Traders use various strategies to win in the market. There are those traders who focus mostly on fundamental analysis like the news and economic data. There are others who focus on technical analysis and those who use price action.

At the same time, there are traders who combine these strategies with reading the tape. In this report, we will look at what this strategy is and how you can use it profitably in the market.

Table of Contents

What does Reading the Tape mean?

Reading the tape is one of the oldest trading strategies in the market. Its roots can be traced in the early 1900s when electronic trading was not there. Instead, market orders were being submitted through telegraph lines on a sticker tape.

This tape included a ticker symbol, the price of the asset and the price. As a result, many traders, including the famous Jesse Livermore, made a living by analysing these tapes, in a process that was known as reading the tape.

Obviously, these strategies were phased out in the 1960s when electronic trading became a thing. Still, many brokers provide these activities to their traders. Most of them provide this data using what is known as a level-2 account.

How do you read a Level Two Stock Chart?

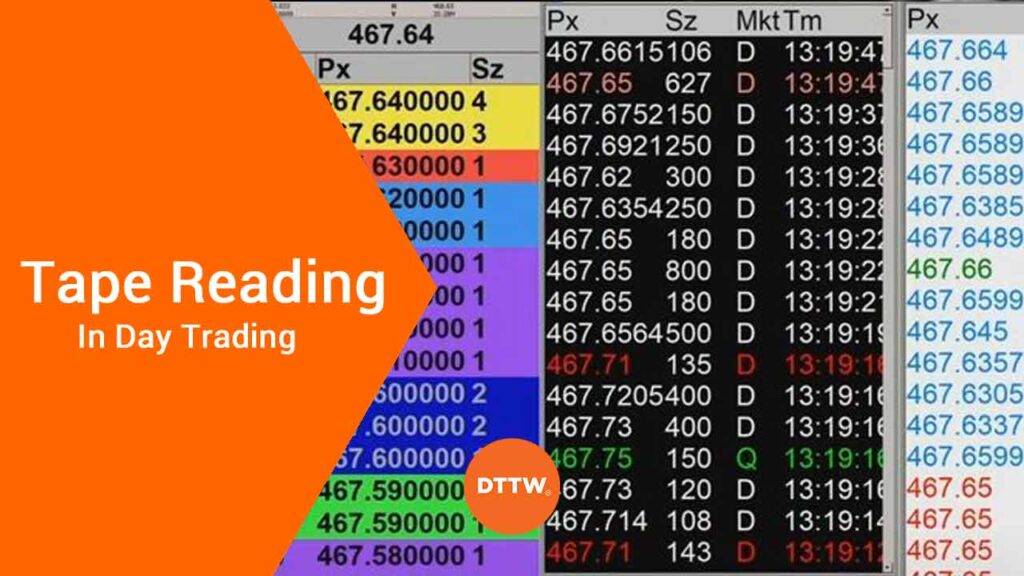

Reading the tape, often known as time and sales, has three main categories. On the left side, it has a price of an asset, the volume involved, and the time of the transaction. In most cases, the tape usually has two colours, blue and green.

Other tapes have several colours, such as yellow, green, blue, and black. These colours simply tell the market participants the state of the orders.

Most importantly, the orders that are placed in the tape are usually pending orders. Once they get filled, they are pushed to the right side of the tape, which is often in black.

Modern approach to reading the tape

As mentioned above, reading the tape is a relatively old technique that looks at the flow of volume in a specific time of the day. Today, the modern approach involves using a tool that is known as time and sales, which is offered by most brokers like WeBull and Real Trading.

With the time and sales dashboard on, you will be able to see the stock price that many buyers and sellers are executing at, the overall volume at the specific time, and its analysis.

A good example of this is shown in the chart below. In it, the time and sales section is shown in the right side and it can help you analyze the market.

Why reading the tape is still important

There are several reasons why reading the tape is important. First, it gives you a lot of information about volume flow in the market. Second, it can help you know when to buy and sell a stock.

Finally, it can give you more context about the market especially when it is used in combination with some tools (We will tell you more about this later).

Reading the tape in various market segments

There are four main parts of the American stock market. First, there is premarket trading, which happens a few hours before the market opens. This period can help you see the top movers and the most active stocks during the day. This can be because of earnings or major news.

Second, there is the first hour of the regular session, which is usually extremely busy as day traders execute their orders. It is worth noting that most trades that are executed in premarket and extended hours are executed when the market closes.

Third, there is the midday period, where volume tends to decline. And finally, there is the after-hours. This is also a period of high volume, especially when there is an important news.

How to use the Reading the Tape Technique

There are several steps you need to use when using the tape reading technique. The steps that we believe are essential to know are the three listed below.

Select a Company

First, you need to select a company that you want to trade. This can be a highly liquid company like Apple or a less liquid firm like Houlihan Lokey. Ideally, you should select companies that you know well.

As you will realize, tapes of highly-liquid companies like Apple and Microsoft will tend to move very fast. On the other hand, tapes of highly illiquid stocks tend to have just a few lines every day.

Reduce the noise

The next important step when your read the tape is to reduce the noise. This simply means that you should use the tools provided by your broker to filter your preferred volume. This means that you should ensure that you are looking at a tape with higher volumes like 100 and above.

The idea is that high volume and action will provide a better guidance on how the price will move.

Combine with other tools

Third, you need to combine this technique with other methods like price action and fundamental analysis. For example, if there are a lot of buy orders in the tape, ask yourself the cause. It could be that the company released weak earnings or that the company is making an acquisition.

At the same time, applying technical analysis will help you to identify key levels. In addition, combining time and sales with other tools like level 2, order flow distribution, and large scale distribution will help you make better decisions.

Final thoughts

Reading the tape is a popular trading technique in big investment banks and hedge funds. Investors use it to analyse all types of assets, including stocks, bonds, currencies, and commodities.

As a trader, you should not rely only on the technique. Instead, you should use it in a holistic way by combining it with other trading techniques like price action and fundamental analysis.

External useful Resources

- How to Interpret the Time and Sales Window – Tradingsim