When it comes to the topic of short-term trading, there are three primary groups of people:

- Short-term traders who do it full-time or part-time.

- People who are blissfully ignorant about short-term trading.

- People who are convinced that short-term trading is a scam.

The first group knows that short-term trading is a legitimate profession because they put in the work and see the profits in their bank accounts.

The second group doesn’t have a dog in the fight.

The third group usually bases its opinion on second-hand stories of bad experiences. Some of those stories come from real scams perpetrated by malicious actors. The rest are just gossip without concern for the truth.

There’s also a fourth group: readers like you. You’re trying to learn about short-term trading and decide whether it’s a career worth pursuing—and you definitely don’t want to get scammed.

Good news: we can help you with both issues. In this article, we’ll expose the world of trading scams, answering the question “is trading a scam?” and pointing you down a proven path to becoming a professional short-term trader.

Table of Contents

Why Do Some People Think Short-Term Trading Is a Scam?

The simplest answer is that short-term trading requires a high degree of skill. This creates two separate phenomena.

Some people begin pursuing short-term trading as a career but struggle to make a living at it. It’s much easier to blame poor results on the “system” than to see your lack of skill or publicize your mistakes.

The second phenomenon is that some people learn enough about short-term trading to be dangerous, and realize that selling so-called online courses and seminars is easier and more ego-gratifying than executing profitable trades.

There are exceptions. People such as Ray Dalio, Anna Coulling, and Nassim Nicholas Taleb have proven their abilities in the market. Their books and guidance on investing are excellent and worth studying.

To put it bluntly, more than 80% of short-term traders lose money. But, by comparison, nearly 50% of small businesses fail in their first five years—nobody calls that a scam, it’s just the reality of entrepreneurship. Consider also the Navy SEALS, where 70-85% of those accepted into training eventually quit or are disqualified.

Short-term traders are individuals who exhibit discipline, strategy, and persistence well above average. And even the very best traders only expect to profit 40% of the time. That means that 60% of the time, even the pros are losing money; they just make much more than they lose.

Finally, many predatory people use “trading” as a cover for various scams and confidence games. These criminals give legitimate traders a bad name and perpetuate the myth that short-term trading is a scam.

We will teach you how to separate the fraudsters from the reputable firms.

Common Trading Scams

Some of these scams may be familiar to you because they’re popular outside of the trading world.

Others are unique to trading, and much harder for beginners to identify. As a rule, if the offer or premise seems too good to be true, then it’s probably a scam.

Always exercise an abundance of caution and skepticism when evaluating opportunities.

Pump and Dump Schemes

Fraudsters coordinate misinformation and multiple buying trades to inflate the price of a stock or asset. When the market pushes the price high enough, they sell the stock en masse. What appeared to be high demand is non-existent, forcing unwitting traders to hold the stock or sell at a loss.

Warning signs: unsolicited stock recommendations (sometimes called “trading signals”), especially for low-volume stocks, unknown companies, or companies with poor fundamentals.

Fake Trading Sites

Building a website that looks good enough to fool most people has never been easier. Fraudsters create sites, marketing campaigns, and social media accounts to give the impression of a legitimate company. Once you sign up and deposit your money, the house of cards falls, and your money is gone.

Warning signs: offers that are too good to be true, newly established websites without sufficient history, lack of contact information, or contact information that leads to dead-ends.

Fake Trading Platforms

As trading technology moved out of physical trading floors onto the internet, it became possible to build a software application with the appearance of a trading platform at a very low cost.

Once would-be traders deposit money to begin trading, they discover that they can’t trade or that the money can’t be withdrawn. This scam is usually paired with the previous one: fake trading sites.

Warning signs: unregulated platforms, poor user-experience design, and a lack of verifiable claims.

Automated Trading Systems

Run the other direction if anyone offers to automate your trades in exchange for a paid subscription or one-time fee. Although algorithmic trading is a legitimate aspect of short-term trading, it’s proprietary, expensive, and unavailable to the public. Don’t believe claims of AI-powered trading either.

Warning signs: promises of easy “no-touch” profits, unclear or vague information about how the system works, and high up-front costs.

Trading Signal Selling

It’s possible that legitimate firms might offer you trading signals in exchange for a fee, but we’ve not seen one yet. It’s too easy to manipulate other traders for your benefit. By telling many people how and when to trade, criminals create a perfect situation to trade in the other direction and rake in profit.

Warning signs: guarantees of high returns, unclear or vague information about the methodology, and pressure to act quickly.

