In any sport or industry, the difference between spectators, amateurs, and professionals lies in hard skills.

In sports, you need to practice hard skills to perform well—there are no two ways around it. The best players demonstrate the highest levels of these skills.

The same is true for short-term trading: if you want to make a living, you’ll need more than opinions or creative ideas. You need hard skills.

Today’s article delves into the essential hard skills that can catapult every short-term trader toward success, together with how you can work on them.

Whether you’re deciphering market indicators or harnessing advanced trading platforms, honing these skills will unlock the door to a thriving career in short-term trading.

Table of Contents

What Are Hard Skills?

A hard skill is a capability that you can learn, apply, and train in a highly repeatable fashion. In most cases, hard skills are clearly defined, which makes them easy to identify and incorporate.

Every profession has its own set of hard skills that you need to master.

Usually, they act as natural gatekeepers to separate competent individuals from novices. You’ll struggle to get a job as a car mechanic if you don’t know how to change oil or repair brakes.

Plumbers need to know how to fit pipes. Doctors must diagnose disease. Painters should understand and apply color theory.

Short-term trading also requires a unique set of hard skills. Some overlap with other professions, such as engineering or math, while others are specific to the world of trading.

Hard skills provide a solid foundation for taking decisive action as a short-term trader.

Soft Skills vs. Hard Skills

In a previous article, we wrote about the soft trading skills that you need to succeed as a trader.

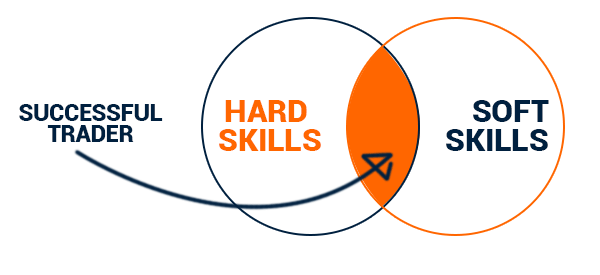

In essence, soft skills act as a force multiplier for hard skills, and include emotional intelligence, discipline, patience, and many others.

Soft skills can be taught, but they’re difficult to measure quantitatively and aren’t enough to compensate for a lack of hard skills.

If you’re a surgeon with an excellent bedside manner, but you’re unable to perform successful surgeries, you won’t get too far.

Alternatively, if you’re a gifted accountant who wields spreadsheets and bookkeeping software like a magician, but you’re terrible at managing your time, things won’t work out as planned.

While hard skills show that you are competent in the technical requirements of a profession, soft skills demonstrate that you’re competent at navigating messy human emotions.

Ultimately, it’s not a battle of soft skills vs hard skills—rather, long-term success requires a healthy blend of both.

Why Hard Trading Skills Matter

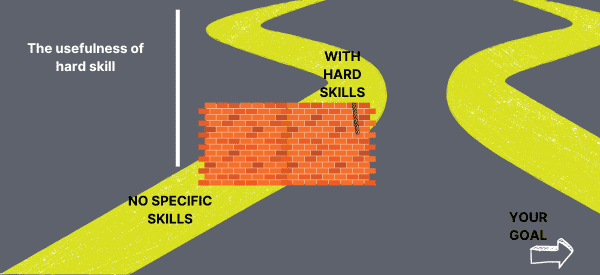

There’s no way around it: if you don’t devote time and energy to acquire the hard skills of short-term trading, it will never be more than a hobby.

However, if you’re ready to learn and train as a short-term trader, there’s no limit to what you can achieve in this profession.

Short-term traders thrive on the intra-day volatility of global markets.

The difference between profit and loss in these situations comes down to hard skills. Here are some of the areas where hard skills can benefit short-term traders.

Enhanced Market Analysis

Analyzing charts and applying technical indicators is a foundational skill for short-term trading.

As you improve your market analysis toolbox, you’ll notice trends faster and can sort the noise from the signal. The quicker you can make sense of the data, the more frequently you’ll spot opportunities that other traders might miss.

