You possibly love trading stocks, currencies, or indices. To many traders, these are the most important financial assets to trade.

However, to others, the best assets are commodities. This is because of the integral role these play in the world economy. Think about a world without crude oil or a world without corn and coffee. How would it be?

In fact, commodities are the most important assets in the world, without which other assets would not exist.

For example, without crude oil, a country like Saudi Arabia would not have a meaningful economy. Without dairy and other agricultural products, the New Zealand’s economy would not be as strong as it is today.

Table of Contents

All commodities are not equal

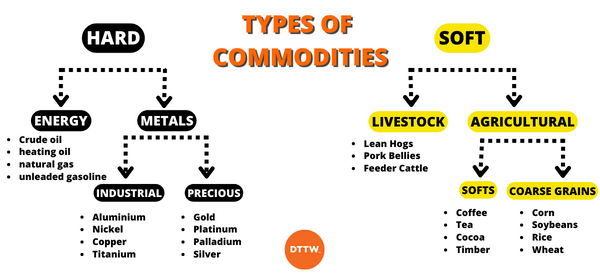

There are two main groups of commodities: the hard one and soft one.

The hard commodities – resources that must be mined or extracted – are then divided into energy and metals while the soft commodities are divided into livestock and agriculture.

The metals are then subdivided into industrial and precious metals. The industrial metals are: aluminum, zinc, tin, copper, nickel, and titanium among others.

The precious metals are gold, platinum, palladium, silver, and Iridium.

Energy commodities are crude oil, heating oil, natural gas, and unleaded gasoline while livestock commodities are lean hogs, pork bellies, and feeder cattle.

Agricultural commodities are then divided into softs and coarse grains. The softs include coffee, tea, cocoa, and timber while coarse grains are corn, soybeans, rice and wheat among others.

Before Trading, Traders should consider the liquidity and the access to financial information of the commodities before trading.

Hard Commodities

Crude Oil

As mentioned above, maybe this is the most important commodity in the world. It enables mobility and the production of other commodities. For example, without it, farmers would not be able to produce crops in large scale.

The benefit of trading in crude oil is the easy access to financial news about it. In terms of liquidity, it is the most liquid commodity.

In addition, you can easily interpret the financial data about it by simply understanding the readily available data on demand and supply.

Natural Gas

Natural Gas is found deep inside the earth’s crust. The gaseous commodity is mostly used as a source of energy. Most power plants are now moving from coal to the natural gas.

As more countries have discovered natural gas deposits, and as technology get advanced, the supply of natural gas has become more than the demand making its price decline from $15 to under $3.

Traders should try this commodity because of the access to information and volatility.

Gold

Gold is a very important metal, which is found deep inside the earth’s crust.

For centuries, gold was used a currency during the exchange of goods and services. Since its supply was limited, governments adopted fiat currencies which are usually backed by gold.

As a result, most investors and governments buy and invest in gold as a store of value. As a raw material, gold has no major uses apart from jewellery and ornaments.

Traders should try trading in gold because of its volatility and the access to its news.

Related » Why You Need Some Gold In Your Portfolio

Palladium

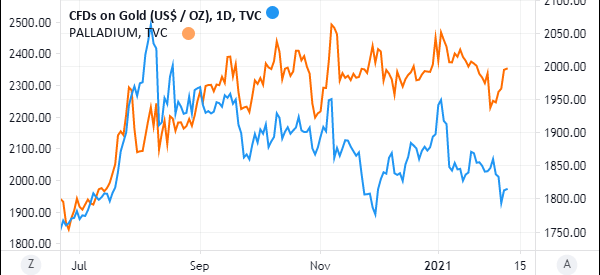

A few years ago, no one used to talk about palladium. In fact, most people didn’t know what it was and what it does. Then, since 2018, it outperformed all commodities, including its close sister, platinum. This performance has happened because countries have put in place more laws to prevent emissions.

Today, palladium is trading at $1,450 (it was near to 2900 in April, 2021), making it one the most expensive precious metal. Gold, on the other hand, is trading at $1,950.

In the graph below we see the “golden time” of palladium, when it had become the most expensive metal.

Palladium is used in the manufacture of vehicles and machinery as a catalytic converter. You should try it because of the rising demand as more investors start focusing on it.

