Day trading refers to a situation where a trader buys and sells financial assets with the goal of making a profit in a short time frame. The most popular assets in the market are

- Commodities

- Stocks

- Currencies

- Exchange-traded funds (ETFs)

All these assets tend to be highly volatile, meaning that things can change at any time. Therefore, in order to perform at our best, we need to know how to adapt and make a decision quickly.

In this article, we will look at the concept of adaptability and why it matters to become a pro trader.

Table of Contents

Managing change in the market

One of the most popular Charles Darwin quotes says:

“It is not the strongest or the most intelligent who will survive but those who can best manage change.”

Darwin said this statement in relation to biology but it can apply to other industries as well. As expert traders, we have seen it apply to day trading and investing. Indeed, most people who succeed in the market are not geniuses.

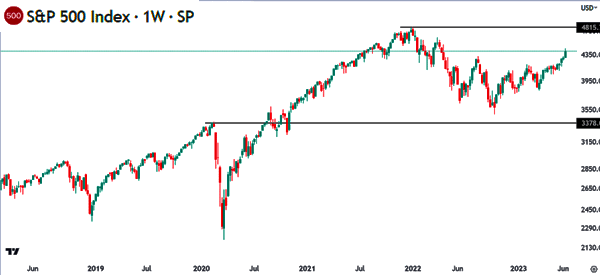

Instead, they are individuals who understand how the market works and the different market cycles. A good example of these cycles is shown below.

As you can see, the S&P 500 dipped sharply in early 2020 when the World Health Organization (WHO) declared Covid-19 a global pandemic. It then staged a major rally and peaked at $4,815 in 2021 and then started another bearish trend.

Why you need to be adaptive

There are many reasons why you need to be adaptive in the market. First, as shown above, the market does not always move in a straight line. In some cases, the market can be highly volatile, which is usually ideal for day traders. Volatility happens when the rate of change of an asset price is fast.

In other cases, the market tends to remain in a tight range. This happens when the market is not moving quickly enough. This period tends to have no major trading opportunities. As such, you need to learn how to trade in these market conditions.

The most interesting period is when the market is moving in a well-defined trend. This trend could either be in the upward or in downward direction. A trending market is usually the most profitable since you can buy low and sell high or short high and exit low.

Therefore, when you grow your adaptability, you will be in a good position to make changes and make money in all market conditions.

Second, being adaptive will enable you to trade using different strategies. The most popular trading strategies are: trend-following, reversals, algorithmic, scalping, and swing trading, among others.

Third, it will help you be an all-weather trader, who makes money in all market conditions. Finally, it is a good way to make money trading across different financial assets.

In some cases, the stock market will be muted while the crypto market is showing some volatility. As such, you will be able to make money in all these conditions.

Key causes of market volatility

There are several causes of volatility in the market. As a day trader, you need to have a good understanding of these causes as you try to become a more adaptable trader. Some of the most popular causes of market volatility are:

Economic data

Some economic data can cause volatility in the financial market because they have monetary and fiscal policy implications. Some of the most popular economic data in the market are inflation, jobs, manufacturing, and industrial production.

High inflation and low unemployment rate can trigger the Federal Reserve to embrace an extremely hawkish tone. In most periods, stocks tend to underperform when the Fed is a bit hawkish, as we saw in 2022.

Other important data that causes volatility are from countries like China, Japan, and the European Union among others,

Geopolitics

Geopolitical issues can have an impact on the financial market. Some of the most popular recent geopolitical events are the Russian invasion of Ukraine, China and US tensions, sanctions on Iran, and North Korean nuclear weapons.

These geopolitical tensions could lead to more volatility in the financial market.

Market sentiment

The other major cause of market volatility is sentiment. At times, investors tend to have a bearish sentiment about the market.

This could be because of weak corporate earnings and fear of the unknown or projected risks like inflation or recession.

Corporate news and earnings

The other important cause of market volatility is corporate news and earnings. In most periods, companies tend to fall sharply when earnings don’t meet analyst expectations.

A sharp decline in a company like ExxonMobil can trigger a decline in other companies in the industry like Chevron, Shell, and Marathon Energy among others.

How to deal with different market conditions

There are several things that professional traders do to deal with the different market conditions. Some of these important things are:

Understanding the different market cycles

First, you need to have a good understanding of the different market cycles. In this case, you need to know where the market is at the moment.

For example, you should know whether the market is in a bull or bear market. You also need to know whether the market is extremely volatile or in a consolidation phase.

Have a trading strategy

Second, you should always have a good trading strategy to handle all market conditions. For example, you can embrace a trend-following strategy when the market is going in an uptrend or when it is in a downtrend.

Alternatively, you can embrace the scalping when the market is in a tight range. This strategy is very effective because it allows you to take advantage of even small movements, allowing you to generate some profit (if done right) in a short time.

Always protect your trades

The next thing is that you should always protect your trades. Fortunately, all trading platforms provide tools to do this.

Day traders face inherent risks, including market volatility, unexpected events, and potential losses. Successful day traders are skilled at managing and mitigating risks.

They employ risk management techniques such as setting stop-loss and take-profit orders, position sizing, and adhering to disciplined trading plans. Protecting your trades will help you avoid making substantial losses in the market.

Technology and Tools

Day traders must stay abreast of technological advancements and utilize appropriate tools to analyze market data, execute trades, and manage risk effectively.

Keeping up with the latest trading software, platforms, and data sources can give traders an edge in adapting to the changing landscape.

Continuous Learning

Finally, Day traders need to stay updated with market trends, trading strategies, and new tools. They should constantly seek opportunities to learn and improve their skills.

This includes studying technical analysis, fundamental analysis, and staying informed about relevant news and events that could impact the markets.

You should always be prepared for any eventuality in the market. This means that you should always remember that anything can happen when you implement a trade.

You can be prepared by doing several things like having the right position sizes and using small leverage.

Summary

The financial market is a dynamic place, meaning that the market does not always move in a straight line. A day trader who aims to become a professional must be able to grasp these changes quickly and implement the correct decisions in a short time.

We then delved into the concept of adaptability, why you need to pay attention to it, and the best practices to put in place when market conditions change.

External useful resources

- How to adapt your trading style to the markets – Best Fx Brokers