In recent years, we have seen a lot of volatility in the financial market. The amount of volatility, as measured by the CBOE volatility index, has increased by more than 100% as market participants fear about a recession.

As a result, global stocks have fallen by more than 20% while the dollar index has strengthened. Gold and Bitcoin, often viewed as safe-haven assets have wobbled too.

In this report, we will look at the concept of dead cat bounce, which will help you navigate the financial markets in time of volatility.

» How to stay safe from recessions«

Table of Contents

What is a Dead Cat Bounce?

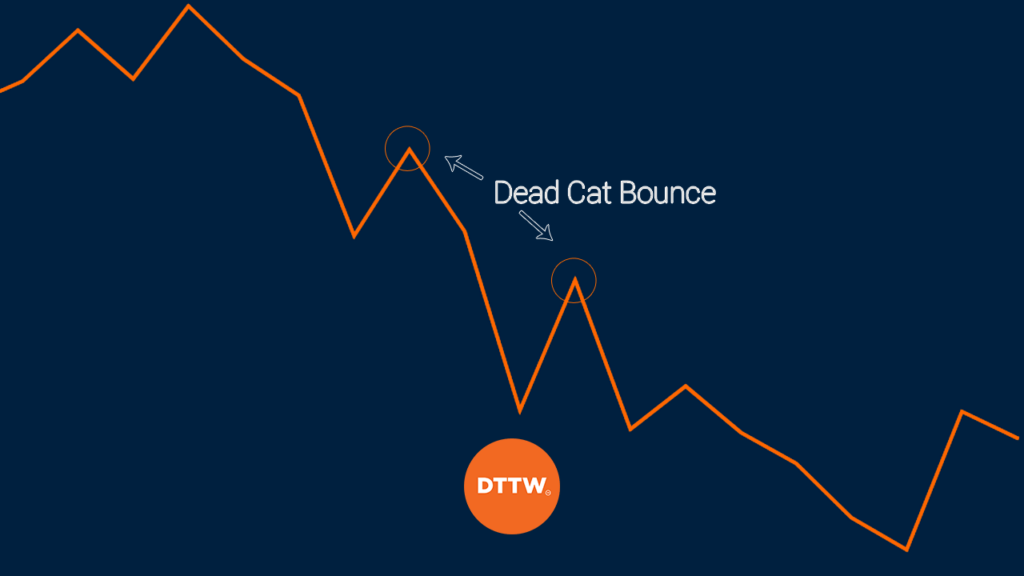

A dead cat bounce is an important concept (and a price pattern) that will help you avoid making mistakes at a time when markets are volatile.

The idea behind it is simple: when you toss a dead cat, it will bounce and then go back to the ground because it is still dead. It will do this because it does not have life in it.

This pattern happens when a financial asset like stock, commodity, currency pair, or an index is declining. As it declines, the asset could rise for a day or two and then continues to decline again. As it does this, traders who bought the bounce see significant losses.

The alternative too is true. A financial asset can jump or rise because of a certain reason. In such a case, a dead cat bounce can happen if the price declines for a day or two and then resumes moving upwards again.

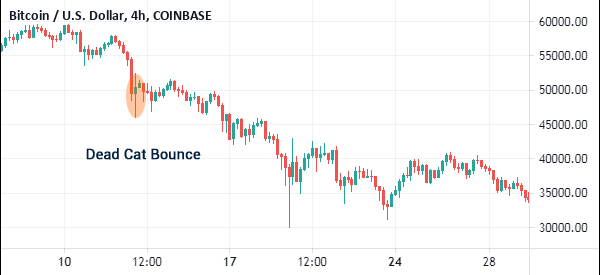

The chart below shows how a dead cat bounce looks like. As you can see, Bitcoin is in an overall bearish trend and has dropped for five consecutive four-hour periods. This decline is then followed by two straight bullish bars. This relief rally is an example of how a dead cat bounce happens.

