Technical analysis is one of the three types of analysis that traders use to make decisions (the other two are fundamental and sentimental). This analysis involves the use of technical indicators to make forecasts on how the asset price will move.

This article will look at some of the most popular technical trading indicators you can use in day trading.

Table of Contents

Trend indicators

The core of trading and investing is to find a trend and follow it to the end. When you find a trend that is moving upwards, the goal is to buy and when you find a trend that is moving downwards, the goal is to sell.

Trend indicators are used to show when a new trend is forming and when it is coming to an end. Examples of this technical analysis tool are:

- Parabolic SAR

- Moving Averages

- Average Directional Index

- Standard Deviation

- Ichimoku Kinko Hyo

- Envelopes

The most common tool: Moving Averages

Moving averages are the most popular of the many technical trading indicators. In fact, it is the foundation of many other trend indicators like the standard deviation, envelopes, average directional movement index (ADX), and the MACD.

There are several types of MAs, including simple moving average, exponential moving average, weighted moving average, and smoothed moving average. These indicators tend to be similar, the only difference being that they attempt to remove or reduce the overall lag and provide better signals.

How day traders use MAs

Day traders use moving averages in different ways. There are some who combine two MAs to find crossovers. A popular approach is known as the golden cross, which refers to a situation where the 50-day and 200-day MAs make a bullish crossover.

The opposite of this is known as a death cross.

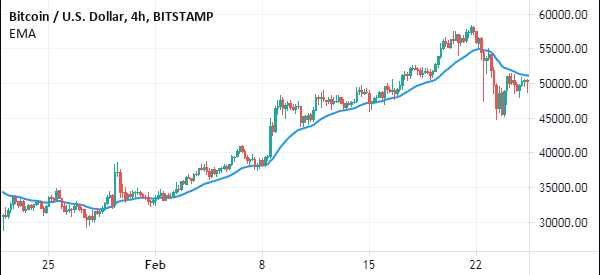

Other day traders use the MAs in trend following. When an asset is trending, they use the MA to identify when a reversal is about to happen. For example, in the chart below, the BTC/USD price was in an uptrend so long as it was above the 25-day EMA.

In addition to moving averages, other popular trend analysis tools are the Bollinger Bands, Average Directional Index, and the Parabolic SAR.

Oscillators

Oscillators are indicators that are used to show the extremes of the trends. They are mostly known as indicators of oversold and overbought positions. Examples of these types of indicators are:

- MACD

- Relative Strength Index

- Stochastics

- Bulls and Bears Power

- DeMarker

- Relative Vigor Index

- Momentum

The most popular oscillator indicator in day trading is the Relative Strength Index (RSI). The indicator is calculated that measures the speed and change of price movements. The indicator moves between 0 and 100.

The most popular way of using it is to identify the 30 and 70 levels. Any moves above 70 are said to be overbought while any moves below 30 are said to be oversold.

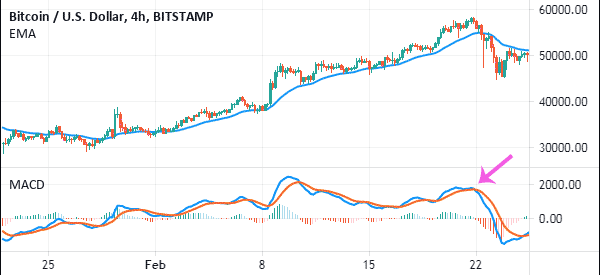

Another popular oscillator is the moving average convergence and divergence (MACD). This indicator usually converts two moving averages into an oscillator.

While there are many ways of using the indicator, the most popular one is to identify when the two lines make a crossover. For example, a shown below, after days of rallying, the BTC/USD price pulled back after the two lines of the MACD crossed over.

Other popular trading oscillators you can use are the Stochastic, Relative Vigor Index, and the Money Flow Index.

It is worth noting that some traders believe buying an asset whose price is in the overbought level. They argue that an overbought item will remain in the original bullish trend.

Volumes

Wise traders don’t focus on oscillators and trend indicators alone. Those who focus on these alone often find themselves making the wrong decision. Instead, the ideal process is to incorporate the concept of volumes in the technical analysis.

The volumes show the activity of the other investors in the market. For example, the trend and volumes indicator can reveal a bullish trend but at a low volume environment. If this happens, it could be a false breakout.

If the volume is high, it means that more investors are following the trend. Examples of these tools are:

Other Indicators

There are other indicators that are not in either of the classification but ones that help the traders make decisions. These include: Fractals, Heiken Ashi, and iExposure among others.

Other Technical Analysis Tools

Apart from these indicators, there are other tools that will help you improve your technical analysis skills. These are known as charting tools because they give you an indication of where the price of an asset will move next.

Examples of these are the Fibonacci Retracement, Gann line and grid, and linear regression.

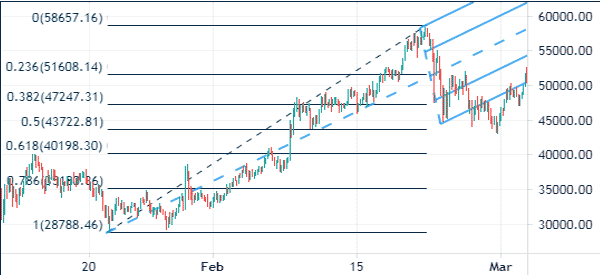

These tools are important because they show you where the price will likely move to. A good example is in the chart below. The black lines represents the Andrews Pitchfork.

As you can see, the price is slightly below the median line of the pitchfork. Therefore, this is as sign that the BTC/USD has not yet recovered. Also, the price is attempting to move above the 23.6% Fibonacci retracement level.

Therefore, any move above this retracement and the median of the pitchfork is a sign that bulls have gained momentum.

Candlestick Patterns

Another important aspect in technical analysis is the candlestick patterns. It is almost impossible to be successful in this analysis if you don’t know how to interpret a candlestick chart.

Examples of the most popular patterns are:

- Three Line Strikes

- Two black gapping

- Three black cows

- Evening and morning stars

- Abandoned baby

- Doji

- Hammer reversal

All these technical analysis tools were created using complex mathematical formulas, but fortunately you don’t need to calculate them yourselves!

Instead, all you need to do is to apply them in the charts provided by us.

In addition, you don’t need to master all the indicators.

You just need to master a few and then learn how you can use them in doing the analysis.

External resources and tools for your Technical Analysis

- discover more on CorporateFinanceInstitute

- A beginner Guide on Investagrams