Ever heard the joke, “How do you make a million dollars as a farmer?”

Start with two million dollars.

Sometimes, the world of short-term trading can feel the same. You need money to make money, right? Yes and no.

Successful short-term traders understand the power of a percentage when applied to volume. If you buy a stock at USD 1.15 per share and it climbs to USD 1.25, you could profit 8.7%.

It’s USD 0.10, but the most important factor is volume: how many shares can you afford to buy? If you bought 10,000 shares, you pocketed USD 1,000.

What about 2X or 10X that many shares? The gains start to pile up.

Here’s the crux of short-term trading: if you can consistently find market opportunities, the only thing holding you back from success is how much capital you invest.

Enter funded trading. In this article, we’ll explain what it is, how it works, and how to get funded as a trader.

Table of Contents

What Is Funded Trading?

Any trader that has enough personal money can trade on the open markets. That’s called self-directed trading, and it’s obviously a type of funding.

When we talk about “funded trading,” however, we’re talking about trading with funding from a third party.

Working for a funded trading firm could involve getting hired full-time to trade on behalf of the company, using the company’s money.

Examples include trading teams at JPMorgan, Franklin Templeton Investments, or a hedge fund like Bridgewater Associates. You operate within the strategy set out by the leadership of the trading floor and work according to their rules.

In this scenario, you aren’t personally responsible for losses, just like you aren’t entitled to take home the profit from winning trades. Traders typically earn a base salary with the potential to earn commissions and bonuses.

Alternatively, you can work for a proprietary (or prop) trading firm where the company supplies you with proprietary trading technology, training, and capital for your trades. These firms work with traders who are independent, with the support of a bigger team.

Prop firms may require an initial deposit to cover equipment and training. They usually ask new traders to pass certification exams and demonstrate their trading prowess using a trading simulator.

Once a trader is certified, the firm provides capital to fund their trades. In exchange, the trader operates under stop-loss measures to limit risk to the firm. As the trader develops a history of successful trades, their buying power increases, and they can take home up to 90% of profit, depending on the asset.

Unfortunately, some trading firms are out to prey on independent traders. They usually require significant deposits before increasing a trader’s buying power, and they take 50% of the profits.

Worse yet, the trader is responsible for all losses. In reality, these firms make more money when traders fail—be wary of such firms.

If you’re looking to join a prop or funded trading firm, you need to read the fine print first. If the firm does not shoulder any of the risk, then it’s a bad deal.

The Benefits of Funded Trading With a Prop Firm

If you’re looking to build a career as an independent, funded trader, working with a prop trading firm is an excellent approach.

You’ll have the freedom to advance as far as your ambition takes you, and you’ll have the support of a community of like-minded traders who are cheering you on.

There are many benefits to working with a prop trading firm. Here are five of the main ones.

1. Access to Capital

Once you’ve proven that you can profit as a day trader, the doors of opportunity open.

Prop firms provide capital to their traders and increase it based on the merits of each trader. This allows most people to execute trades at a scale they barely dreamed of prior to joining the prop trading firm.

With the increased profit potential comes increased risk, which explains why most prop firms put measures in place to limit losses and dial back a trader’s buying power when appropriate.

2. Low Financial Risk

A legitimate prop trading firm doesn’t require traders to place deposits before unlocking buying power. The firm shares in the profits and shoulders the losses, as they (test and) trust the skills and ambition of each trader.

Why don’t they require traders to share the risk? Because it creates a level of hesitation and risk aversion that undermines success and growth.

Prop firms use safeguards to limit their downside and put traders at ease. The goal is to boldly enter markets and make winning trades, but it’s challenging if you’re afraid of losing your shirt.

3. Education and Support

Another way that prop firms hedge their risks is by putting traders through rigorous training courses and market simulations. If a trader knows the fundamentals and trades at a professional level on the simulator, they will perform well in the real market.

Although short-term traders tend to be ambitious and competitive, the structure of a prop trading firm lends to collaboration and intelligence sharing.