As this happened, traders who rushed to buy the coin experienced substantial losses since the rally was not yet confirmed.

Why Does a Dead Cat Bounce Happen?

A dead cat bounce happens mostly because of the herd mentality in the market. This is a mentality where traders tend to follow the crowd. Therefore, as the price recovers, they hope that a new long-term trend is just getting started.

However, as they do this, the market is still worried about the main reasons for the decline of the price. In most cases, the people who suffer during a dead cat bounce are usually retail traders.

»Direct Market Access vs. Retail Trading«

How to spot a dead cat bounce

A dead cat bounce is relatively easy to spot. It usually happens when a financial asset like a stock, cryptocurrency, and currency pair declines sharply within a short period. After it drops, the asset tends to jump in the following day as some buyers rush to buy the dips. At times, this jump is usually brief and ends up with further declines.

For example, assume that a stock that is in a sharp upward trend rises from $50 to $70. Then one day, the stock declines to $50 and then hurriedly rises to $60. If it then drops to $40, the initial jump can be said to be a dead cat bounce.

Therefore, you can easily spot it by looking at an asset that is in a previous upward trend. It then declines sharply and then resumes the downward trend.

How long a dead cat bounce lasts

A dead cat bounce can take as short as a few minutes or as long as a few months to form. If you are a scalper, meaning that you rely on very short-term charts, it is possible to see a dead cat bounce. This mostly happens after a major market event like an earnings release or economic data.

Similarly, if you are a longer-term trader, meaning that you use longer charts, it is possible to see the pattern. In all cases, the bounce is usually relatively short.

Useful Examples of DCB

In this report, we will look at two recent examples of a dead cat bounce. The first example is on the S&P 500.

The chart above shows that the S&P 500 was declining between February and March 2020 as the reports of coronavirus dominated headlines.

The price declined because market participants and economists started to warn of a recession or depression as businesses and shut. As the price was declining, we saw a few days when it rose.

As it rose, we heard several market commentators try to call a bottom but the price declined the following day.

In the chart below, we see that the price of crude oil was in a downward trend. The price had just moved from above $50 per barrel to less than $30 in just a few days. As the price declined, it also made a few dead cat bounces as traders started to price-in a recovery.

When it Happen

In most cases, dead cat bounces happen after a significant news about a stock, currency pair, or commodity. For example, a company’s stock will move sharply after it makes a significant announcement. This can be a negative earnings report or forecast.

It can also be a major news like the resignation of a CEO or a flop of a major product.

In currencies, such a price action can happen after the central bank rises or slashes interest rates or when a country releases negative economic data like employment and manufacturing PMIs.

How to Trade Dead Cat Bounces

There are two main things you need to know about dead cat bounces. First, you should always avoid timing the market. By this, we mean that you should avoid going against the overall trend especially when more news is coming in.

»Follow the Crowd Trading Strategy«

For example, on coronavirus, you should avoid going long when the market and news media are continuing to focus on the news.

Second, you should always wait before you go against a trend. In other words, you should follow the trend. This means that you should wait for a new trend to form and then you follow it.

In other words, wait for a trend to form and then buy the asset.

Finally, you should use several tools to guide you when trading the dead cat bounce. Some of the popular tools you could use are Andrews Pitchfork and the Fibonacci retracement. These tools have several key levels to watch as you try to confirm the new trend.

Also, you should use technical indicators like moving averages and Bollinger bands to confirm the new trend. And don’t forget this: You should always have a stop loss on all of your trades!

Summary

A dead cat bounce is a popular phenomenon in the stock market. You will mostly see it when the market is a bit volatile. For example, we experienced several dead cat bounces in May 2021 when the price of cryptocurrencies dropped suddenly.

As they dropped, we saw several relief rallies that ended with a major declines since they were not supported by fundamentals. This article has looked at the basis of this pattern and how you can day trade it effectively.

External Useful Resources

- Beware Of A Dead Cat Bounce – Forbes

- Bulkowski’s DCB – The Pattern Site