Since the invention of the stock market at the beginning of the 17th century, humans have been making and breaking their fortunes in the high-risk, high-reward world of asset markets.

Stock markets tend to move at the speed of information. Thus, every time a mode of transportation or communication advanced, so did the markets. Think railroads, telegraphs, telephones, the internet, high-speed data networks, algorithmic trading software, and so on.

The first stock traders had to wait until their ship literally returned to port before they knew if their investment paid off. Today, traders can open and close a position in a matter of minutes—or seconds—and take a profit or loss.

While technology has made short-term trading more accessible, it doesn’t mean it’s made it easier. There’s a lot to learn if you want to become a trader. And finding the right partners for your trading career will make all the difference in your success.

In this article, we’ll explore the discipline of short-term trading and the best way for you to learn trading without betting your life savings.

Table of Contents

Is Short-Term Trading for Everyone?

We’ll cut to the chase: short-term trading isn’t for everyone. The social media influencers and so-called trading “experts” on Reddit who say otherwise probably have a course to sell you.

However, anyone can learn to trade profitably (just not everyone).

The two primary factors that determine your success are knowledge and skills. If you can cultivate a teachable mindset and work hard at the fundamentals of trading, you’ll go far—no advanced degree required!

First, you need to understand the difference between long-term and short-term trading.

Long-term traders, also known as investors, tend to look at the fundamentals of a company or asset and hold positions for months and years. They’re rarely concerned with daily or even weekly swings in the market. Warren Buffet is a classic example of a long-term investor.

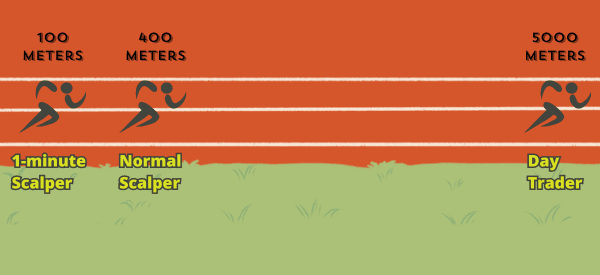

Short-term traders are usually subdivided into:

- Swing traders: these individuals take positions that last for days, weeks, and even months in some rare cases. Swing traders usually focus on a handful of assets to help manage their risk.

- Day traders: this is one of the most widely known short-term trading styles. Day traders buy and sell assets within a single day, making sure to close all their positions before the market closes—executing dozens of trades per day.

- Scalpers: the most fast-paced short-term trading style. These traders aim to profit from rapid (usually measured in minutes) price fluctuations. They may trade hundreds of times in a single day.

If you don’t take the time to learn trading and the unique strategies and techniques for a given trading approach, you’re guaranteed to lose money.

When starting your trading career, you can learn on a part-time basis. Many professional traders started out doing it as a hobby and moved to full-time trading after they had the skills and discipline to make the jump.

Ambition and speed are helpful attributes for a trader to have, but it’s important to approach trading as a long-term lifestyle choice, not a path to get rich overnight.

It’s not uncommon to spend six months to a year gaining all the skills and experience required to trade full-time. But once you reach the professional level, you can make an excellent living.

Learning the Fundamentals of Short-Term Trading

As we just mentioned, it takes six to twelve months for most people to become proficient at short-term trading.

Below, you’ll find a high-level guide to some basic concepts. Each topic requires careful study and practical application to master. You might hear these topics referred to as “hard skills,” which refers to quantifiable abilities that successful traders exhibit.

A comprehensive training program can help you acquire this knowledge in a streamlined fashion, while a training simulator allows you to master your skills to become a trader.

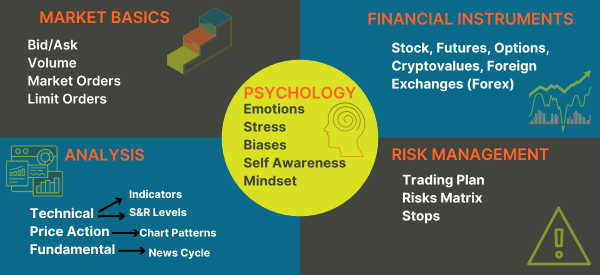

Market Basics

Trading is about buying and selling, but there’s a huge variety in what you trade, where you trade it, and when you trade.

