Day trading is a popular way of making money online through buying and selling of financial assets like stocks, cryptocurrencies, and commodities.

It differs from investing in that day traders are only interested in price movements of the assets. In most cases, they are not interested in the asset’s fundamentals like a company revenue or market share.

Online day trading has grown in popularity in recent years due to several favorable circumstances: increasingly powerful and accessible tools, acceleration towards online activities due to the Covid-19 pandemic, uncertainties in the markets that have created opportunities for substantial profits (starting with the Wall Street Bets story).

In this article, we will explain how you can start day trading.

Table of Contents

Day trading vs investing

As mentioned, day trading is a bit different from investing. Day traders focus on buying an asset and holding it for a few minutes. The idea is that of holding a trade for some time and then ending it before the market closes.

Investing is different since investors rely on in-depth fundamental analysis and then hold the asset for a long time. It is not uncommon for some investors like Warren Buffett to buy and hold a stock for decades.

The two approaches have their pros and cons. They also have their believers in that some people believe that day trading is the best way to make money while others believe that investing is a safe option.

Step 1: Know yourself

The first step in becoming a good trader is to know yourself. This is where you do a personal assessment about yourself and your experience. Most importantly, you should assess why you want to be a trader, whether you have the time to trade, and what you want to achieve.

Doing this type of assessment is one of the most important things that you can do before you start your trading career.

For example, if you don’t have any experience about the market, doing the assessment will help you know where to start day trading. In this case, you can start learning how the financial market works and the different types of assets that are involved.

To help you in this, we have developed two comprehensive guides that we recommend you to consult:

- One on day trading, which we have already put at the beginning of the article

- A guide on how to move in the forex market

On the other hand, if you have some experience in the market, doing this assessment will save you a substantial amount of time.

At times, knowing yourself can even help you determine whether you want to become a trader or not. If you cannot handle the pressure of losing money, then exiting the industry earlier enough will help you a great deal. Possibly, instead of being a trader, you can be an investor.

Step 2: what is your goal?

The next step in becoming a day trader is setting goals and examining your mindset. Like in all professions, you want to have a clear goal about what you want to achieve. For example, if you are in the humanitarian industry, you want to save as much life as possible.

The same applies in the financial market. Here, you want to set realistic goals about what you want to achieve. A possible goal is where you want to start as a small day trader and then move on to manage a hedge fund or a home office. You can also have a goal of starting a trading floor, where you employ a group of traders.

The right mindset

The goal-setting part is where most people fail. That’s because they start their careers with the goal of making a lot of money quickly. As a result, in their journey to achieve this, they will bypass some important steps such as learning and coming up with a strategy.

The best mindset is where you want to establish a trading career and becoming a successful money manager. With this mindset, you will be at a good position to follow all the recommended steps such as learning and developing a strategy.

Trading part-time or for a living?

Another possible goal you might have is on substituting your income if you have a full-time job. For example, if you work in a company, you can decide to be a trader in order to supplement your income. In this case, you need to have a goal that is realistic.

» Related: How to Day Trade Part-Time

For example, you can decide to focus on trading cryptocurrencies or forex, which are traded for longer hours. You can also decide to trade in extended hours if your goal is to focus on stocks.

It is worth noting that while having a goal is important, it is part of the process. You need to write these goals down and then work towards achieving them.

Step 3: How much do you need for trading?

A common question among many people is on the amount of money that you need to start your trading career. This question is usually part of the money management aspect of trading.

There are several angles to look at this.

First, today, it is possible to start day trading with as little as $50. For one, companies like Robinhood and WeBull don’t have a minimum balance requirement. You can download the application and deposit as little as $50 and buy your first stock.

The same is true with forex and CFD brokers. In the past, these companies required people to start their trading with a minimum of $500 and above. Today, this requirement has almost disappeared because of the amount of competition in the industry. These companies allow people to start trading with as little as $50.

Obviously if you start with 50$ you have to pay attention to your trades and use an adequate position sizing. Preferring above any approach the scalping, that allows you to close a trade even after few seconds or minutes (and not to remain with an empty account).

» Related: How Much Money do You Need to Start Day Trading?

Figure out how much you can afford to lose

Still, the most important thing to remember is to trade money you can afford to lose. For example, if you have $1 million, you can afford to lose $5,000. Start with such amount.

On the other hand, if you have just $1,000, it is not recommended to spend $500 trading. This is risky because it is possible to lose all your money in a single trade.

In the past, we have seen many people make the mistake of taking huge loans to trade or invest only for them to lose it all. We have also seen others deposit money intended for medical cover or education purposes only for them to lose it all.

Trading rules

There are other things about this issue. For example, in the United States, there is the rule known as Pattern Day Trader (PDT) rule. It puts limits on the number of trades that you can implement if you have a certain amount of money.

There is also the way of proprietary trading, which is a strategy that involves to trade with a company’s money. This is our case.

Step 4: Your way to trade for a living

The next approach that is so important is on developing your trading strategy and the need for in-depth learning.

Grow your knowledge

If you are new to the trading industry, we recommend that you spend a lot of time learning about how the industry works and how to limit your losses.

Fortunately, there are so many places where you can get a quality trading education. Some of them are:

- Brokers – At times, the broker you decide to use will provide you with educational materials and even mentoring. At Real Trading, we give access to quality education materials and experienced mentors.

- Websites – There are many websites that provide free or premium trading courses that you can use easily. You can consider using our blog to take your first steps.

- Educational platforms – There are many educational platforms that offer premium trading and investing courses. Examples of these platforms are companies like Coursera, Udemy, and Khan Academy.

