After hours trading refers to the session that happens just after the close of the regular session. It is part of what is known as extended hours, which also includes premarket trading.

The after-hours trading session is so important for several reasons. First, it extends the number of hours that are available to traders, especially those who have a full-time day job.

Second, it is useful in that it sets the tone for what will happen in the pre-market and in the regular session on the following day.

Further, after-hours trading helps traders react to important news events like earnings. In most cases, American companies publish their results after the regular session ends.

In this article, we will look at what after-hours are and why they should matter to you as a trader.

Table of Contents

What are after hours?

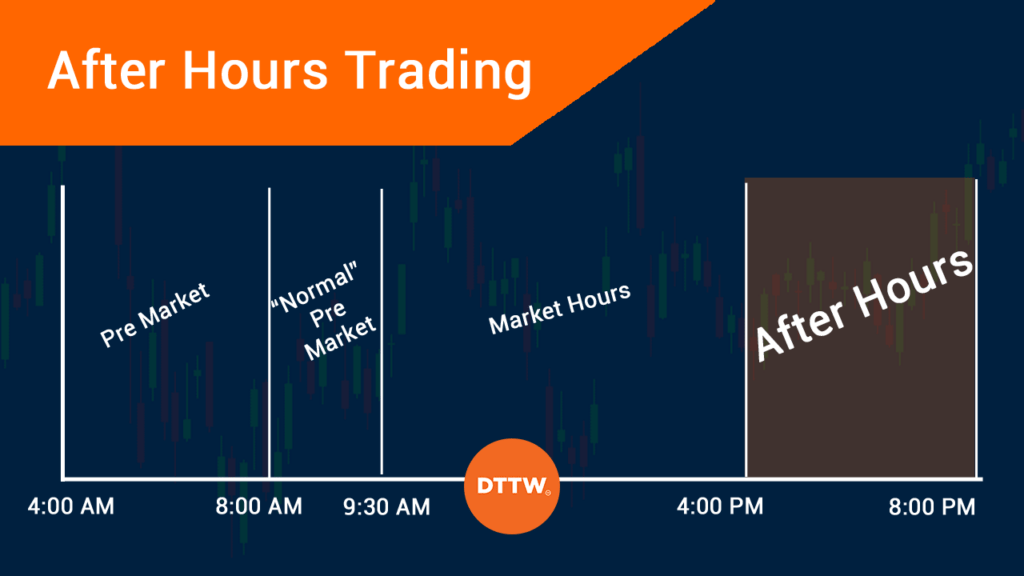

There are basically two trading sessions in the financial market. There is the regular session where most of the trading usually happens. It usually starts at around 9:30 am every weekday and ends at 4:00 pm. This is where most traders and investors buy and sell shares.

Related » Standard workday for a trader

Trading time

The after-hours trading happens after the regular session ends. It starts immediately after 4 PM and moves ahead until 08:05 pm. The premarket session, on the other hand, starts at 07:00 a.m to 09.25 am every weekday.

Combined, the premarket and after-hours are known as extended hours.

These hours are important in the financial market since for years, market participants have questioned the short trading hours. For one, the stock market is usually open for about 9 hours per day. This usually excludes many traders, especially those who work during the day, from making money during the session.

How does the after hours trading session work

The after-hours trading session is quite different from the regular session (as we will see below). The regular session is usually powered by exchanges like the NYSE and NASDAQ and market makers like Arca, Citadel Securities, and Virtu Finance.

The after-hours session, on the other hand, is implemented by a system known as the Electronic Communication Networks (ECN). These networks enable people to place limit orders, which are then executed when the regular session happens.

A limit order is a situation where a person places an order that is then executed by a broker when these conditions are met.

In the case of after-hours, when you buy a stock at $10, it is not implemented directly. Instead, it will be bought when the regular session happens. To be clear, the after-hours session only applies to stocks since the forex market is usually open for 24 hours.

Why trade after-hours session

There are several reasons why you may want to trade in the after-hours session, including:

- To increase trading hours – The first main reason is when you want to increase the number of your trading hours. This is a common reason since the regular session tends to be not enough for most people.

- If you have a day job – The other reason is when you have a day job that keeps you away from the market during the regular session.

- Take advantage of new events – You should use the after-hours session if you want to take advantage of events in the extended hours like breaking news and earnings.

- Transition to trading – You may want to trade in the after-hours if you want to transition from your full-time job to trading.

Why you should not trade in after-hours

There are a few reasons why you might not want to trade in the after-hours session. Some of these reasons are:

- Overnight risks – Trades in the after-hours session are not implemented immediately. Therefore, there is a risk that the situation can change overnight, leading to a big loss.

- High costs – Trading in the after-hours tends to have higher costs because it usually has higher spreads.

- Limited order types – There are limited order types in after-hours trading. This means that you cannot open market orders.

- High volatility – The session tends to be highly volatile compared to the regular session. This volatility can lead to substantial losses.

After hours vs regular session

The after hours session is relatively different from the regular session. There are several differences from the two.