There are more than 50 markets that allow traders to participate using a computerized trading platform, such as Real Trading’s PPro8™. Some markets are open for fixed windows relative to the time zone, while foreign exchange markets operate 24/7.

There are five broad market categories:

- Stocks.

- Futures.

- Options.

- Cryptocurrency.

- Foreign exchange (Forex).

As a trader, you need to learn the terminology of trading, including bid/ask (buying and selling prices), volume (how much of an asset is being traded), market orders (instructions to buy or sell at the best price), limit orders (instructions to buy or sell at a fixed price), and much more.

Some terms will help you converse with and learn from other traders. Other terms will allow you to navigate the fast-paced and often volatile demands of short-term trading.

Financial Instruments

Some concepts from the trading world are familiar to the general public; but what they mean is less widely understood.

Financial instruments are assets that allow individuals and companies to move and create value, and can be traded and exchanged.

Some of these financial instruments have a market of their own, as we covered above.

For instance, a stock is a tool that permits fractional ownership in a company; an option gives you the right (but not the obligation) to buy or sell an asset at a fixed price, while a futures contract allows you to buy or sell an asset at a future time.

An exchange-traded fund (ETF) is essentially a basket of assets that track an index, commodity, or other types of securities.

Analysis

If you meet a trader who claims to trade on instinct alone, run away!

Professional traders may appear to operate on reflex and instinct, but that’s a function of analytical mastery, not casualness.

Professional traders understand and use:

- Technical analysis: by means of complex mathematical formulas and charting tools, it’s possible to make smart guesses about where the price of an asset is headed.

- Indicators: leading and lagging indicators give you a strong idea about the most probable price movement based on historical data. None are foolproof, but all of them can be useful.

- Resistance and support levels: these refer to the tendency of an asset to oscillate between a maximum (resistance) and minimum (support) price. When an asset breaks through one of these levels it can be a strong clue about what’s going to happen next..

- Fundamental analysis: although this is the favored tool of long-term investors, fundamental analysis of an asset plays a significant role in the daily price movement of an asset.

- Industry and sector analysis: information can make or break your trading strategy. If you don’t understand what’s happening in the real-world domain of the asset you’re trading, you’re likely to miss vital trading signals.

- News cycle: interest rates, geopolitics, weather, social upheaval, economic reports, annual reports, and many other public events affect the price of assets. Smart traders watch the news cycle for relevant headlines and monitor developing situations to aid their trading strategy.

Nobody is capable of predicting the future, but by relying on analysis, the best traders are able to gauge the likelihood that the price of an asset is going to climb or fall. To learn trading, you must understand the importance of careful analysis.

Risk Management

Just like you wouldn’t say that somebody knew how to drive a car if they could only step on the gas pedal and move the steering wheel, you shouldn’t consider yourself a trader until you understand risk management.

No other discipline is as widely applicable or as effective at helping you maximize profits and minimize losses.

Key risk management concepts include risk-reward ratio, stop-loss orders, diversification and correlation, position sizing, value at risk, and scenario analysis.

Many professional traders expect to lose money on 40-60% of their trades, but thanks to risk management mastery, their profitable trades more than compensate for those losses.

The Emotional Aspect of Short-Term Trading

Short-term trading is an intense, analytical profession. Many traders have backgrounds in STEM or at least a higher-than-average affinity for those subjects. However, any trader who ignores the emotional and psychological aspects of short-term trading is bound to lose money and burn out.

By mastering these “soft skills,” you’ll have a well-rounded toolbox that you can use to navigate even the most stressful and chaotic trading environments.

Manage Stress and Emotions

Short-term trading requires laser-like focus, quick reaction times, and the ability to switch tactics in an instant. The price of the asset you’re trading isn’t in your control. The actions of other traders aren’t in your control either.

All you can control is your response to what’s happening in the market. That means you need outlets to manage stress and process your emotions in healthy, non-destructive ways.

Without proper stress and emotional management, you’re more likely to fall victim to fear, greed, and revenge trading—classic ways to lose money.

