As the concept of day trading becomes popular, most people are finding out how difficult the process is. Most available data shows that over 80% of all people who start trading fail.

In most cases, these people don’t fail because they are poor traders. Instead, they fail simply because of the lack of discipline in the market. In this article, we will explain why you need to be a disciplined trader to succeed in the market.

Table of Contents

Understand discipline in the market

Discipline refers to the process of following the rules and order in all areas. As a day trader or investor, discipline is seen in several areas.

For example, it is identified in parts like consistency, adherence to your trading plan, and having self-control when handling common biases.

A trading plan is the most important part of day trading. It refers to the entire approach in which a trader does the research, executes trades, observes their performance, and exits them.

Having a good trading plan is an essential part in you becoming a good trader in the financial market. However, if you are not disciplined enough, the plan will likely not work out as expected.

A good example of this is where a trader ignores his trading plan or strategy and then opens trades without doing any research. They are also often caught in making important mistakes like buying a stock that is just rising for no reason.

Key areas to boost your trading discipline

There are many areas that you can use to boost your trading discipline. Most of these areas are related to the psychology of the day trader. Some of the top areas to work on are:

Fear and greed in trading

Fear and greed are the most important emotions that drive the market. Stocks and other assets rise sharply when investors are getting a bit greedy. For example, AI stocks like Nvidia and Palantir jumped sharply in 2023 as investors bought the hype.

Stocks also plunge because of the fear among the investing and trading community. This fear can be driven by company-specific news like weak earnings and product details.

A disciplined trader will avoid all this by doing independent research about an asset and then allocating their funds accordingly. For example, a trader can decide to buy a stock that is soaring and exiting it before the end of the day.

Most importantly, a trader can avoid fear and greed by having a trading journal where they detail all their trade transactions in a paper or a soft copy document.

Revenge trading

Another concept common among day traders is known as revenge trading. This is a situation where a trader attempts to make up for losses by opening one or more poorly-researched trades.

For example, if a trade loses $200, you can open a new one hoping to make the same money. If this loss happened in a long Apple trade, you can attempt to recover by opening a short trade of the same asset.

A disciplined trader will first ensure that their maximum losses are minimal. Also, they will always do research before opening the trade.

Irrational exuberance

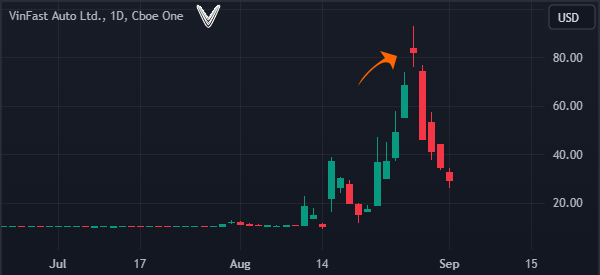

Irrational exuberance – or hype, if you prefer – is a situation where traders make decisions that don’t make sense. For example, in 2023, a Vietnamese company known as VinFast attained a market cap of over $100 billion.

This valuation made it bigger than firms like GM and Ford even though it had minimal sales. Ultimately, the stock collapsed, as shown below.

A rational investor or trader will know that the valuation makes no sense at all and avoid buying the stock.

Panic selling

Another area where discipline is needed is known as panic selling. This is a situation where a trader exits a trade rapidly when a stock starts falling.

If you are convinced that a company is a good investment, then you should avoid selling in panic. And, in any case, you must always protect yourself with the tools at your disposal.

Common biases

A trader should also be disciplined when it comes to common biases in the market. First, there is the optimism or pessimism bias, where they make decisions based on their feelings about the companies.

For example, some traders love some companies so much that they cannot short them even when opportunities emerge.

Second, there is anchoring bias, where traders focus on the information they receive at first. In most cases, this bias can lead to substantial losses in the market.

Third, there is the overconfidence bias, where people assume that they are better than the others. As such, this bias can lead to substantial losses in the market.

You must create a solid trading plan

Embrace a solid trading plan is the foundation of success in financial markets. It includes carefully outlined strategies, clear entry and exit points, and rigorous risk management.

These components provide traders with direction, enabling them to capitalize on opportunities while minimizing potential losses. In the world of trading, a well-structured plan is not just valuable; it’s indispensable.

