The dollar is the reserve currency of the world. A reserve currency is simply a currency that is accepted in all countries around the world. With the dollar, you can buy anything in all countries. On the other hand, with currencies like Uganda Shillings, Turkish Liras, and Brazilian Real, it is impossible to buy products in other countries.

The other most common currencies you can use to shop with are Japanese Yen, Euro, and Pound. However, the dollar makes up more than 64% of all reserve bank currencies in the world.

Table of Contents

A short introduction on the US dollar

The dollar is printed by the Federal Reserve, which is the most important central bank in the world. This is because, the bank can limit the supply of the currency or even flood the market with it.

To increase the value of the dollar, the Fed can increase interest rates and to lower its value, it can easily lower rates. In addition to lowering rates, the bank can use other tools.

A stronger American economy is very important for the dollar. This is because all countries with dollar reserves want to be sure that the economy is in good shape. No country wants to invest or have reserves for a worthless currency.

Also, a strong US economy usually incentivizes the Federal Reserve to tighten its monetary policy. Higher interest rates tend to have a positive impact on the greenback.

Reasons for a strong dollar

Hedge against risks

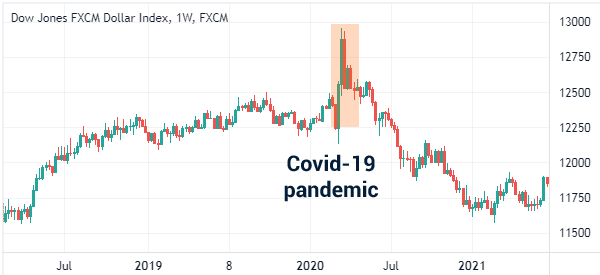

There are several catalysts that usually lead to a strong US dollar. First, the greenback is usually seen as a hedge against risk. As such, the currency tends to gain when there are emerging risks to the economy. For example, the currency initially jumped during the dot com bubble and the Covid-19 pandemic.

This situation happens because investors see the dollar as the currency of the last resort. Besides, the dollar is the world’s reserve currency and the US economy is known for its strength and stability. Most importantly, unlike other strong economies like China, the US is not known for outright currency manipulation.

Therefore, when there is a major crisis, investors and business people tend to convert their currencies to the greenback.

Fed Decisions

The second thing that has an impact on the strength of the US dollar is the Federal Reserve. The US central banks is the only institution that has the mandate to print money and set interest rates.

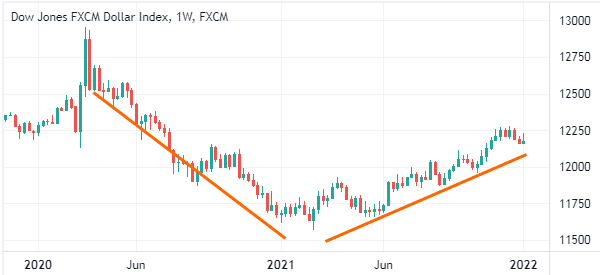

In most cases, when the Fed decides to tighten, the US dollar usually rises. The vice versa is also true. When the Fed eases interest rates and launches a quantitative easing (QE) program, the US dollar tends to decline.

For example, the chart below shows that the US dollar index declined sharply during the Covid-19 pandemic after the Fed launched an open-ended quantitative easing (QE) program. It then rose in 2021 after signs emerged that the Fed will start tightening.

There are other factors that can push the US dollar higher or pull it lower. For example, policies by the US legislature have an impact on the currency. In response to the Covid-19 pandemic, Congress decided to provide free money to individuals. This, in turn, led to more funds supply, which led to a weaker US dollar.

How to trade a stong dollar

In this section, we will look at the key strategies to use when trading a strong US dollar. There are two main ways of trading the US dollar. First, you can focus on the US dollar index. This is an index that compares the greenback’s performance with that of a basket of other currencies like euro, yen, pound, and Swiss franc.

Second, you can trade currency pairs with the greenback. Currency majors refer to those of developed countries that have the US dollar. They include the GBP/USD, EUR/USD, and USD/JPY. There are exotics, which combine the US dollar with emerging market currencies like the South African rand and Brazilian real.

Steps

There are three main steps for trading the US dollar. First, you need to do a fundamental analysis on the currency. This is where you look at the news and economic data that will affect the currency. Some of the top data to watch are on employment, inflation, retail sales, and manufacturing and services PMIs.

Second, you should do a technical analysis on the asset that you are trading. This involves using technical indicators like the Relative Strength Index (RSI) and the MACD.

Finally, you should do a price action analysis. This is where you look at the emerging patterns and how they will pan out.

Impacts of the strong US dollar

A stronger US dollar can have major implications on the US economy. For one, in general, a strong US dollar is good for the American economy since it is a net importer. However, it usually affects the country’s exporters by making their products more expensive internationally.

A strong US dollar can also lead to a downward pressure on inflation since it is a net importer of most things that Americans buy. Think of products like toys, furniture, and clothes.

In addition, a stronger US dollar usually leads to downward pressure on commodities. This is simply because most commodities like crude oil and copper are usually traded in dollars. Still, at times, a stronger US dollar can co-exist with higher commodity prices because of external factors.

Finally, a strong US dollar can have a negative impact on earnings since many companies in the US make most of their money internationally.

US dollar and gold

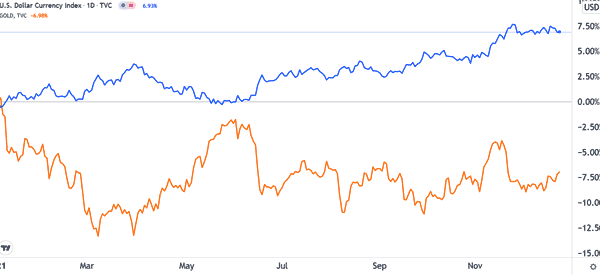

The US dollar has a correlation with gold. In most cases, a stronger US dollar usually coincides with a weak gold price. This is simply because the dollar tends to do well in a period when the Fed is hawkish. Gold, on the other hand, does well in a period of easy money because it is seen as a hedge against inflation.

The chart below shows the performance of the US dollar index compared with gold in 2021.

Reasons For the Strong Dollar and How to Trade it – UsefuTips

- Discover more on MarketWatch