The gap and go strategy is one of the popular ones, especially among small-cap stock traders. As the name suggests, the goal is to identify a gap and then either follow it or short it.

In this article, we will look at what a gap is and how you can use the gap and go strategy well.

Table of Contents

What is a gap in trading?

A gap refers to a situation where the price of a financial asset opens sharply higher or lower. The strategy can be used in both stocks, currencies, exchange-traded funds (ETFs), and commodities.

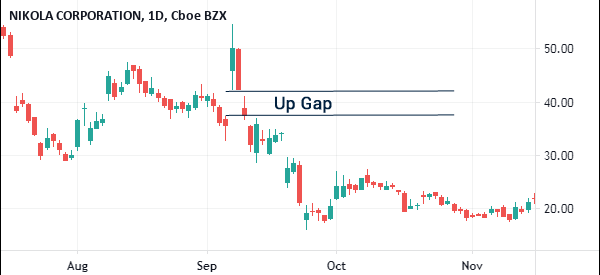

You can use it in both day trading, scalping, swing trading, and even long-term or position trading. The chart below is an example of a down-gap shown on the Nikola stock.

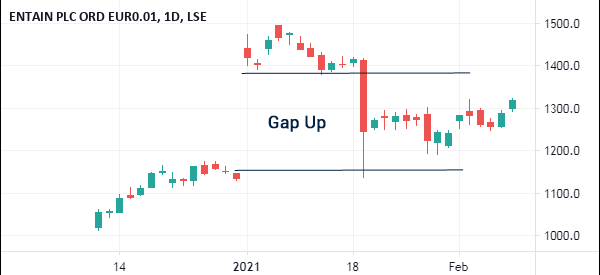

The chart below shows an up-gap on the Nikola stock.

Main outcomes

As seen above, there are usually two main outcomes when a gap happens:

- The asset’s price can continue moving in the direction of the gap

- The price can have a gap and then start reversing

As you will see below, this partly depends on the main cause of the gap and the prior chart formation.

Related » The Key Concept of Morning Gappers

Causes of gaps in the market

There are several main causes of gaps in the financial market. Here is a quick view among the most notable ones.

Economic data

A common cause of a gap in the forex market is economic data like employment numbers, manufacturing and services PMIs, and interest rate decisions.

For example, if the US releases weak economic numbers, it is possible that you will see a gap in the EUR/USD pair. Similarly, if the country releases strong numbers, you will often see a gap.

Earnings

For stocks, a main cause of gaps is earnings. In most cases, when a company reports strong earnings, you will often see a gap-up. Similarly, if it releases weak earnings, you will tend to see a gap-down.

This happens as long-term investors digest the numbers and shift their allocation. Existing investors can add to their positions in case of strong numbers. They can also scale-down their acquisitions in case of weak numbers.

Mergers and acquisitions

Another cause of gaps is mergers and acquisitions. In most cases, when a deal is announced, the stock of the company being acquired will have a gap-up since the acquirer will need to pay a premium.

A good example of this is what happened recently to Entain shares after MGM expressed its interest. As you can see below, when the stock opened, it gapped-up.

Analyst pick

At times, the stock of a company will have an up or down-gap when there is an analyst pick. For example, if analysts at a company like Goldman Sachs or Morgan Stanley raises or lowers their target, you will often see the stock gapping upwards or downwards.

Important investor

Last but not least, another cause of a gap-up or gap-down is when there is an important investor in the market. For example, when someone like Warren Buffett, Carl Icahn, or Bill Ackman announces a position, the stock will often rise.

How to trade the gap and go strategy

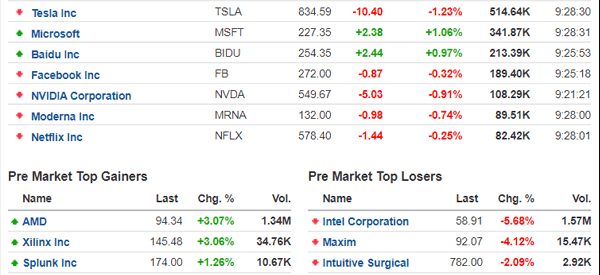

The process of trading the gap and go strategy is a relatively easy one. First, you need to identify when the gap has formed. To do this, we recommend that you use premarket screeners to find the most active stocks. Some of the most popular screeners are provided by Investing.com and Market Chameleon.

