Market data plays an important role for day traders and investors. This explains why many market participants are usually willing to pay a subscription to get access to data.

Not all data are the same. For a first glimpse, basic data is enough.. If You want to do more in-depth analysis, you should go deeper.

In this article, we will focus on an important part of the market known as level 2. We will explain how asset pricing works in stocks and how this level differs from level 1.

Table of Contents

What is level 2 data?

Level 2 data is an important data that is provided by advanced brokers on a subscription basis. This data provides a real-time bid and ask prices for an asset. The goal is to ensure that a trader can find more data when executing trades.

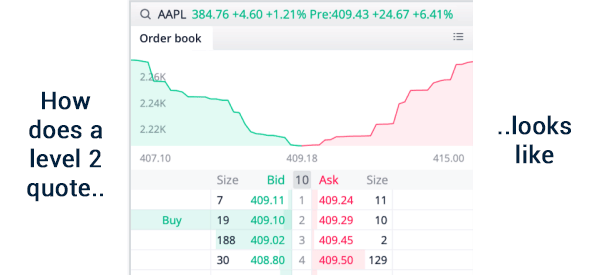

In other words, the tool provides traders with access to an order book so that they can make informed decisions. The chart below shows how this quote looks like.

Level 2 vs Level 1

A common question is on the difference between level 1 and level 2 orders. Level 1 is the most basic pricing data that is offered by most brokers.

For example, when you are using a broker like Robinhood and Schwab, the price that you are seeing is the level 1 data. Brokers are mandated by law to provide the most accurate data to their customers.

The main difference between level 2 and level 1 is that the latter has more depth, which level 1 lacks. It is also more opaque than level 1.

Level 2 vs time & sales

Another concept you need to know is time and sales. Level 2 is often accompanied by time and sales. The latter is known as reading the tape. It simply refers to the volume, price, direction, date, and time that each trade is executed.

These two are extremely useful when you are day trading since they provide you with more information.

How level 2 quotes work

To understand how level 2 works, we need first to understand the concept of payment for order flow (PFOF), which explains how American brokers work.

American brokers like Robinhood, Schwab, and TD Ameritrade don’t execute orders themselves. Instead, they work with market makers, which provide liquidity to them.

Examples of the biggest market makers in the US are Citadel Securities, Virtu Finance, Susquehanna, and ARCA among others. Citadel and Virtu control about 22% of the entire market.

These market makers take a small commission for completing the order. Despite this, they are able to make millions of dollars per day since they execute millions or even billions of trades.

When you enter a trade, the broker sends the order to its pool of market makers and selects the best price. By law, the order must be executed at the best price for traders. These transactions happen within microseconds.

Therefore, if you have a level-2 subscription, you will be able to see how an asset’s order is being placed. For highly popular stocks like Google and Tesla, these transactions usually happen so fast that it is difficult to see the queue. However, for thinly-traded companies, it is possible to see the line.

How to get access to level 2 data

There are two main ways to get access to these data when trading. First, you can pay a small fee to your broker to get this data. A broker like Webull charges about $2.99 per month to get access to this data. Depending on the type of trader you are, this small charge might make sense. However, if you are an occasional trader, it is not worth paying the fee.

The other option is getting level 2 data from your trading company. Several prop trading companies pay this fee to companies and then provide the data to their traders for free. Real Trading is one of those companies that provide this data to its traders.

Parts of a level 2 quote

The level 2 quote is made up of several important parts that you can use to day trade. First, these data contain the MPID category. Also known as the market ID, this category shows the market maker who will be executing the order.

Some of the most popular MPIDs are NYB, MEMX, AMEX, and IEXX. In most cases, the price difference between these market makers will always be thin.

The other category in a level 2 quote is the price. The price you are seeing is what other traders are willing to pay for the asset.

Finally, there is the size. In most cases, the size is usually quoted in hundreds. Therefore, when you see a size as 78, it simply means that there is a trader who has placed a 7,800 order to buy an asset.

The right side of the level 2 data is the ask side. Ask is defined as the lowest price that a seller is willing to take while bid is the maximum price that a buyer is willing to pay.

Related » What’s Spread Trading on the Markets?

Benefits of using level 2 data

There are several benefits of using level 2 data. Some of the top benefits are:

Better understanding of market liquidity

Liquidity is defined as the ease of entering and exiting a trade. Unlike level 1 data, level 2 can provide you with more information about the liquidity in the market by showing you the strength of the order book.

This happens by showing you the number of orders at each price level and helps you know the support and resistance.

Ability to spot market manipulation

Market manipulation is an important thing that happens regularly. One of the common strategies is where large traders place large orders and then cancel them.

When using level 1 data, it is almost impossible to spot this market manipulation. Level 2 data can help you see this in a relatively easy way.

Improve order execution

Level 2 data can help you improve your order execution rate since it gives you access to more in-depth prices. At times, some market makers can even pay you when they execute your order.

Also, by seeing the price that most traders are placing their trades, you have the ability to make informed decisions. In other sizes, you can get the best bid and ask prices.

Increased market awareness

Having access to level 2 data can give you more market awareness by providing you more information about how market participants are trading. This information is extremely difficult to get in a level 1 data.

Summary

In this article, we have looked at the important concept of level 2 data and how to use it in the market. We have also looked at some of the best strategies to use the data and how it differs from level 1 data. Also, we have assessed the pros of using the data.

External useful resources

- Why and How Investors Use Level 2 Market Data – Smart Asset