When individual traders win, the whole firm wins. It makes sense for the firm to create an environment where their funded traders have the support to get creative, execute bold trades, and repeat the process without burning out.

4. Profit Sharing

While the big trading desks ply their people with commissions and bonus checks, prop trading firms put their traders in the driver’s seat and let them collect the majority of their winnings.

Backed by the firm’s capital, funded traders can maximize their earning potential and enjoy up to 90% of the profit. This approach adds less money to the firm’s bottom line in the short term, but it incentivizes traders to win, which delivers better financial results for the firm in the long term.

5. Future Opportunities

Funded prop traders work in a meritocracy, where they’re rewarded for smart trades and consistent performance. As they succeed, their buying power grows, and so does their earning potential.

Remember, trading for small percentages at bigger volumes brings in serious profits. Traders who value their independence and know their value will find far more satisfaction working for a prop firm than in any other trading environment.

Types of Funded Trading Accounts

Some prop trading firms specialize in certain assets, countries, or markets. Others offer different possibilities across an array of options.

It also comes down to your unique funded trading style. If you’re a new trader, get a feel for what works best for you. If you’re an experienced trader, these are the types of funded trading accounts that are available.

Forex Funded Accounts

Short for “foreign exchange,” these accounts allow you to trade in global currencies, capitalizing on ever-shifting geopolitical and economic conditions.

You’ll be given capital to trade pairs of currency, looking to gain value as the power of a certain currency rises. Forex traders usually need to pass a trading evaluation or “challenge” assignment to demonstrate proficiency in this domain.

Futures Funded Accounts

A futures contract is simply an agreement to buy an asset (usually a share or commodity) at a set price but take delivery of it at a later date.

Futures trading is a specialized skill that requires traders to navigate the unique dynamics of risk that govern futures markets. Prop trading firms often put traders through a test to verify their command of futures trading.

Stocks Funded Accounts

These accounts trade equities or shares in public companies. Many countries maintain stock exchanges, with the U.S., the European Union, England, China, Japan, and India operating the largest.

Trading stocks in a single market or multiple markets requires a strong command of market forces, risk management, and technical analysis.

Options Funded Accounts

An option contract gives the trader the right (or option) to buy an asset at a fixed price, but not the obligation. Contrast that with a futures contract, where the trader is obligated to buy the asset at the agreed upon price in the future.

Options markets are highly sophisticated and require a precise understanding of market forces and winning strategies in dramatically different scenarios.

Cryptocurrency Funded Accounts

A recent entrant to the world of globally traded assets, cryptocurrencies are deeply technical. Bitcoin, Ethereum, and Tether, along with other digital currencies, can be bought and sold digitally, just like other assets.

And despite their utility as a store or method of transferring value, cryptocurrencies display unique market dynamics that require traders to stay on top of a volatile and chaotic space.

Commodities Funded Accounts

Physical goods such as coffee, oil, grains, and metals are bought and sold in commodities markets. Each commodity is subject to a host of geopolitical, economic, and weather-related factors, not to mention logistics challenges.

Traders need to understand these factors and manage their strategies accordingly.

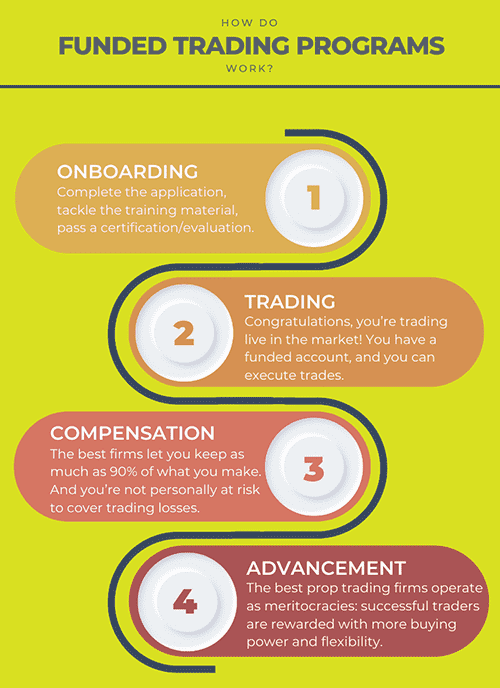

How Do Funded Trading Programs Work?