Create and Follow a Trading Plan

Some traders have decades of experience, but they don’t follow a trading plan. Instead of focusing on a particular domain or industry, they jump from opportunity to opportunity. Instead of setting goals and risk management protocols, they throw money at trendy stocks and then double-down to compensate for preventable losses.

Trading without a plan is a recipe for failure. Following a trading plan allows you to make smart decisions even when your emotions are screaming at you to do something different.

Practice Self-Awareness

It bears saying again: even though many traders see themselves as rational, logical creatures, everyone is human. Your best defense against becoming an emotional, erratic trader is to learn and practice self-awareness.

Keep a trading journal where you record each trade along with relevant details. Make notes about how you feel throughout the trading session, including things like hunger, anger, loneliness, and energy levels. These are all warning signals for emotional trading.

Self-awareness will also help you separate your value as a person from your success as a trader—two things that should never be confused.

Develop a Growth Mindset

The activist, statesman, author, and Nobel Peace Prize Winner Nelson Mandela once said, “I never lose. I either win, or I learn.” That is what’s known as a growth mindset and it gives you the ability to improve yourself in any situation.

Pursue continuous education as a short-term trader and you won’t stay stuck in any rut for long. Develop relationships with more experienced traders, invite feedback from your peers and mentors. Ask people for their book and podcast recommendations. Use everything as your ally in the journey to becoming a successful trader.

Short-Term Trading Questions

If you’re wondering how to learn trading, you have questions. In fact, even people who don’t want to become traders often have questions about trading.

Here are some of the most common questions that we hear from people who are exploring the world of short-term trading.

Can I learn to trade on my own?

If you’re a self-led learner, then it’s quite possible that you can acquire all the knowledge you need to become a trader, but knowledge isn’t everything. You must apply your knowledge in realistic trading environments so you can learn the difference between theory and practice.

Funding your own trading career can be very expensive too. One of the best ways to learn trading and control your costs is to join a prop trading firm. Prop firms offer training, technology, coaching, and funding for qualified traders.

How fast can I learn trading?

This depends on your commitment and willingness to follow directions. By following a proven training program like the one Real Trading provides, you could start making live trades within six months.

Most traders take closer to a year before they acquire the skill to trade full-time and pay their bills. Be wary of any trading “expert” or guru on social media who claims they can teach you faster or help you get rich overnight.

Where and how can I learn to trade?

Real Trading has taught more than 3,000 traders the basic and advanced skills of short-term trading. Our curriculum is proven to help ambitious traders turn pro.

There are also lots of additional resources you can find on the internet to round out your trading education:

- TraderTV.Live is the number one short-term trading channel on YouTube, and features live trading sessions and explainer videos.

- Udemy is food for some soft and hard skills.

- Coursera is more business-focused than Udemy.

- The Corporate Finance Institute is specifically for people who want to learn capital markets.

- Ray Dalio is a famous investor and founder of Bridgewater Associates.

- Nassim Nicholas Taleb is an author, professor, and full-on trader.

- The Real Trader is a free newsletter with tons of short-term trading resources.

Get your hands on as many books about soft and hard skills, and everything in between. Our blog has plenty of informative reading material as well.

How much do I need to begin trading?

It’s possible to start with as little as USD 500. Although some traders prefer to use their own money to fund their trades, we recommend partnering with a prop trading firm.

As a prop trader, you’ll gain access to the firm’s buying power and their advanced technology. The better your performance, the more buying power you’ll have access to. Plus, you’re not responsible for your losses. In exchange, the firm lets you take home up to 90% of your profits.

Prop trading isn’t for everyone, but it’s a fantastic career for many.

Continuous Learning = Continuous Profit

The formula to learn trading, and eventually becoming a professional trader who makes a good living isn’t a secret. If you can embrace a posture of relentless learning and real-world practice, you’ll master the skills and achieve your dreams.

The vast majority of people who attempt to learn to trade quit as soon as they hit difficulties. It could be a string of losing trades or lost opportunity, but the hard times will come. The best way to overcome those challenges is to learn that it’s all part of the business of becoming a trader.

Real Trading offers you everything you need to learn trading and make a career out of it.