- YouTube – There are so many YouTube channels that focus on trading and education (as our partners at TraderTv). Indeed, many people have move from newbies to experienced professionals by using these videos.

- Personalized coaching – Another option is where you enrol in a trading course that is run by an experienced professional.

These options are also good for experienced traders who want to broaden their knowledge, or refine their strategies. Learning a little bit more never killed anyone after all, did it?

Which asset to choose?

After learning, the next stage is where you decide to come up with a trading strategy. Ideally, there are various ways that you can approach this. First, you can create a strategy based on the asset you will be trading. Some of the most important assets in the market are:

- Commodities – These are a assets like crude oil, copper, natural gas, and wheat that people can trade. They are offered by most online exchanges. The benefit of commodities is that they have longer trading hours and are often volatile.

- Stocks – A stock is simply a share of a company that is listed in an exchange. Stocks are traded for a few hours every day. There are different types of stocks. For example, there are penny stocks that trade for less than $5. Similarly, there are mega stocks like Berkshire Hathaway that trade for thousands of dollars. The main disadvantage of stock trading is that they are open for a small amount of time.

- Cryptocurrencies – These are digital currencies like Bitcoin, Ether, and XRP that are offered by brokers and exchanges. These assets are traded every day and at all time.

- ETFs – Exchange Traded Funds are assets that track multiple stocks or commodities at the same time. For example, Invesco QQQ tracks the Nasdaq 100 index while Vanguard S&P 500 tracks the S&P 500 index. These ones are mostly recommended for investors since they are usually not all that volatile.

Other assets you can focus on as a trader are indices, options, futures, and forex. Forex is the most popular asset, with daily volume of over $5 trillion.

Your trading style

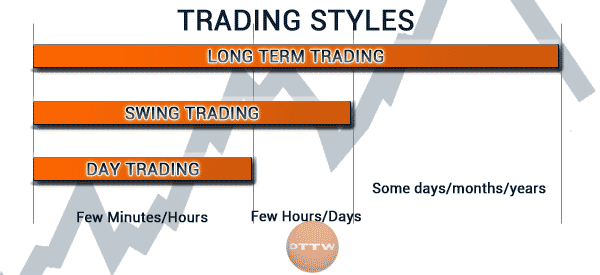

The next part is where you come with the angle of attack, meaning the way you will approach the asset that you select. Some of the most popular strategies are:

- Scalping – This is a strategy where you decide to buy and sell assets within a few minutes. For example, you can buy a stock at $10.10 and then exit it when it rises to $10.50. In this strategy, you will make a small amount of money in each trade. As a result, you will need to open tens of trades per day.

- Day trading – Scalping is a type of day trading. Another option of day trading is where you decide to open a trade and hold it for a few hours. The goal is to ensure that you have ended your trade before the market closes. By doing so, you will be at a good position to avoid risks that happen overnight.

- Swing trading – These are traders who have a longer horizon. They analyze, execute trades, and then hold them for a few days. These traders rely mostly on chart analysis and some form of fundamentals.

- Position trading – This approach is commonly known as investing. It involves buying or shorting an asset and holding it fot a few weeks or months.

- Algorithmic trading – This is a trading strategy that relies on algorithms known as robots or expert advisors. These tools will do market analysis and then execute trades by themselves.

- Copy-trading – This is a relatively new method of day trading. It involves copying trades of other experienced traders automatically.

Therefore, you should do all this and then spend some time determining the best trading strategy that you can follow. Most importantly, it is in this stage that you will focus on things like risk assessment. In it, you will work to find strategies to reduce your risks.

For example, you can determine that you will not expose your account to a 10% risk. In this case, if you have a $10,000 account, the maximum that you can lose per trade is $1000.

Useful tools in trading

There are several tools that you will encounter when you start your trading career. Some of those tools are:

- Stop-loss and take-profit – These are tools that will automatically stop your trades when specific levels are reached.

- Watchlist – it is a tool that allows you to watch a select number of stocks or other assets. For example, instead of focusing on thousands of stocks, you can have a watchlist that shows you a handful of these assets.

- Stock screener – This is a tool that helps you to focus on key assets. For example, if you want to identify stocks with a PE of above 20, you can use the screener to see it.

- Trading journal – A journal is a tool that allows you to write all happenings in the market. For example, you can write all trades that you initiated in a certain day.

- Software – You will need a trading software. At Real Trading, all our traders have access to the PPRo8 software to execute trades. Other popular software are NinjaTrader, MetaTrader and ThinkorSwim.

FAQS

Is day trading a good idea?

Yes. Day trading is a good idea to make money online. If you follow the strategies mentioned above, you will have a good experience as a trader. It is also a good way to complement your regular income.

Is trading sustainable for new traders?

Ideally, most new traders will lose money. But if you are patient enough, you will find day trading being a sustainable way of making money in the market.

Can you trade with $500 or less?

Yes. As mentioned above, many brokers are today comfortable with allowing people to start trading with as little as $50. Still, it is worth noting that starting with a very small amount of money exposes you to more risks.

Major risks in day trading

The biggest risk in day trading is losing more money than you initially invested. This happens when your broker does not give you a negative balance protection feature. Other risks are overtrading and emotional torture.

Summary

Don’t let anything we’ve written above scare you off. We are sure you have thought about many of these aspects. But they are all fundamental steps to start day trading, in order to avoid losing money due to lack of competence or stimulus.

As much as day trading may have appeal and you may want to try it right away, entering the financial markets without first having the points we’ve outlined in mind could be counterproductive (unless you want to try it on a whim once, as if it were a horse bet).

External useful resources

- Day Trading Tips for Beginners – The Balance