The chart below shows the most active Nasdaq 100 stocks in the pre-market at the time of writing.

Find answers

The next stage is to identify the reasons for the gapping-up. Ideally, when there is a major gap, it is usually accompanied by a reason. For example, in the chart above, we see that Intel’s stock fell by more than 5.68%. A deeper dive shows that the reason for the price action is that the company reported weak earnings.

As you do this, try and identify the volume of the financial asset. In most cases, when a gap is accompanied by high volume, it means that it will continue in its direction.

Have a watchlist

A good way to find these answers is to have a watchlist. A watchlist is a tool that gives you the main reasons why stocks are gapping up and downwards. At Real Trading, our team provides a good watchlist that you can use to identify opportunities.

Identify potential support and resistance levels

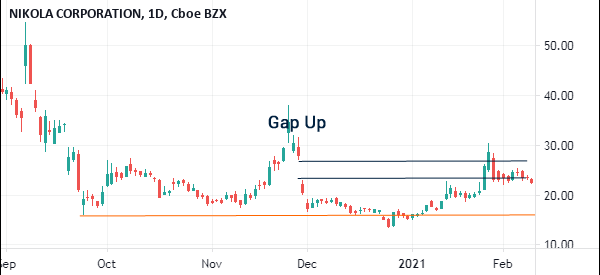

The next stage is where you identify potential support and resistance levels. A good way to do this is to expand the chart. If you use an hourly chart, you can expand it to the daily or four-hour chart to see the potential levels.

For example, in the hourly Nikola chart shown above, you can see the gap. Now, if we expand it to the weekly chart, we see an important support level at $16. Therefore, if the price moves below the support, it means that bulls are in total control, which will see the price continue falling.

Stages of trading the gap and go strategy

The first stage for trading the gap and go strategy is to find stocks that have gaps. As mentioned above, the best approach is to find pre-market movers. As you do this, ensure that the stocks you are considering have at least a 4% or 5% gap.

The next stage is to consider the reason for the gap. There are several ways for doing this, including looking at social media platforms like Twitter and Reddit. You can also look at financial media companies like CNBC and Bloomberg.

Further, it is recommended that you conduct a multi-timeframe analysis, which will help you identify support and resistance levels. In this, you should consider looking at three time frames. As a day trader, you should use the 1-minute chart to execute the trade.

Finally, you should place the buy trade either in the pre-market session or when the market opens. Your trade should be accompanied by a stop-loss and a take-profit.

A stop-loss stops a trade when it reaches a certain loss level while a take-profit closes it when it reaches a certain profit point.

How to choose the right gap

A common question among traders is on how to select the best gap when trading. There is really no good answer to this but there are guidelines that you can follow.

Always look at the cause of the gap. If there is no major cause of the gap, then there is a likelihood that it will be filled within a short period.

Analysts recommend looking for gaps that are over 4%. After finding a gap, find the main catalyst by looking at financial websites like CNBC and WSJ and social media platforms like StockTwits and Reddit. Trading a gap with a good catalyst is mostly recommended.

The importance of float in gap and go strategy

A float is an important part of the financial market. It refers to the number of stocks that are outstanding. For example, a company like Tesla has over 3.1 billion outstanding shares while Starbucks has 1.15 billion.

In most cases when using the gap and go strategy, it is recommended that you focus on companies with low floats. As you will realize, most of these companies will be in the biotech industry. These companies usually have a higher chance of having big moves during the day.

Summary

The gap and go strategy is one of the most important ones in the financial market because of how often it forms and how easy it is to use it.

In this article, we have looked at the causes of gaps and a simple way of using the strategy in the market. We recommend that you combine it with indicators and other tools like level 2 and time and sales.

External useful resources

- What’s the more “correct” gap-and-go entry? – Reddit