Day trading is a popular way of making money that involves buying and selling financial assets. Unlike investing, day traders hold their positions for just a few minutes and ensure that their trades are closed by the end of the day.

Full-time day traders buy and sell tens or hundreds of trades per day. Conversely, investors hold their positions for a long time and tend to implement a few purchases in a month.

Therefore, traders and investors have different daily routines. In fact, many investors do nothing in a day since they have allocated their cash already.

In this article, we are going to look at what are the macro areas that shape the day (and routine) of a day trader.

Table of Contents

Key market sessions

The US market usually opens at 9:30 pm and closes at around 4 pm. However, it is possible to trade for longer periods, commonly known as extended hours.

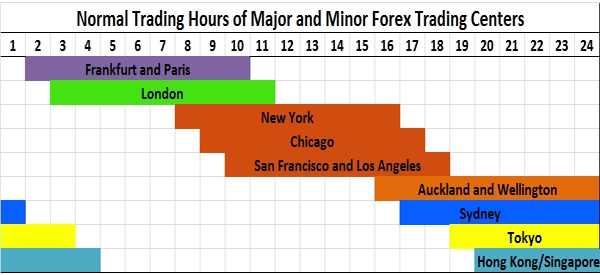

Most importantly, day traders focusing on assets like forex and cryptocurrencies can day trade at any time since these markets are usually open for 24 hours. Forex is open on a 24/5 basis while the cryptocurrency market is open 24/7 basis.

Regular session

The regular session is a period when most people are trading stocks in the United States. It refers to when the Nasdaq and the New York Stock Exchange (NYSE) open their markets to traders. The regular session starts at 09:30 and ends at 16:00.

This is the most active and most liquid session of the day. In most cases, all orders implemented in this session will go through because of the deep liquidity. This happens because most investors, including large hedge funds and investment banks are usually active during this session.

Most importantly, all order types are usually accepted in this session. This means that you can open the market and pending orders during the session.

A market order is one that directs the broker to execute a trade instantly while pending orders direct them to open orders when assets reach a certain price.

Pre-market session

The pre-market session is a period that happens much earlier than the regular session. This session usually opens at 4:00 am and runs until 9:30 am. It is an important session where people who are not available in the regular session can trade.

This session is known for setting the tone of the rest of the trading day since it incorporates news that happened in the overnight session. For example, companies that released their results in the after-hours and early morning tend to have some substantial market action.

After-hours

The after-hours session happens exactly when the market closes. It happens between 4 pm and 8 pm every Monday to Friday. The goal of the pre-market and after-hours session is to give investors and traders an opportunity to trade for longer periods in a day.

There are three main caveats for pre-market and after-hours, which are collectively known as extended hours.

- These sessions tend to have lower volumes compared to the regular session. As a result, the transaction costs can be higher.

- In the two sessions, don’t allow market orders. Instead, traders are required to place pending orders that are implemented when the market opens,

- Not all stocks are available during the pre-market and post-market hours. As such, it is possible that your preferred asset will not be available in these sessions.

Related » How to Day Trade Part-Time

How to manage your day as a day trader

There are several strategies that you can embrace to become a better trader. At Real Trading, we work with thousands of traders every day. In the past two decades, we have observed several strategies that traders use to manage their time well.

Find your sweet spot

Most successful traders find their sweet spot during the trading session.

Some day traders are more successful when focusing on extended hours. Other traders do well when they focus on the first few hours after the market opens.

Therefore, we recommend that you find your sweet spot and work to maximize the opportunities. Usually, day traders prefer the first hour (“the open“) and/or the last hour (“the close“) because they have more liquidity and volatility.

Use a trading journal

The other important thing we see is the use of a trading journal. As the name suggests, a journal is a document where you write all details about your trades.

Some of the top details to include in a journal are:

- The assets

- Time of implementing the trade

- The reason for opening the trade

- The trades you are waiting to execute

The benefit of having a trading journal is that it will keep you disciplined when trading.

Use a watchlist

One way that will help you save a lot of time when day trading is using a watchlist. A watchlist is a document that provides a summary of the top movers in the market.

At Real Trading, we provide a free watchlist that identifies the top movers and the reason for their movements. Having such a watchlist will save you time in your research.

Take some time off

There is always a risk of working too hard. For example, it is easy to go through diminishing returns. This happens when your success in a session starts to dwindle.

Also, there is a risk that you will be following too much information during the session. We recommend that you always take some time off. You can play a game, read a novel, or even watch a movie as you relax.

Trading committee

If you are trading in a trading floor, we recommend that you always start the day meeting other members of the floor.

The goal of such a meeting is to ensure that you share ideas about the market and some of the trading opportunities. At times, you can do this meeting when the market starts to cool during the regular session.

Summary

This article has looked at some of the important aspects of day trading. In it, we have seen the concept of time management and the three periods in stock trading. Precisely, we looked at the regular, pre and post trading sessions and how to take advantage of them.

External useful resources

- A Day in the Life of a Day Trader – Investopedia