To trade palladium, you should look at the automobile market, strength of the dollar, and the overall performance of the global economy.

Silver

Silver is one of the most common metals you can trade in the market. It is also provided by most brokers. The metal is important because it is often classified as a precious metal. Also, it has a close relationship with gold.

In fact, most traders view silver as a cheaper way to leverage on the price of gold.

While silver is a precious metal, it is also an industrial metal whose price is influenced by the underlying macro situations. To trade silver, you need to watch the overall interest rates in the United States, the performance of the US dollar, and the overall performance of the US, China, and European economy.

In most cases, the price of silver will rise when the dollar is weak and fall when the US dollar is relatively strong. Also, the price of silver will rise when there are strong economic numbers because they imply that there will be more demand.

Further, you should pay attention to any supply and demand dynamics.

Platinum

Platinum is another popular metal you should trade in the market. The metal belongs to the same class as palladium. Most of the metal is mined in South Africa, Zimbabwe, and Russia. It is used in the manufacture of jewellery and cars.

To trade the metal, you need to look at the overall performance of the automobile market and the health of the global economy.

Copper

Copper is one of the most important commodities in the market. It is widely used in electrical appliances and utilities. As such, it is often seen as a barometer for the world economy.

In most cases, copper price tends to do well when the economy, especially in China, is doing well and vice versa. The biggest copper producing country is Chile followed by Peru, China, Congo, and the US. Copper is provided by most trading companies.

Iron ore

Iron ore is another important metal that you can day trade. It is used to manufacture steel, which is used in most construction projects.

Most of the world’s iron ore comes from countries like Australia, China, Chile, and South Africa. However, iron ore is not provided as a tradable commodity by most companies.

Soft Commodities

Cocoa

Cocoa is an important agricultural commodity that mostly comes from Ivory Coast and Ghana. It is used to make beverage drinks and chocolates.

In the past, eating chocolate was mostly a reserve of Western countries. Today, countries in Asia are discovering the sweetness of chocolate.

At the same time, the producers of Cocoa are embracing technology to improve yield. All this, coupled with the low oil prices has made the price of cocoa decline.

Coffee

Coffee is one of the most popular drinks in the world. Asian countries have also started to love the drink!

In recent years, the coffee market has been going through increased oversupply and the price fell down. This happened mainly due to the exaggerated production and the decline of the Brazilian Real against the dollar.

Related » How to Trade Coffee futures profitably

Soybeans

Soybeans is probably the most active soft-commodity in the market because of the biggest buyer and seller. The US is the world’s biggest producer of soybeans while China is the biggest buyer.

Therefore, as the two countries flex their muscles, the price of soybeans is being affected. For example, in the past few years, the price of soybeans was volatile because of the trade war between China and the United States.

The price also rose because if a new disease that led to the death of millions of pigs in China.

Corn

Corn is another popular soft commodity that you can day trade. It is an important part of the world economy. Most of the world’s corn comes from the United States, Brazil, and Argentina.

In terms of demand, most of the world’s corn is consumed in China. The main factors that affect corn prices are geopolitics and weather.

Factors to consider when choosing a commodity

There are several factors that you should consider when selecting a commodity to day trade. Some of the top factors to have in mind when considering a commodity to trade are:

- Liquidity – You should always consider the commodity’s liquidity. While there are many commodities, unfortunately, most of them are not liquid enough. As such, you should consider commodities like copper, gold, and silver that are highly liquid.

- News – You should also consider commodities that are in the news. In most periods, these commodities tend to have some volatility.

- Expertise – You should consider commodities that you have expertise in. For example, if you are good in crude oil, you should always trade it. In other words, you should avoid trading commodities like nickel and lithium that you don’t have experience in.

Which are the best commodities to day trade?

So, which is the best commodity to day trade? Depending on your trading style, we recommend a situation where you focus on popular commodities like crude oil, gold, silver, and copper.

Other commodities you can focus on are platinum, palladium, corn, and soybeans.

Summary

As we mentioned above, all commodities are not created equal. As a result, before you start trading on commodities, you should do a lot of research to understand the dynamics of demand and supply.

External Useful Resources

- What Makes for Good Commodities—and How to Trade Them – The Balance