A common question among new day traders is on the best trading software to use. Ideally, most online brokers like Robinhood, Schwab, and Interactive Brokers have built their personalized trading platforms.

At Real Trading, we have also built a robust and relatively easy-to-use trading software that is used by thousands of traders every day.

In this article, we will look at what a trading software is and how to choose the best.

Table of Contents

What is a day trading software?

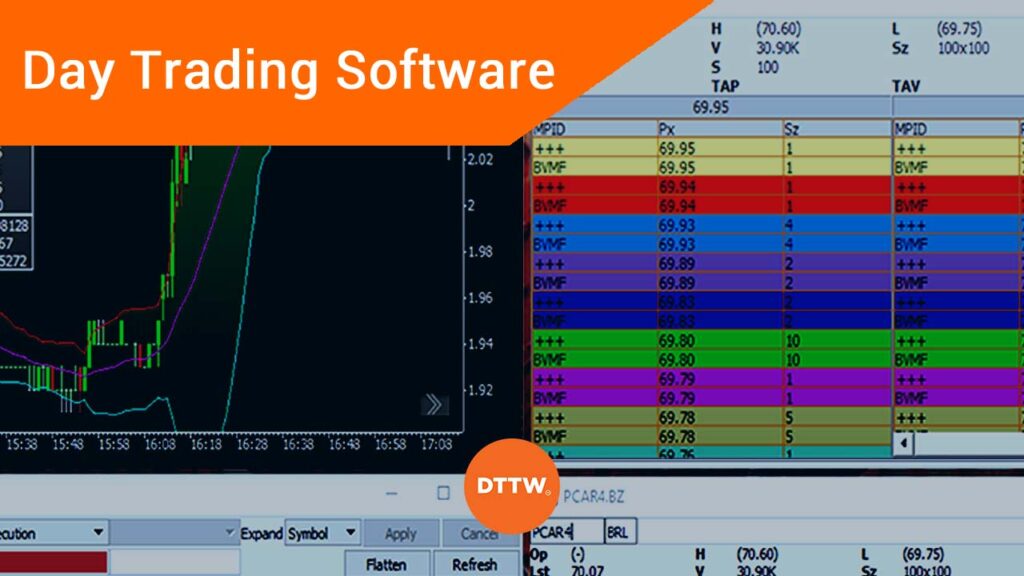

Trading software is a platform that is provided by most brokers to help their trades analyze and execute orders. The software basically offers tools to conduct both technical and fundamental analysis. It provides the charts and other tools.

In addition, it offers a communication route that links the day trader and the broker. Therefore, when a trader presses the buy or sell button, a communication link happens that tells the broker to execute the order.

The trading software is usually free of charge provided that you are a company’s customer. Some platforms are even offered free of charge. For example, you can easily download and create a demo account with MT4 and MT5 by just downloading the software online.

Trading software comes in different forms. Some come as mobile-only platforms while others come as downloadable software for Windows, Linux, and Mac.

Our Day Trading Software, called PPro8, is only available for Windows (for now).

Related » Features of The Right Automated Trading Platforms

Some Examples

There are many trading software in the market. Some of the most popular ones are:

- MetaTrader 4 and 5 – This is the most popular trading platform, popular among foreign brokers. It offers loads of tools to help people trade.

- PPro8 – This is our inbuilt trading platform that offers multiple tools, including DMA.

- NinjaTrader – This is a platform that is provided by many brokers globally.

- TradingView – This is a web platform that helps traders analyze and execute orders.

How to use the day trading software

Using a day trading software is a relatively easy process. But this depends on the one you decide to use. First, you need to download it and have a look at its features. Ideally, most trading platforms have a few key features, including:

- Technical indicators – This is a tab where you can find all the indicators offered by the platform. Among the popular ones are moving averages, relative strength index (RSI), and the MACD.

- Charting tools – These are tools that are helpful in day trading. They include Fibonacci retracements, trend lines, and Andrews Pitchfork, among others.