If you’re considering a career as a funded trader, you need to know what you’re getting into—how to get funded as a trader is the “easy” part.

While working in funded trading varies depending on the company and your country of residence, here’s a broad overview of what it looks like for most traders.

1. Onboarding

In this phase, you’ll complete the application, tackle the training material, and pass a certification or evaluation. This will most likely include a period where you execute trades in a simulator to hone your strategy and demonstrate your proficiency.

It also gives you the opportunity to show your discipline as a trader, including hitting certain targets, adhering to drawdown limits, and complying with the trading firm’s rules.

Once you’ve successfully passed the evaluation period, you’ll be offered a funding agreement with the firm. This covers the terms of your funding, the amount of buying power you’ll receive initially, profit-sharing ratios, trading objectives, and any supplemental restrictions.

2. Trading

Congratulations, you’re trading live in the market!

You have a funded account, and you can execute trades. Whether your funding limit is a few thousand dollars or a few hundred thousand dollars, you’re playing for real and need to be at the top of your game.

Although you may have worked in a simulator during the onboarding phase, it’s a tool that even veteran traders use to test hunches and refine their trading strategies.

You won’t win every trade, but your professional compensation and opportunity to advance are based on your performance.

You’re responsible for managing risk and protecting the firm’s capital. Stop-loss orders and maximum drawdown are some of the constraints that you must respect in return for trading with the firm’s capital.

3. Compensation

You made winning trades, and now it’s time to divvy up the money. While some firms take as much as 50% of the profit from your trades, the best firms let you keep as much as 90% of what you make.

Some assets may fall under lower ratios, but funded trading programs are designed to reward traders for their performance and compensate the firm for its capital.

It’s also important to note that you’re not personally at risk to cover trading losses, so the firm also needs to recoup enough money to maintain a growing capital base.

4. Advancement

The best prop trading firms operate as meritocracies where successful traders are rewarded with more buying power and flexibility to trade as they see fit.

Every trade you make adds to the perception that you’re either a smart trader who is going places or a wild animal who needs to stay on a short lead.

In the worst-case scenario, if you cannot meet the firm’s ongoing performance standards, they will terminate your funding agreement and ask you to trade elsewhere. This is a last resort for most firms since they try to weed out unqualified traders early in the process.

What To Look For in a Funded Trading Program

As we’ve already stated, not all funded trading programs are the same. And while their goal should be to set you up for success, some firms are only interested in taking your money.

In your search for the right firm and the right program, there are some basic criteria to examine.

Setup Cost and Ongoing Fees

Make a note of the setup costs, deposits, subscription fees, or challenge fees that you’ll be charged as a trader. Some firms use this money to help defray the cost of losing trades due to poor trader evaluation and performance.

You should expect to pay some fees, even just for the technology and training you receive. Every profession has standards, and the best prop trading firms are looking for serious traders, not casual rookies who think they can “get rich quick.”

Reputation

Spend time researching the company before you sign up. Ask questions on trader forums and social media platforms. Watch their videos and read their newsletter—their integrity (or lack thereof) will shine through.

The best prop trading firms should have clear communication channels with the public and the courage to post verified user testimonials, including praise and criticism. No firm is perfect. You’re looking for a company that can take responsibility and make things right.

Technology

Some firms offer trading platforms that are built to handicap your trades and put you at a disadvantage.

If you can’t get a modern trading platform with direct market access (DMA), you should probably look elsewhere. You also want a robust trading simulator and built-in technical analysis tools so you can validate trends and market behavior.