Copy-Trading

Scammers offer to let you copy the trades of an experienced trader and coast on their prowess. There are legitimate copy-trading platforms, but it’s also a perfect mechanism to take advantage of people. Scammers can fake their success and manipulate the results with no accountability.

Warning signs: unverified track records, guaranteed returns, and pushy sales tactics that ask you to act before you can verify any claims.

Ponzi Schemes

You may have heard of Bernie Madoff’s $68 billion Ponzi scheme. It was one of the largest in history and continued for decades, throwing off many savvy investors.

In a Ponzi scheme, the criminals promise high returns to investors. They recruit investors in waves and use money from new investors to pay off the earlier wave. Usually, each new wave of investors needs to be larger than the last for it to work. Once investment dries up, the scheme crumbles, and nobody gets their money back.

Warning signs: consistently high returns with little risk and complex or secretive investment strategies.

Front-Running Scams

Criminals trade ahead of a client’s trade order to benefit from the expected movement. This is why direct market access is so important for short-term traders. Any delay in your trade order could benefit a well-placed fraudster.

Warning signs: unusual trading activity before a significant trade, lack of communication or transparency from the broker.

Social Media Influencer Scams

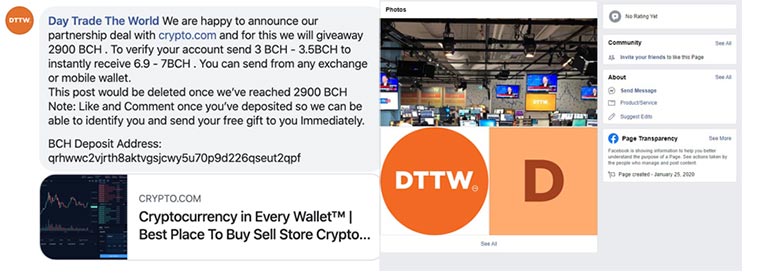

Platforms like Facebook, Instagram, and Reddit, allow fraudsters to build a following and promote predatory trading platforms or subscriptions. They can easily manufacture evidence of their trading results, exaggerating profit and hiding losses.

Warning signs: unverified claims of high returns, aggressive marketing and sales tactics, and dubious evidence to support their claims.

This happened to our Facebook page too.

So, if you’re not 100% sure about something, double check before leave your data.

Best Practices for Avoiding Trading Scams

The experience of getting scammed is unlike any other. The shame, anger, and agony over lost money are intense. Next, we’ll review a list of things you can do to uncover scammers and protect yourself from deception.

The most important thing you can do is investigate the company, the opportunity, and other traders who have participated in the program. Here’s how you should direct your research.

Read Online Reviews

Start with trusted review platforms such as the Better Business Bureau and Trustpilot. These platforms ensure that each public review corresponds with a real person who does not have a vested interest in the company.

Testimonials are a compelling form of social proof. But beware of reviews that can be fabricated or curated. Check the trading firm’s website, then visit the review platform directly and search the company again.

Verify Registration and Regulation

Although different countries have different regulators and standards, some regulatory oversight is essential. Examine the firm’s website and public documentation, determine which regulatory authority they report to, and cross-confirm their compliance status if possible.

Most firms are required to display their certifications publicly. Certification badges can be faked, so it’s just one of the markers you should look for.

Traceability

Does the firm have a physical address? Can you find the location on a map and confirm it via the public business registry?

You should also research the company executives and employees. Search for their profiles on social media platforms and look for articles and public appearances such as podcasts and YouTube.

This search may return few results if the company is a recent start-up, but if you can’t find any genuine digital footprints, that’s a red flag.

Identity Verification

Identity theft is a common online scam, and fraudsters are constantly experimenting with new ways to lure victims into revealing personal information.

This could happen through the pretense of verifying your identity, similar to interviewing for a job.

Before you reveal any personal information that isn’t public on the web, you should be 100% sure of the credibility of the person asking and the company behind them.

Beware of Trading Seminars

This scam falls into a slightly different category from the trading scams we listed in the previous section.

A seemingly successful trader runs a campaign for a free event in your town. The seminar ends up as a carefully constructed sales pitch where the trader shows off their lavish lifestyle and plays up their trading expertise.

They invite you to become a student at the end of the seminar, paying thousands of dollars to study their program.

In many cases, there is a real trading course for you to follow, but the high cost doesn’t match the value delivered. These individuals can get away with this behavior for a long time because they “delivered” what they sold you. It doesn’t matter that the content is trivial or even wrong— it’s not a scam, you’re just an unsatisfied customer.