Clear entry and exit points are the cornerstones of this plan, acting as guiding stars in the tumultuous sea of market volatility.

The most successful people in the market are known for having a good plan and sticking with it. For example, Warren Buffett buys and holds companies for many years. He also avoids industries he does not understand well like pharmaceuticals and technology.

Being a disciplined investor has helped him become one of the richest people in the world and the most successful investors of all time.

The Smart approach

A solid trading plan should follow the SMART approach. It should be specific, measurable, achievable, time-bound, and relevant.

This smart approach aligns the plan with individual goals and risk tolerance, ensuring it evolves with changing conditions. It acts as a trader’s compass, offering direction, discipline, and confidence in navigating the complexities of the market.

This customization ensures that the plan is a dynamic tool, evolving with changing market conditions and personal circumstances.

For example, it should be specific in the assets you trade and have the time factor. Some traders hold their trades for a few days while others hold them for a few weeks.

Trade and protect yourself

Entry points help traders to seize opportunities at the right moment, capitalizing on favorable market conditions. These points are not arbitrary; they are carefully calculated based on technical and fundamental analysis, offering a strategic advantage.

Equally important are exit points, which protect traders from potential losses. Knowing when to exit a trade, whether to secure profits or cut losses, is essential for long-term success. These exit strategies act as a safety net, preventing emotional decision-making and minimizing risks.

Risk management strategies, including stop-loss orders and position sizing, further fortify the trading plan.

Stop-loss orders automatically limit potential losses by closing a position when a predetermined threshold is reached. Position sizing ensures that no single trade can excessively impact the overall portfolio, safeguarding against catastrophic losses.

Stick for it

While having a trading plan is undeniably crucial, we firmly believe that the true essence of success lies in adhering to it with diligence.

It’s not merely about having a plan in place; it’s about the unwavering commitment to follow it diligently, or perhaps, with just enough flexibility to seize exceptional opportunities without compromising the plan’s integrity.

Hence, we advocate a balanced approach – one that encourages the strict adherence to the core principles of your plan while allowing for a degree of flexibility to adapt to unexpected market shifts.

Deal with losses

The next important part for discipline is how to deal with losses. We highly recommend that you focus on having a good risk-reward ratio and then you protect your trades using a take-profit and a stop-loss.

By having these stops, you will often not worry about the losses you make since they are smaller enough. Traders who don’t use this strategy often make the error of either cutting losses too fast and letting them run for long.

For example, if a stock is trading at $20 and you place a buy trade, you can set a take-profit at $23 and a stop-loss at $18. In this case, the stop-loss will be triggered when the shares drop to $18.

A trailing stop loss is even better since it captures the initial profits even when the stock reverses after rising to $22.

How to develop effective discipline in trading

There are several strategies that will help you be effective in having the most discipline in the market. The most common of these strategies are:

First, you should always take time to learn about the market as you start your trading journey. Reading books will give you a chance to learn from the experiences of other people.

Second, having a mentor who has been in the industry for a long period will go a long way in boosting your skills. A mentor will give you the experience that you need to help you become a better trader.

Third, starting your career as part of a trading floor will boost your trading skills because most of these partners have many years in the industry.

Further, having a good trading journal will help to boost your trading skills. In a journal, you simply write everything about trades, including entry and exit prices, catalyst for the trade, and the outcome.

Another simple way is to watch TraderTV, the fastest-growing YouTube channel for day traders. By watching them trade in the live market, you will be at a position to learn how they handle pressure.

FAQs

Which are the best soft skills for boosting discipline?

There are many soft skills that will help you boost your trading discipline. The most popular of them are patience, resilience, and the ability to make decisions fast. Also, you need to be calm under intense pressure.

Which are the top tools to help you boost your discipline?

There are many tools that help you boost your discipline as a trader. The most important ones are stop-loss and take-profit, trading journal, strategy tester, and stock screener.

Which are the common biases to work on?

A trader should always focus on several biases, including anchoring, optimism, overconfidence, and loss aversion bias.

External useful resources

- 3 Tips to Help You Develop Self-Discipline in Trading – Babypips