A bear market is a difficult market for most people. It is particularly a tough period for long-only investors who buy and hold financial assets like stocks and currencies.

Under these conditions, some strategies are much more dangerous to implement because they could lead to huge losses. In this article, we will focus on the concept of short-selling during a bear market.

Table of Contents

What is a bear market?

A bear market is a period when assets are moving in a strong downward trend. It is the opposite of a bull market, when an asset is simply moving in a strong uptrend.

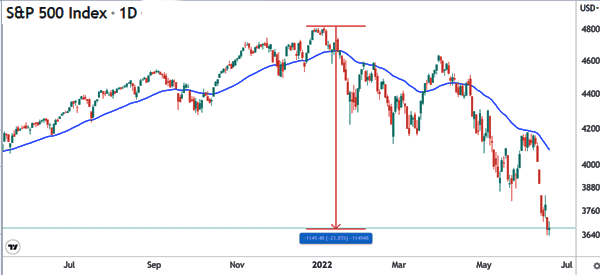

A bear market is typically defined as a period when an asset declines by more than 20% from its period high. For example, in 2022, the S&P 500 index declined by 20% from its highest point.

Causes of a bear market

When we go to analyze a bear market, we have to keep in mind that there can be several causes for it. Let’s go through the most relevant ones.

Fed actions

First, a bear market can happen because of actions by the Federal Reserve. A hawkish Federal Reserve is usually seen as being dovish for stocks.

In 2022, stocks moved into a bear market when the Fed decided to hike interest rates in a bid to fight the soaring inflation.

Natural disasters

Second, a natural disaster can lead to a bear market. A good example of this is what happened when the Covid-19 pandemic started. In this, stocks nosedived as investors worried about the impact of lockdowns on the economy and companies in general.

Bubble bursts

Third, a bear market can happen after after a bubble bursts. A bubble is a period when the value of stocks and other assets see an elevated valuation.

Three of the best common bubbles are the dot com bubble, the cryptocurrency bubble, and the housing bubble of 2008. In all these periods, all these assets declined by more than 20% from their highs.

There are other causes of a bear market such as valuation concerns. By narrowing an asset down, an asset could drop to a bear territory because of a change in management and other specific reasons. For example, in 2022, Terra LUNA crashed after its stablecoin lost its peg.

What is short selling?

Short-selling is a situation where a trader or investor bets that an asset’s price will drop. The concept is relatively simple. Assume that a stock is trading at $20 and you expect that it will continue falling. In this case, you can borrow shares at $20 and then sell them in the public market.

After selling the stock, you will then be left with cash. If the stock falls to $10, you will then buy it back and return the shares to the lender. In this case, the trader will make a 50% profit.

In trading, short-selling is done by just pressing a buttom and activating the trade. So, how do you short-sell during a bear market?

Short selling strategies in a bear market

Use moving averages

One of the top strategies to short-sell during a bear market is to use moving average. This is a popular technical indicator that focuses on an asset’s trend. The idea is that in a bear market, the asset’s price will remain below the moving average.

Therefore, you should select an ideal MA, such as 50 or 25, and keep shorting the asset as long as it is below the asset.

In the chart below, we see that the S&P 500 index is below the 50-day moving average. Therefore, a trader can short the index and exit it when it moves to the MA.

Sell the rally

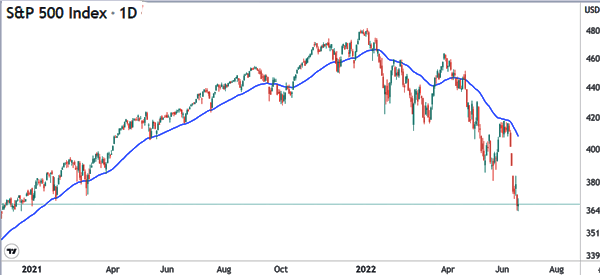

A key happening in a bear market is known as a dead cat bounce. It is a situation where an asset makes a short-lived recovery during a bear market. This bounce usually happens when some people move to buy the dip.

Since this is a dead cat bounce, you can assess the right place to short the asset. For example, this level could be at a certain moving average or along the Volume-Weighted Average Price (VWAP).

The opposite of selling the rally is known as buying the dip. Buying the dip is when you buy an asset when it makes a pullback. The two points shown below shows potential areas for shorting the S&P 500 as it dropped.

Relaed » When you should buy the dip?

Using chart patterns

Another way of shorting during a bear market is to focus on bearish chart patterns. Some chart patterns have been designed to help people short assets.

For example, patterns like a bearish flag and bearish pennant are usually signs that an asset’s price will have a bearish breakout. Therefore, when they form, it is usually a sign that the price will continue falling and that you can just short it.

Another sign of bearish continuation is a descending triangle, A descending triangle pattern is usually followed by a bearish breakout.

Related » What is Short Covering

Break and retest

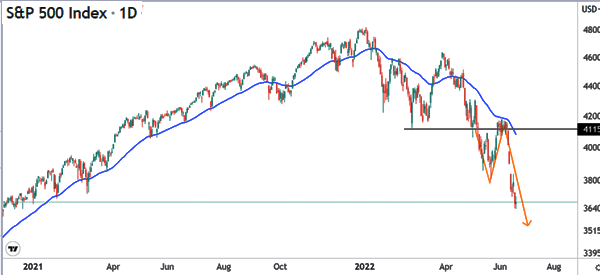

Another approach to trade an asset in a bear market is known as break and retest. It is an approach where you look at an asset that has made a bearish breakout and then short it after it retests a key level.

For example, in the chart below, we see that the index made a bearish breakout and then retested the level. It then resumed the downward trend.

Summary

In this article, we have looked at how to short during a bear market. As described, it is possible for one to make money when asset prices are falling. It should be noted that shorting an asset can be a bit expensive during a bear market since short interest is usually high.

External useful resources

- Stocks have officially entered bear market territory: here’s what that means and what you should do – CNBC