising on the five-minute chart. As such, you can decide to buy and hold the trade.

Reversal

Reversal is a trading strategy where a trader aims to identify an existing trend and then wait for its reversal.

Traders use several reversal strategies, including head and shoulders, double and triple top, and rising and falling wedge. Also, there are reversal candlestick patterns like hammer and bullish engulfing.

A good example of this is shown below. In it, we see that the stock made a double-bottom pattern and then resumed the bullish trend.

Breakout trading

The other popular scalping strategy is known as breakout trading. This is where you buy or short an asset that is close to a breakout.

For example, if a stock is in a tight range, you can trade it when it is nearing a certain point. One way of trading breakouts is setting limit orders, as shown below.

Divergencies

A relatively uncommon trading strategy is known as divergencies. This is where you use oscillators like the Relative Strength Index and the MACD.

Divergencies happen when the asset price and these oscillators are moving in different directions.

1-minute and 5-minute strategies

All these strategies should be applied on the 1-minute and 5-minute charts. These charts are highly responsive for scalping strategy.

As mentioned, we recommend against using longer-term charts like hourly and daily. Even in your analyses of multiple timeframes, you should start with those no wider than 15 minutes.

FAQs

Is scalping profitable?

Yes. Scalping can be a highly profitable trading strategy. However, like other strategies, it requires a lot of work for it to be profitable. We recommend that you spend a few months learning in a demo account before you move to a live account.

Is scalping good for beginners?

Yes, scalping is one of the best strategies for beginners since it is easy to learn and master. All you need to do is to learn and test it using a demo account.

How long do scalpers hold trades?

In most cases, scalpers seek to hold trades for less than five minutes. The goal is to enter a trade, make some cash, and then exit.

Can I be a scalper and a day trader?

As we mentioned, scalping is a type of day trading. Anyone can be a day trader. However, you need to take time to learn more about it and how it works.

How many trades do scalpers do in a day?

In most cases, scalpers aim to open between 5 and 10 trades per hour. This means that some of them can open up to 100 trades per day. But for starters, we recommend that you start with just a few trades.

Ready to get started?

See why Day Trade The World™ is your best connection to 50+ global trading markets.

Fill out our form below and a member of our sales team will get in touch!