Increased Trading Efficiency

When you start trading, you’re excited to exercise your new-found hard skills and rack up some wins. But it’s easy to overwhelm yourself with multiple overlapping trades and lose them all.

As you build experience and competence with your trading platform, you can execute precise trades faster without losing track of anything.

The only way to develop this skill is to practice—over time, you build the mental and muscle memory needed to trade at maximum efficiency.

Improved Risk Management

Many short-term traders have left the profession because they failed to study risk management and refine their trading strategies accordingly.

On the other hand, when you’ve internalized the basics of risk management, like stop-loss orders, take-profit orders, position size, and risk tolerance, you can quickly scale your earning potential.

No trader wins 100% of their trades. You should always aim to profit but understand that, in reality, winning more than 50% of the time is a good ratio. Proper risk management helps you minimize losses and maximize profits.

Greater Financial Literacy

You might think financial literacy refers to financial planning or some other tangential discipline for short-term trading.

In reality, the data-heavy nature of short-term trading favors mathematical and scientific skills more than retirement planning or portfolio optimization.

The ability to perform quantitative analysis and build financial models is far more helpful when handling global securities. Studying global markets and applying that research to your trades will uncover new opportunities.

Consistency in Trading Results

You’ve probably heard the saying “sometimes, even a blind squirrel finds a nut.”

This laughable aphorism applies to novice traders: it’s possible to make winning trades without fully understanding how or why they were successful.

When you develop, nurture, practice hard skills, you’ll consistently make better trades in profit margin and size.

The Top 9 Hard Trading Skills

Becoming a professional short-term trader takes more than ambition or an affinity for math. You must commit yourself to studying and practicing skills in low-risk scenarios until you feel confident.

Here are the nine hard-skill domains that we recommend for every short-term trader. Each area has “sub-skills” to help you become a more well-rounded trader.

1. Technical Analysis

Short-term traders live and die by the numbers.

Your ability to read charts, discern what they mean, and speculate where the price is headed will significantly boost your trading strategy. Without technical analysis skills, you can easily get caught up in the noise and miss the signal.

Technical Indicators

There are many technical indicators. For the most part, they help you interpret where an asset is headed or what part of a given cycle it’s in.

Technical indicators are lagging indicators as opposed to leading indicators, meaning that they should be used as hard and fast predictors—they merely suggest likely outcomes.

Chart Patterns

A chart shows the overall movement of an asset over time. Experienced traders use charts to help determine where a security is headed and what type of trade will deliver the most profit.

You’ll gain meaningful insights for your trades when you learn to read charts and combine them with technical indicators.

Volume Analysis

While price is the most obvious metric that traders watch, volume provides a secondary confirmation of the strength of where an asset is headed.

Low volume movement is a weak indicator for a trend, while high volume movement is a strong indicator. Short-term traders can monitor price and volume to avoid being caught in a false break or trend reversal.

2. Quantitative Analysis

This skill requires some of the most sophisticated math of any discipline. It uses complicated formulas and statistical models to identify patterns in a market and suggest how to trade it for a profit.

Nassim Nicholas Taleb is a famous quantitative analyst who has written a series of books on the topic and regularly posts to X and YouTube, teaching his theories of quantitative analysis.

Statistical Models

There are many statistical models for how certain stocks and markets move.

The tricky part is identifying models that make sense to you and that you want to incorporate into your strategy. Statistics isn’t a means of prediction, but a constructive way to explain the behavior of large, complex data sets.

Risk Metrics

Understanding risk measurement is integral to building a risk management plan.

There are five primary risk metrics: alpha, beta, R-squared, standard deviation, and the Sharpe ratio. These measures offer historical predictions of investment risk and the volatility of a given security.

Backtesting

Like testing your strategies on live data using a trading simulator, backtesting is a way to examine if a given strategy would have worked in the past.