Compensation

Some prop firms will tell you that if you trade with their capital, they’re entitled to 50% or more of the profit. They want you to believe that they’re doing you a favor—they aren’t.

Look for a firm that lets you keep 90% of the profit from your trades and respects your skills enough to increase your buying power when you consistently make winning trades.

Also, make sure to read the fine print so that you understand who is responsible for losses and how they affect your standing in the program. If you’re not entering into a “win-win” agreement, don’t move forward.

Constraints

When you’re agreeing to use someone else’s money to trade, it’s reasonable that you would cooperate with their rules about how you trade.

Make sure that you read those rules, including permitted instruments or assets, drawdown limits, stop-loss measures, and other restrictions.

Support and Communication

Funded trading isn’t what you’d call a “team sport,” but it doesn’t have to be lonely, either. Look for firms that offer extensive training, expert coaching, and a community of like-minded traders you can engage.

Is the firm active on social media and private communication channels with traders? Are the policies and procedures transparent and easily available in written form?

Authentic prop trading firms are interested in mutual success. Their true colors show if you look at how they communicate with their traders and the public.

Consider Prop Trading With Real Trading

At Real Trading, our promise is simple and clear: we win when you win.

We’re a prop firm, meaning we provide proprietary technology and training for funded traders. We exclusively work with traders who get certified and are capable of trading with our capital—which makes us a funded trading program as well.

Outside of your initial deposits to cover training and technology costs, you’ll always trade using Real Trading capital. How much buying power you get is directly tied to your performance in the evaluation phase.

This approach allows our traders to make way more money than they could elsewhere. It also builds sustainable long-term revenue for our company. Here is what you can expect when trading with us.

Funded Trading

When you pass the Real Trading evaluation process, you can start with USD 50,000 for trading markets such as NYSE (AMEX), NASDAQ, Toronto Stock Exchange, Chicago Stock Exchange, Bovespa, and all other American markets.

You can also get USD 400,000 for trading on Forex markets.

Depending on how well you perform as a trader, Real Trading will increase your buying power to help you increase your success.

Cutting-Edge Technology

With our technology—including the PPro8™ trading platform and TMS™ simulator—you’ll have the industry’s best tools at your fingertips.

When you trade using PPro8, you get direct market access (DMA), meaning that you never get delayed prices or use contract for difference (CFD) trades.

Our TMS simulator is exactly like trading using PPro8, but you’re not putting real money into the game. The TMS lets you test your strategies, refine your skills, and validate new techniques. It’s the best way to prepare for your best performance.

Direct Access to Over 90 Global Markets

Real Trading provides our funded traders with DMA on various financial instruments across over 90 markets. You get real-time quotes and action on stocks, futures, options, and crypto.

Pick the assets and markets you want to trade and hit them hard. The opportunity is waiting for you if you’re hungry and ready to work for it.

Education and Support

Every trader who joins Real Trading goes through our Beginner and Advanced trading courses, which equip you with the fundamental knowledge you need for short-term trading on our technology.

Our trading coaches can answer questions and guide you on your journey to becoming a professional short-term trader. And our global community of short-term traders is constantly growing.

With Real Trading, you can learn from some of the best short-term traders in the industry and celebrate your success with peers who want to see you win.

A Rewarding Career

Few prop trading firms let their traders take home up to 90% of the profits. They’re happy to benefit from your talent and hard work, but they don’t want to give you a fair share of the winnings.

As a short-term trader funded by Real Trading, you’ll embark on a profitable career where you’re fairly compensated and encouraged to grow. You also get to use our capital to trade without being personally liable for losses.

Real Trading: It’s Time to Trade With the Best

Most people will not travel the road to becoming a funded trader. They don’t have the ambition, skill, or desire to commit fully.

However, for smart, motivated traders, there’s no better place to build your future than with Real Trading.

After reading this article, you not only know how to get funded as a trader, but also what and where to look for the best benefits of funded trading.

Once you’re armed with the right technology, education, and sufficient capital, there’s no limit to what you can achieve.