Volume

First, the total volume in regular hours is usually more than during the after hours. That’s because many large traders and investment banks usually trade during this period. The volume tends to thin during after hours since many of the large players are usually away from the market.

Obviously..the timing

Second, another difference is the time of the day when the markets are opened. After hours open from 04:30 to 08:05 p.m, making the session relatively shorter than the regular session.

The Market Access (Market maker, DMA, ECN)

Third, there is a fundamental difference between how the two sessions work. For example, when you open a trade during the regular session, the broker usually routes it through a market maker. Some of the popular market makers are Virtu Finance and Citadel Securities.

For most brokers, the process of market-maker selection is usually automatic. Others have a direct market access (DMA), meaning that they allow users to select the market maker that offers the best pricing.

However, the after hours trading session usually uses an electronic communication network (ECN) to execute the orders. This means that at times, you will not get the right price for the order.

» See also Direct Market Access vs. Retail Trading «

Assets

Fourth, in the regular session, you can trade all assets that are offered by your broker. This means that you can any asset, including stocks and ETFs. However, many brokers have limits on the types of assets that you can trade during after hours.

For example, you can only trade companies listed on the Nasdaq exchange.

Number of shares

Fifth, there are no limits to the number of shares that you can trade during the regular session. You can buy as much shares of a company as you want. However, in extended hours, you can only buy a maximum of 25,000 shares of a company.

Orders

Finally, you can use both limit and market orders in the market. A market order will be executed immediately while a limit order is conditional on the price hitting the specific preset level. In extended hours, you can only open limit orders.

Common after-hours trading strategies

Gap trading

A gap is a situation where an asset either rises or falls sharply from the closing price. For example, if a stock closes at $10 and then opens at $12, a gap has been formed.

There are several strategies used when trading gaps. For example, there is a gap and go, where you move in the same direction as the gap.

There is also gap filling, where you aim to go against the gap direction. For example, if a stock opens up by 10%, you can place a trade in the opposite direction.

News trading

A common situation in the after-hours is known as news trading. This is an approach that aims to take advantage of the news of the day like earnings, M&A, product launch, and management change.

If a company publishes strong earnings, you can take advantage of that price movement. Also, if a company has positive news, you can take advantage of that in the extended hours.

Momentum trading

This is a trading strategy that takes advantage of the existing trend of an asset. In this case, if an asset is in an uptrend, you can place a buy trade and wait for it to continue rising.

You can also take advantage of trends that start in the after-hours. The alternative of this is where you decide to move against the direction of the existing trend.

Why trade after-hours

There are several reasons why many traders focus on after-hours trading. First, many traders who have a regular job usually appreciate the situation of being able to buy and sell shares when the market is closed.

Surf the news

Second, after-hours trading is important because it lets traders take advantage of events that happen after the regular session. For example, many companies are known to release their financial results when the markets close. This gives traders time to digest the news before the next regular session starts.

Therefore, stocks usually react sharply immediately after the earnings comes out. It is not uncommon to see a stock jump or fall by more than 10% in after hours.

Related » Strategy: Breaking News or Price Action?

Make more money!

Third, the session helps traders make money for a long period. To many traders, the hours offered in the regular session are not enough. Therefore, having extra hours can help you make more money especially when you are profitable.

Is it safe to buy stock after-hours?

Price divergencies

While many traders love the after hours, there are several risks involved. First, as mentioned above, the trades are executed using the ECN market. This eliminates the need for a market-maker, meaning that you will often not get a good price. In fact, it is common for orders to have a divergence of some points.

Lower liquidity

Second, trading in the after-hours is risky because of the lower liquidity since only a small portion of investors use it. In the regular session, liquidity on all assets is usually high, meaning that you can get a good price.

One type of order

Finally, after hours only accepts limit orders. For new traders, this can be a relatively difficult trading approach.

Best practices for after-hours trading

- Do your research – The most important thing is that you should do your research well before you execute a trade. It is recommended that you do technical and fundamental analysis.

- Set realistic expectations – A common mistake that people make is that they set unrealistic expectations about their potential profits.

- Risk management – One of the best things to have in mind is risk management because of the challenges in the industry. The best way is to set a take-profit and a stop-loss for your trades.

- Position sizing – Focus on ensuring that your trades are of the right size since large ones can expose you to substantial risks.

When does the after hours session end?

The after-hours trading session starts at 4:00pm ET and then ends at 8:00pm ET.

Is there after hours trading on Friday?

Yes. The after hours trading session runs from Monday to Friday. The only days when there are no after-hours is when there is a holiday.

What are the rules of after hours?

Some of the rules of after-hours are on the order types, where you can only place limit orders in the market.

Summary

The after hours session is an important period in the stock market because it has extended the number of hours that traders have to make money. It has also allowed them to react instantly to latest news and events like earnings and news.

Most brokers in the United States like Robinhood, Schwab, and TD Ameritrade offer the after-hours session that you can take advantage of.

External useful resoruces

- After-Hours stock screener – Marketwatch

- After hours quotes – CNN