Research the trader, verify their claims, and look for complaints or legal issues. Authentic traders and mentors will have a clear, public track record of success. They never sell you on unrealistic returns or downplay the risks.

Test the Trading Platform

If a trading firm won’t let you test the trading platform (or won’t show any demo) before you deposit money, just step away.

If you are allowed to test it, here are some areas that you should examine closely to verify a legitimate trading platform:

- Backtest the system: This involves taking historical data about the market, and applying the firm’s trading recommendations to see if they hold up. If your backtesting results don’t match theirs, it’s a red flag.

- Paper trading: Also called demo trading or simulated trading, you conduct trades on the platform without investing real money. Every professional-grade trading platform should have a trading simulator.

- Evaluate key metrics: If the firm or its representatives claim unrealistic win rates, profits, or other unlikely performance metrics, proceed cautiously.

- Check usability and transparency: Confusion and ambiguity are the standard tools of a scammer. Legitimate companies provide clear, detailed information about tools, strategies, and performance. In short, a trustworthy firm has nothing to hide.

- Verify claims: User reviews are the first step in your research. When testing a platform, you need to dig even deeper. Look for recommendations from traders who’ve been in the profession for years and used multiple platforms. Join private trader forums and ask people to share their experiences with the firm you’re evaluating.

However, the most common reason new traders get deceived by scammers is a lack of industry knowledge. Short-term trading is complicated, and even expert traders disagree about certain fundamental aspects of trading successfully.

That’s why it’s essential to read and study about short-term trading before trying to make a career.

Credible Regulators Are a Must

Regulator oversight of financial markets is essential for accountability and economic sustainability. That’s one reason the U.S. has the largest stock market on the planet: it has a sophisticated regulatory apparatus.

Other developed countries, such as Canada, Japan, Great Britain, and the EU, also have highly capable regulators.

Use the applicable regulator’s website to verify the status of any company you’re researching. Credible regulators include:

- The U.S. Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and Financial Industry Regulatory Authority (FINRA).

- Canadian Investment Regulatory Authority (CIRO/OCRI).

- The U.K. Financial Conduct Authority (FCA).

- Australian Securities and Investments Commission (ASIC).

- European Securities and Markets Authority (ESMA).

- Japan Exchange Regulation (JPX-R).

- The Hong Kong Securities and Futures Commission (SFC).

If you’re looking at an unregulated firm or program, that’s a red flag.

Regulated brokers and firms offer better protection for client funds and commit to fair trading practices. If anything does go wrong with your trades, regulated firms have an established process they follow for dispute resolution.

Regulator compliance makes it much easier to research a firm and verify legitimacy. And while regulatory guardrails don’t offer foolproof protection from fraud (even legitimate companies can engage in risky behavior), they’re the best mechanism we have.

A regulated firm should offer transparent fee structures, detailed disclaimers, clear terms and conditions, and reliable customer support.

At the end of the day, regulators hold firms accountable if they breach the rules or attempt to manipulate the market. Penalties for infringement can include fees, permanent closure, and sanctions on firm executives.

Real Trading Helps You Create Real Results

Real Trading is a proprietary trading firm (prop firm) that has been in business for over a decade. We’re one of the largest true prop trading firms, with more than 3,000 traders operating in 90 countries. You can read reviews from those traders on our website and at Trustpilot.com.

Headquartered in Canada, we’re regulated by the Canadian authorities through our parent company, Select Vantage. We provide services to short-term traders in virtually every country except the U.S.—this exclusion only applies to U.S. citizens.

As a short-term trader with Real Trading, you’re legally permitted to trade in all markets we cover, unless your country or province of residence has laws prohibiting such activity.

Our program is designed to train smart traders and help them build sustainable careers as professional short-term traders. We offer comprehensive training and proprietary trading technology that gives you every possible legal advantage.

Our trader support is available 24/7, to ensure that you get the help you need, no matter your time zone or the market you trade in.

We encourage all of our traders to join the community at TraderTV.Live; the #1 global trading channel on YouTube, with more than 500,000 subscribers. You can learn proven short-term trading techniques from traders who have mastered their craft and excel at teaching on the fly.

Don’t Let Scammers Ruin Your Trading Career

Now you have all the information. Is trading a scam? Not any more than starting a small business or having a career as a professional athlete.

There are definitely criminals who prey on uninformed people, promising big profits for little work. The internet makes it easy for bad actors to deceive and steal from ordinary people. But you don’t have to become a victim.

The best thing you can do for yourself is to find a trustworthy trading firm and stick to their program. If you commit to ongoing education and continuous skill improvement, you’ll build a short-term trading career that no scammer could hold a candle to.