- Trading options – This refers to options for buying and selling financial assets.

- Assets – The software has a tab that lists the assets that are provided by the broker.

To use the trading software, you just need to know how to use these tools. Fortunately, most of the tools available are usually relatively easy to use. Before you select a broker, ensure that you look at how easy the trading platform is to use.

How a trading software works

As mentioned above, a trading software works in an easy method. It is a simple platform that connects a broker to the trader. Therefore, when you open a trade, you are simply telling the broker to make it happen. Similarly, when you close a trade, you are basically telling the broker to close an active trade.

However, behind the scenes, a lot of things usually happen when you open or close a trade.

For example, if you are using companies like Schwab and TD Ameritrade, when you open a trade, they usually send a message to their market-makers, who implement the trades. When using our PPro8, since we are a direct market access (DMA) platform, you will be able to select the market-maker to use.

The other features included in the trading software are usually built-in in the platform. Some software also allow you to import plugins or indicators from the internet.

How much do day trading software cost?

These tools are usually provided for free. Brokers don’t charge their customers any funds for the software because they require it for their trading. If you are a new trader and find a broker that is charging money to access the software, we recommend that you find another one.

Day trading demo software

A day trading demo software is a platform that uses fake money and real data (simply, a stock market simulator). The demo mode comes as part of the main trading software. Most trading platforms provide the demo account to help traders practice about trading.

Also, the demo is used by experienced day traders to test their trading strategies.

For example, if you come up with a trading strategy, instead of testing it on a real account, you can test it in a demo instead of a live account. This will help you not to risk your money. When using a demo, we recommend that you use it as if you are using a real account.

»Practice Trading like a pro with our TMS™«

Direct access to the market

As mentioned above, direct market access (DMA) is an important thing when you are day trading. It refers to the process of having a direct access to the market data.

In the United States, most online brokers don’t give you this access. Instead, when you place an order, they simply select the best market maker in the backend.

If you have a DMA, you will have access to the market, whereby, you will be able to select the preferred market-maker. This helps you to select the best price! At times, the market maker can also reimburse some of your funds for using its route.

What features should you want?

Not all systems are equal. Some of them are specifically made for day trading. These systems will have tools that will help you make split second decisions.

There are several aspects of a trading system that should be considered.

1. Is the system stable?

The stability of a trading system is probably the most important thing (even if many traders probably think speed is the most important). Stock quotes and stock executions must be reliable and stable, because some systems have significant downtime.

You must ensure you have as much trading time as possible, since this will ensure you are connected to the market to take advantage of all the opportunities that may present themselves.

2. Is the system fast?

The speed of a trading system is extremely important (of course, if the system is stable). When you see a great trading opportunity, you want to make sure that you can take full advantage of it.

You will not be the only trader that is seeing that opportunity and you want to make sure you can be first to make the trade. Speed is important in both seeing the trade and making it. So make sure the system you use is very fast.

3. Does the system have stock charts?

Stock charts are very important to a trader. These are essentially a way of tracking the previous transaction throughout the life of a stock. A good charting program will let you run countless technical studies on a stock.

Using these studies, you will be able to identify patterns in the history of a way a stock trades. Hopefully a day trader will see future trading opportunities in stocks’ historical patterns.

4. Does the trading platform have a good support team?

There are two reasons that a trader may need support from his or her platform provider. The first being that, no matter how stable a trading platform is, there are always issues.

These issues can be in the network connecting the trading system to the stock market or with the stock market itself. A strong support team can make sure you are aware of all of the issues in a timely manner.

The second reason is that a good trading platform will have a lot of features that a trader can take advantage of. A good support team will be able to explain the tools and help a trader learn to use them. When considering what trading platform to use to day trade, a trader must consider all of these things.

Final thoughts

A trading software is a tool that helps people study charts and implements trades. In this article, we have looked at some of the popular trading platforms in the world and how they work.