Backtesting lets you validate a theory based on real-world scenarios and discover weaknesses before you lose money.

3. Risk Management

Trading securities of any type carries inherent risk. You have no control over the market and the price of a given asset. That means that when you open a trade, the market may move against you, and you’ll lose money.

Risk management is the skill of minimizing losses and maximizing profit.

Stop-Loss and Buy-Stop Orders

A stop-loss order is a relatively simple practice that entails setting a low price when you want to sell an asset if it falls instead of rising.

A buy-stop order is the equivalent practice for short positions.

In both cases, you limit the losses you will sustain if the asset price moves against your trade. This is a simple way to protect against black swan events or mild price swings outside your risk tolerance.

Position Sizing

As a prop trader, your buying power is based on your track record of successful trades. Proper application of position sizing is necessary if you want to increase your profit and your buying power.

The larger your position in a given trade, the greater the profit potential, but also the greater the risk of loss. Beginning traders should start with relatively small positions to validate their trading strategy and progress to larger positions as they develop confidence.

Leverage Management

This concept is tied to position sizing, and is a powerful tool if you understand how to use it wisely.

Leverage represents the amount of securities you can buy on credit with your broker. The benefit is that you have a smaller capital outlay and the potential to make more money. The downside is that you’re on the hook for a lot of money if your trade goes south.

4. Proficiency With Trading Platforms and Tools

The fundamental concepts of short-term trading are consistent across markets and trading technologies.

However, the practical aspects of trading can vary significantly on different trading platforms.

You need to build proficiency on the platform you’ve chosen to trade on. That competence allows you to execute trades faster, reduce mistakes, and maximize profit.

5. Market Research

While quantitative analysis uses math to identify trading patterns, market research is a more subjective assessment of factors such as breaking news, industry trends, and consumer confidence.

While they may appear less scientific, they’re just as important because they directly correlate with changes in the market.

Economic Indicators

Inflation, national GDP, government debt, and other economic factors will affect the price of entire markets, let alone specific securities.

Paying attention to these factors and watching their effect on markets gives you a deeper understanding of what’s happening and the opportunities it offers for your trading strategy.

Sector Analysis

Maybe you’re interested in cars and want to study the global automotive industry. This will give you insights that commodity traders don’t have. Gaining an information edge is a decisive advantage and can fuel a career of solid trades.

Examine different industry sectors and make a point of getting comfortable trading in them on a rotation. This will help keep you flexible and open-minded in your trading practices and strategies.

Geopolitical Events

Wars, terrorism, diplomacy, and natural disasters directly affect the performance of global markets. You certainly can’t predict when these breaking news events will take place, but you can monitor newsfeeds and learn to act quickly when they do.

Consider February of 2020, when international travel shut down at the start of the coronavirus pandemic. Many industries were affected negatively, but airlines and travel companies may have suffered worse than most. Some fast-acting traders made a lot of money in that chaotic period.

6. Fundamental Analysis

While fundamental analysis is typically the domain of long-term value traders, it’s a valuable skill for any trader.

The ability to assess a company’s financial health or the prospects for a given commodity is vital if you’re going to stay ahead of the crowd.

While there are companies that deviate from normal trading patterns (Tesla’s chronic overvaluation and persistent bullish run, for example), those exceptions prove the rule.

Earnings Reports

If a company is struggling, the evidence should appear in its earnings report.

This information is public, so it’s not going to give you the jump on professional traders, but it’s the equivalent of checking your rear-view mirror while driving—you should check it regularly.

Interest Rates

The Federal Reserve Bank sets the base interest rate for the American economy. The fed funds rate is a leading indicator of what every other central bank does with their interest rate.

Again, it’s public information, but it’s one of the strongest indicators of the economy’s health and how businesses will respond. You must monitor the Federal Open Market Committee (FOMC) meetings’ results just like you monitor earnings reports.

Commodity Reports

If you’re interested in trading commodities, get familiar with the various commodity reports released by the various associations and governing bodies.

