The American stock market is the most active and liquid globally. It has thousands of stocks, including global giants like Apple, Microsoft, and Nvidia. Anyone in the US can trade equities every Monday to Friday.

There are three key sessions in the market. Every trading day starts with the pre-market session, which happens from as early as 4 a.m. This session tends to set the tone for the rest of the day.

The pre-market period is followed by the regular session, which is the most active in Wall Street. It is where most retail and institutional traders and investors participate in the market.

Finally, there is the after-hours session, which happens after the regular session ends. In most cases, especially in the earnings period, this session is important because it is when most companies publish their earnings.

Why should traders be interested in this kind of trading approach?

Some may be looking to trade longer or have identified some excellent opportunities through careful analysis. Yet, others may have only those hours available as they are already engaged with a 9-5 job.

This article will explore the concept of extended hours and how you can take advantage of them.

Table of Contents

What are extended hours?

Extended hours refers to periods when the main exchanges are closed. In the United States, the main session usually starts at 09:30 am and ends at 16:00 ET. All other hours when assets can be traded are those defined as extended.

There are two types of extended hours. First, there is the afterhours session, which happens shortly after the markets have been closed. While the period ranges from broker to broker, it usually starts from 16:00 ET and ends at 08:00 ET.

Second, there is the pre-market session that starts between 07:30 ET to 09:25 ET. This is a trading session that comes shortly before the main market opens. (Robinhood offers premarket orders between 09:00 to 09:30 ET and after-hours until 6PM).

Since the main markets are usually closed during this period, most brokers use an Electronic Communications Network (ECN) or an Electronic Stock Exchange.

Why extended hours matters

While the standard market session is the most important, extended hours are usually equally important. In fact, they tend to set the tone for what will happen when the main market is open.

Related » Day Trader’s workday

There are several reasons why this happens. First, many companies tend to make most announcements when the market is closed. They do this to give investors and other market participants time to process this information.

Some of the most important news that come during this period are:

- Earnings – In most cases, companies publish their earnings before or after the market closes.

- Mergers and acquisitions (M&A) – Since M&A deals lead to high volatility for the affected stocks. Therefore, companies tend to release the news during this period.

- Analyst calls – Most analysts usually deliver their calls before the market opens.

- Management changes – Companies announce major executive changes after the market closes or before they open.

- Investigations – In most periods when there are investigations, companies tend to reveal them in extended hours.

Who can benefit from extended hours?

All traders and investors can benefit in the extended hours session. Normal full-time traders benefit from the extended hours since they extend the trading day.

As such, instead of just trading during the regular session, these traders can benefit by having much longer hours.

Part-time traders who have a full-time job can benefit from the extended hours since, in most cases, they are not able to trade during the regular session. By embracing these sessions, these traders avoid trading when they are working.

Further, some day traders have mastered the art of focusing on extended hours instead of the regular session. These traders love the volatility that exists in these sessions.

Differences between standard and extended hours

There are several key differences between trading in standard and doing this outside of market opening hours . Some of these are:

Types of orders filled

In regular hours trading, you can implement all types of orders. You can place a market order that ensures that your orders are filled at the market price.

You can also fill limit orders like buy and sell limit and buy and sell stops. These orders are only implemented when the price of a stock reaches the predetermined level.

In extended hours, many brokers usually accept only limit orders. For example, Schwab is one of those that only accepts this type of order during this period.

Robinhood, on the other hand, accepts all types of orders. However, these orders are usually implemented when the market opens.

Number of available stocks

Most brokers provide thousands of stocks and exchange-traded funds (ETFs) to their traders and investors. All these assets are available during the regular market session.

However, some companies usually limit the number of assets that can be traded during the aftermarket session. For example, Schwab only offers companies listed in the New York Stock Exchange (NYSE) and Nasdaq.

Order sizes

You can buy as many shares as you want in the standard session. However, many online brokers put a limit on the number of shares that you can buy during extended hours. With Schwab, you can only buy 25,000 shares in a single order.

More liquidity

Finally, liquidity is an important aspect in the financial market. It simply refers to the amount of money that is flowing inside and out of the market.

In the regular session, there is usually unmatched liquidity in the market because of the number of investors participating. This can help ensure that your order will get filled faster.

However, since many large investors stay away from the market for extended hours, there is usually the challenge of liquidity. There are also some technical differences.

Technical Differences

For example, in the regular channel, trading occurs in exchanges like the NYSE and Nasdaq through market makers. In extended hours, it happens through the ECN market.

Also, in the regular session, there are different time limits available, including Day, GTC, IOC, and FOK. In extended hours, orders are usually good for all seasons.

