Scalping is a trading strategy that involves buying and selling of securities within a short period at a profit. Scalpers typically open tens or even hundreds of trades per day and aim to make a small profit in each.

It’s definitely a more time consuming strategy, but it allows you to respond very quickly to market fluctuations (which is impossible for investors). In this article, we will look at what scalping is, its alternatives, and some strategies to use.

Table of Contents

What is scalping?

Scalping is a method of day trading where a trader opens many trades per day. The overall goal of the strategy is to make small profits many times in a day. For example, if you can open 10 trades per day and make a $50 profit in each trade, that will be a cool $500. In a month, assuming that you trade Monday to Friday, that will be about $10,000.

» Related: Scalping trading: key info you MUST know

How scalping works

Scalping works in a relatively simple way. First, the trader needs to have a set of assets to trade. These assets could be stocks, currencies, commodities, exchange-traded funds (ETFs), and even bonds.

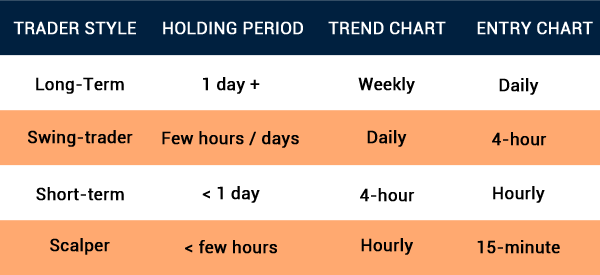

Second, the next step is to tweak chart settings. Most scalpers prefer using very short-term charts that range from 1 minute to 5 minutes. In most cases, long-term charts like hourly or daily charts cannot work well in scalping. A candle in an hourly chart usually represents one hour. As such, it does not make sense to use such a chart when your goal is to identify trades you intend to hold for a few minutes.

Third, the trader identifies some top moving assets and then trades them. After opening the trade, they will wait for it to turn positive and then close the trade at a profit.

Related » How to improve scalping trading

How to scalp well? Scalping strategies

To be clear. Most experts believe that scalping is a relatively risky trading strategy. However, there are several strategies that can help you do it well.

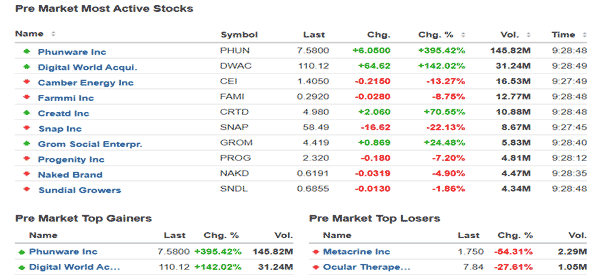

Top Movers and acrive stocks

First, you should first look at the top movers or most active stocks. The goal of doing this is to ensure you are trading assets that are seeing substantial market activity. Fortunately, there are many free resources that give you a set of this kind of stocks. You can also look at the shares that are hitting their 52-week highs or 52-week lows.

Our favourite platform for these movers is Investing.com although you can use others such as Market Chameleon and Webull. The chart below shows the stocks that were most active, best performing, and worst performing in pre-market trading.

Alternatively, you could subscribe to our watchlist. This is a free resource that sends you the most active stocks to watch and why they are moving.

» Related: Why Traders need a Stock Watchlist (and how to Built it)

Use technical analysis

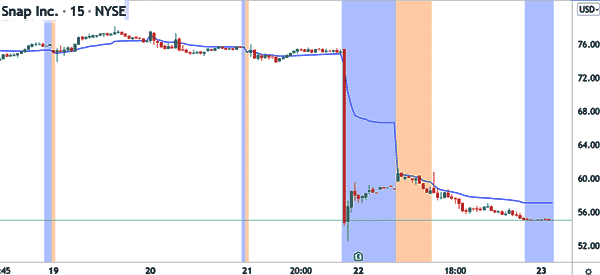

Second, you can decide to use technical analysis to find market opportunities. Many traders use several strategies to do this. One of the best indicator you could use in scalping is known as the Volume Weighted Average Price (VWAP). This is an indicator that looks at the volume-weighted average price of an asset.

For example, in the chart below, we have applied VWAP on SNAP’s stock. In this case, a scalper could remain short the stock so long as it was below the VWAP indicator.

There are other indicators that are relatively popular among scalpers. Some of them are the exponential moving average (EMA), Bollinger Bands, and even the Ichimoku Kinko Hyo.

Initiate a trade (long or short)

Third, after identifying a market opportunity, you should initiate a long or short trade. When you open a long trade, you are simply betting that the asset’s price will keep rising. Similarly, when you open a short trade, your goal is that the asset’s price will keep falling. You should always ensure that you have protected your trades with a stop-loss or a take-profit.

Finally, you should exit the trade when you make a profit. Remember, your goal is not to hold your trades for an extended period of time.

In addition to technical indicators, many scalpers use other approaches to trade. These include price action, where they use chart patterns like triangles, bullish and bearish pennants and flags, and rectangles to do this analysis.

Alternatives to scalping

There are other alternatives to scalping. First, there is ordinary day trading, which involves opening and closing trades at an extended period. The goal of day traders is to ensure that all trades have been closed within the day. They mostly avoid leaving their trades overnight because of the risks that are involved.

Second, there is a trading approach known as swing trading. This is the trading approach that has a longer runway. Here, traders are more comfortable holding trades for a few days. Their goal is to identify trends that will last for a few days and hold them.

» Related: Day Trading vs Swing Trading

Finally, there is position trading, where the trader will buy or short an asset and hold them for an extended period. Think of position trading as investing. These traders use longer-term charts like daily and weekly charts for their analysis.

Summary: Is scalping a good idea?

Scalping is one of the most popular trading strategies today since more people are becoming traders. In this article, we have looked at what the strategy is, some of the strategies to use, and whether it is a good strategy to use.

There are several schools of thought about scalping. On the one hand, there are trading professionals who strongly believe in the approach. These are mostly people who have made a living using the scalping methodology.

On the other hand, there are those who believe that scalping is a bad idea since it exposes a trader to substantial risks. For one, opening more trades is riskier than opening fewer ones.

Still, we take the middle ground since many people have succeeded using the scalping method. We believe that you can do the strategy well and see success. However, you should always do it after practising for years and seeing how it is performing.

External Useful Resources

- Why Scalping Strategies Won’t Work For You – Bulls on Wall Street