These will give you valuable data about the market’s performance, the positions of other traders, and issues affecting individual commodities. Unless you become familiar with these factors and understand how they affect pricing, you’ll struggle to make a profit trading commodities.

7. Order Types

A trading order is a basic command traders give to buy or sell a security. There are many different types of orders that allow you to execute complex strategies and mitigate risk.

By studying all the different types of orders, you arm yourself with precise tools to navigate volatility and capitalize on opportunities.

You’ll lose money if you fail to use the correct order at the right time. Even when you execute an order, slippage happens, and the order gets executed at a price different from what you requested.

Veteran traders’ command of trade orders is automatic and instinctual. With enough practice, yours can too.

8. Financial Modeling

Financial modeling is popular with traders who favor quantitative analysis. It’s the practice of combining different measurements and weights to achieve a desired portfolio outcome.

These models are complex mathematical equations that respond best to consistent optimization and tweaking, especially if your trading goals change.

Financial modeling is an advanced hard skill that can supercharge your trading strategy, but we don’t advise it for beginners or those who lack high math competency.

9. Trade Journal

This is another vital hard skill that many traders neglect, but it’s easily the most simple and powerful skill on this list.

Take notes on every trade you make. Record your thoughts and feelings about the trade. Comment on your strategy and how well you stuck to your plan.

An expert short-term trader might execute hundreds of trades a day, which could translate into a lot of journaling. Journaling is way more important at the beginning of your career when you have low competency and self-awareness.

A detailed journaling practice will allow you to review your actions and constantly improve. Nobody is born a genius at short-term trading, but few things will accelerate your career as quickly as trade journaling and reflection.

How You Can Develop Hard Trading Skills

Skill acquisition is a skill in itself. If you can learn new skills quickly and thoroughly, you’ll accelerate your career and become a highly successful trader.

Here are some excellent ways to jumpstart your trading hard skill education.

Online Courses and Webinars

There are many websites, such as Udemy, Coursera, and The Corporate Finance Institute, where you can take courses on day trading and specific hard skills you want to grow.

Look for short-term trader communities with forums or social media groups where you can connect, learn from other traders, and hear about industry events.

Even a platform like YouTube can provide valuable instruction on short-term trading hard skills through daily streaming channels, like TraderTV.Live.

Books and Financial Publications

Investment experts like Ray Dalio, Nassim Nicholas Taleb, and Bill Ackman have a lot of wisdom to offer short-term traders of every experience level.

The Internet has more resources available than you could consume in a lifetime, including free newsletters such as The Real Trader.

The best approach is to develop a habit of study and professional development. Develop your own mix of free and paid resources you trust and keep tabs on them. If you commit to steady, marginal improvement daily, your results will compound exponentially.

Join a Trading Program As a Prop Trader

Some people go to college and get advanced degrees in quantitative analysis, statistical modeling, or other trading-related disciplines. This is certainly an expensive route.

On the other hand, you could join a prop trading firm where you pay a nominal fee for access to short-term trading courses as well as trading hardware and software.

Once you complete the training and prove your capabilities in a trading simulator, prop firms will start funding your trade, which is where you can begin to make some significant income.

Prop trading firms provide valuable support and guidance to build your trading career.

Real Trading: Hard Skills Made Easy

Making profitable trades and building a career as a short-term trader don’t happen by accident.

You need to set your mind to it, and learn and train the necessary trading skills.

At Real Trading, we’re looking for the best and brightest short-term traders in the world. Our training program takes intelligent, hungry individuals and helps them build successful short-term trading careers.

By providing training, technology, and funding, we’re powering a global community of professional traders with the skills and tools to make a great living while working independently.

Once you get certified, we base your buying power on your performance, not your deposit.

The more you train and execute live trades, the more you’ll discover the hard skills that best suit your wiring and ambitions. Real Trading will be with you every step of the way.

We want to help you become the best short-term trader you can be.