Risks of extended hours trading

While extended hours offer excellent opportunities to traders, it also has some risks. Some of the most popular ones are:

- Orders being filled – Unlike in the regular session, there is usually no guarantee that an order will be filled in extended hours. This is because of the lack of liquidity in some names.

- Fees – Some brokers charge higher commissions or fees for trading during these periods.

- Not the best prices – At times, trading outside of market opening hours ensures that you don’t get the right price. That’s because you are using the ECN model.

- Lower liquidity – The extended hours session has much lower liquidity than the regular one, especially for certain thinly traded stocks.

- Increased spreads – The session has wider spreads partly because market makers are not involved. This can make it expensive to trade.

- Market orders not available – Some brokers don’t make market orders in the extended session. This means that orders will only be opened when the market opens the following day.

- Overnight risks – There are risks when you open pending orders, especially during the extended hours since something can happen when the session ends.

Risk management in extended hours

Risk management is an important part in day trading. It refers to a situation where you mitigate risks while ensuring that you maximize the returns. Some of the top risk management strategies to consider?

First, you should always use a stop-loss and a take-profit in this. These tools will automatically stop your trades when they reach a certain level.

Second, look at the volume of a stock. In most cases, you want to trade stocks that have a higher volume.

Further, minimize risks by looking at the correlation of different stocks. For example, buying similar stocks like Visa and Mastercard will leave you at a big risk if they drop.

Extended hours trading strategies

A common question among many traders is on the best extended hours trading strategies. Some of the most popular trading strategies you can use are:

Momentum

Momentum is a popular trading strategy that seeks to buy stocks that are rising or short those that are dropping.

For example, during the meme stock mania in 2021, it made sense to buy companies like GameStop and AMC that were soaring despite their weak fundamentals.

News trading

This is an approach that seeks to benefit from the current news of the day. For example, if a company publishes earnings during the extended hours session, you can react to it immediately.

If the results were good, you can place a buy trade. Similarly, if the results were not good, you can place a short trade.

Gap trading

A gap is a situation where a stock drops or rises sharply after a major event. One of the strategies in this is known as gap and go, where you place a trade in the same direction as the gap.

If it gaps up higher, you can place a buy trade. If it gaps lower, you can place a short trade.

Using extended hours to prepare for regular session

The other approach is to use the extended hours session to prepare for the regular session. This is where you identify stocks that are doing well in the pre-market session and then create a plan about it.

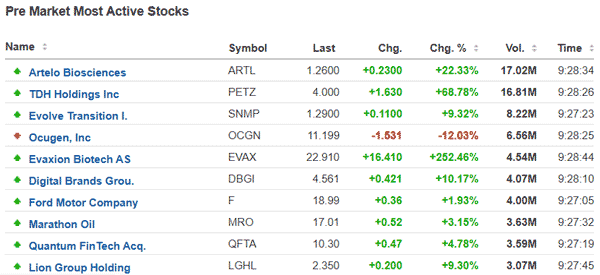

The chart below shows some of the top movers in the premarket at a certain time.

How to prepare for the extended hours

As mentioned, extended hours refers to market hours that fall outside of the regular session. They include the after-hours and pre-market sessions. Therefore, it is always important to prepare yourself well when trading in these sessions.

First, always check out the earnings calendar, which provides a schedule of when companies will publish their results. In most cases, we see more volatility when firms publish their earnings. Therefore, knowing companies that will do that will help you to prepare.

Second, be prepared for additional news and rumors from companies. In many cases, some crucial news like M&A usually comes up in this period. Therefore, take your time to prepare by looking at popular social media channels and news organizations.

Select a good trading company. Further, if you are just starting your trading journey, take your time to learn and find the best trading companies. Read their terms and conditions on extended hours.

Tips for using extended hours

We recommend that you be careful when trading in the extended hours. Instead, you should use the data in the session to prepare for the regular session.

For example, you can study the actions in the premarket and set limit orders that will be implemented when the market opens. Also, you can subscribe to our morning watchlist that looks at the top performers in extended hours.

FAQs

What orders are allowed?

Most brokers allow pending orders in the extended hours. These orders include buy-stop, sell-stop, buy-limit, and sell-limit. They differ from market orders, which are executed instantly.

Does after-hours trading count as day trading?

Yes. You can be a day trader who focuses on extended hours. This is especially when your goal is to enter and exit a trade on the same day.

What are extended hours in the stock market?

This is a trading session that happens outside of the regular session. The regular session starts at 9 am and ends at 4 pm. The after-hours trading runs from 4pm to about 8pm while the pre-market session starts at 4 am.

Final thoughts

Extended hours are a victory for many market participants who have long-argued that the regular session is usually not enough. For years, many traders have made the case for trading overnight and even during the weekend.

However, as we have seen above, there are still key risks of trading in these periods.

External Useful Resources

- About Extended Hours Trading – Charles Schwab