The earnings season are popular periods in the financial market when most companies in the S&P 500 index publish their quarterly results.

The season officially kicks off when big banks like JP Morgan, Morgan Stanley, Wells Fargo, and Citigroup publish their results. In this article, we will look at what the earning season is (a short recap) and some of the top tips to trade the season well.

Table of Contents

What is the earnings season?

According to American securities laws, it is mandatory for all companies listed in all exchanges to publish their results every quarter. This is a highly divisive issue. Proponents argue that publishing results quarterly is a good way for companies to showcase what they did.

On the other hand, opponents say that three months is a short period. And with many CEOs having pay that is tied to the stock performance, they argue that quarterly results removes the incentive for long-term investments. For example, a bank CEO will have the challenge of investing $1 billion in a promising technology because the investment will reduce its earnings.

While companies publish their quarterly results throughout the year, the official season starts with the release of bank earnings. It is known as the season since most companies in the S&P 500 index publish their results during this period (so there are four earning seasons in a year).

Okay, let’s move on now to see something more practical, the top tips to trade this season well.

Best tips for the earning season

Use the earnings calendar

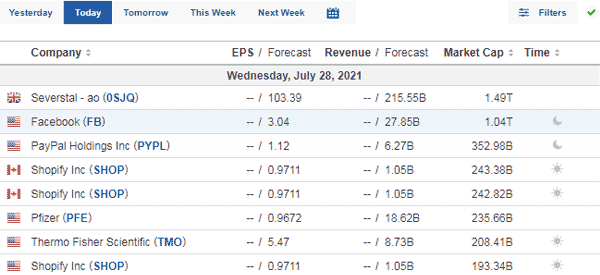

The first tip to trade this season is to know when the earnings season will start. The earnings calendar will help you substantially to achieve this. This tool is relatively similar to the economic calendar. It basically shows you when a company will publish its results.

The difference between the two is that the economic calendar shows the exact time when a company will publish its results while an earnings calendar shows the period. The period is either after-hours or pre-session. This is because companies usually publish their results before the market opens and after it closes.

Therefore, you should always use the earnings calendar to see when a company will publish its results. After using it for a while, it will become easy for you to use it in the future.

Momentum vs fundamentals

The next earnings tip is to consider a company’s momentum towards earnings. This is where you look at how a company’s share price is trading ahead of its quarterly results.

Ideally, a stock will likely rise when analysts expects that it will release a strong quarter. In this case, there is usually a high probability that it will have a steep dip if it releases strong results.

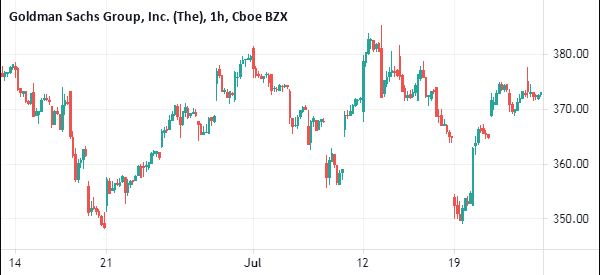

This happens because of what is known as buying the rumours and selling the news. A good example is Goldman Sachs. As shown below, the company’s stock declined sharply after its second-quarter results. This is despite the fact that these results were relatively stronger than expected.

Still, in the longer term, the stock tends to bounce back provided that the fundamentals are strong. For example, if its sales growth and balance sheet are strong, there is a possibility that the firm will keep rising towards the next quarter.

»How to conduct a fundamental analysis«

Aftermarket vs premarket

The next key tip for trading corporate earnings is to look at the time when a company will publish its quarterly results. As mentioned above, most companies typically release their reports before the market opens while others release them after the market closes. A smaller group of companies tend to publish their results during the trading session.

Therefore, there are several things you need to know about this. First, you need to know the time when the company will publish its results. Second, depending on the time, you should know whether your broker allows to place trades in extended hours. If they do, you can take advantage of these price actions that happen shortly after a company publishes its quarterly results.

You could use these sessions to place trades using the regular session’s range. For example, if a stock made a significant top at $10 and then retreated to $8, you could place a buy trade with a take-profit at $10.

Another approach is to use pending orders. In the example above, you could place a buy-stop above $10 and a sell-stop below 8. In this case, you will benefit if the stock shows some volatility after earnings.

Price action is key

The next important tip for trading earnings is to use the concept of price action. Price action refers to the overall arrangement of a stock chart. There are several common price action patterns that form after a company’s earnings.

- Stock may break out higher or lower and then extend the trend.

- Stock may move higher and then start a new steep bearish trend.

- Company’s shares may break out higher and then start a new wave of consolidation. Further, a stock may showcase a prolonged period of volatility.

Therefore, as a trader, you need to identify these patterns early on and take advantage of them.

Using technicals

Finally, it is possible to use technicals when day trading corporate earnings. The most popular indicator to use is the moving average. In this case, you could place a 50-day moving average on the daily chart. If the price drops below this MA, it is a sign that the previous upward momentum is fading.

Other top indicators that you can use to trade earnings are VWAP and the Relative Strength Index (RSI).

Summary

Corporate earnings provide opportunities to day traders and long-term investors. This article has looked at what an earnings report is and some of the top strategies to use.

External Useful Resources

- Earning News – Seeking Alpha