Day trading is one of the fastest growing industries globally, as people seek to take advantage of the financial market. In the past decades, the stock and crypto markets have been among the best creators of wealth.

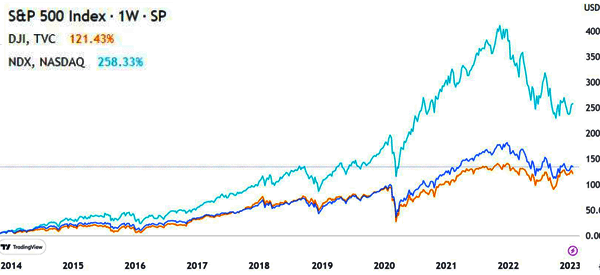

The Nasdaq 100 and S&P 500 indices have more than tripled in this period as companies like Tesla, Nvidia, and Alphabet surged. Cryptocurrencies like Bitcoin, Ethereum, and Avalanche have also had stronger results.

At the same time, access to the financial market has grown substantially as companies like Robinhood, Schwab, and WeBull slashed commissions. Internationally, brokers like Coinbase, Binance, and Kraken have succeeded in enlisting millions of customers.

This article will focus on two key approaches to the financial market: prop trading and quant trading. We will assess what they are, how they work, and some of their top differences and similarities.

Table of Contents

Define prop trading

Proprietary trading, also known as prop trading, is a unique approach where a company participates in the financial market using its own funds and strategies. It differs with other approaches, where companies like hedge funds and investment banks take client cash to trade.

Prop trading firms take different approaches to this. Some companies hire employees and fund their accounts. In addition to having a monthly retainer, these traders receive a share of their trading profits.

Other prop trading companies are more decentralized in nature. Instead of hiring traders as employees, they recruit people from around the world. After going through training and testing, these companies fund their accounts and compensate them based on their profits.

Real Trading is one of the biggest players in the prop trading industry. Other top companies in the industry are FTMO, FundNext, and Topstep, among others.

The industry has several participants, including the prop trading firms themselves and market makers. A market maker is a company that works behind the scenes to execute orders. Popular market makers are Virtu Finance and Citadel Securities.

Define quant trading

Quant trading is an approach where market participants rely on mathematical models to make trading decisions. These models are mostly based on an asset price and include technical analysis models.

The quant trading industry is growing and is now incorporating other models in the industry like fundamental analysis and artificial intelligence (AI).

The idea behind quantitative trading is relatively easy. It seeks to take the manual approaches we use in the market and automate them. For example, a simple model can be based on moving average crossovers.

In this case, the quant model will initiate a buy trade if two moving averages, say 50 and 25 – make a crossover. Similarly, the model will execute a bearish trade when the two averages crossover while pointing downwards.

Prop trading vs quant trading: differences

Use different approaches

Prop trading and quant trading are often thought about in the same way but they are significantly different from each other. At a top level, prop trading is an approach where people use different strategies to make money. They are then compensated by a prop trading company.

Quant trading, on the other hand, is an approach where a person uses various models to identify trading opportunities in the market. In this case, quant trading can be compared to other approaches like trend following, reversals, and breakouts.

Quant trading focuses on mathematical models and algorithms to make decisions on entry, exit, and risk management.

Taken together, it is possible for a prop trading person or company to use the quantitative trading strategy to make decisions.

Decision making

The other difference between the two is on the use of technology. Quant trading is fully based on technology and other models. Even simple quant models like moving average crossover are relatively difficult to create. In most cases, you will need to learn complex coding languages like CSS and Java.

Complex models rely on other additional technological concepts like AI, machine learning, and sentiment analysis. These tools are designed to ensure systematic and rule-based decision-making processes.

Most importantly, these algorithms are designed to analyze vast technical and fundamental data and execute trades without being emotionally involved.

Prop trading, on the other hand, is a broad approach where a trader can use different approaches to make decisions. Again, the use of technology is relevant, but this is quite limited (e.g. to hardware and trading software).

For example, these traders use different strategies, of which quant trading is one of them. Some of the other top approaches that traders use are trend following, scalping, reversal, and pairs trading.

Psychology

The other major difference between quant trading and prop trading is the psychology of emotions. Quant trading is often seen as an autopilot approach for making money. This happens simply because after being implemented, the quant model will often scan the market for opportunities and then execute orders.

Quant models, unlike humans, are not limited by emotions that cost many traders their money. For example, if a model recommends executing a buy trade when two moving averages cross each other, that trade will be implemented.

Prop traders who use other trading approaches are often challenged by the issue of emotions. Emotions can see them overtrade, avoid risk management, do revenge trading, and get caught in some common biases like overconfidence, anchoring, and loss aversion bias.

Time horizon

Most prop traders focus on short-term price movements. In most cases, prop trading companies like Real Trading and City Traders Emporium have rules to ensure that all trades are closed before the end of the day.

As a result, prop traders mostly focus on scalping, which involves buying and selling assets within a few minutes.

Quant trading is different from that because it has a varied timeline. While most quant traders also focus on the short-term, others use these models to execute long-term trades. Some hedge funds also use quants to analyze and execute trades that last a few weeks or months.

Regulations

There is also a regulatory difference between prop trading and quant trading. Quant trading is not regulated by any major regulator since it is just a trading strategy. This means that regulators cannot dictate the strategies that traders can use.

Prop trading, on the other hand, is more regulated at a high level. Following the Global Financial Crisis (GFC) of 2008/09, American regulators barred banks from engaging in prop trading. They argued that banks were shorting stocks that they were actively recommending customers to buy.

Still, big companies like JPMorgan and Bank of America have found workarounds and are still actively involved in trading.

Similarities of prop trading and quant trading

Data analysis and market research

The first similarity between prop trading and quant trading is that they both use in-depth data analysis and market research. For quant trading, most of this study and analysis usually happens before and during the creation process.

Prop traders rely on in-depth market analysis to identify trading opportunities. This analysis can be divided into fundamental, technical, and sentiment analysis. Fundamental analysis looks at economic and company-specific data, and news events when making decisions.

Technical analysis involves looking at charts, identifying patterns, and incorporating indicators when making decisions. Sentiment analysis looks at the broader feeling of the market and indices like the VIX and fear and greed index in decision-making.

Taken together, analysis and research are some of the most important parts of both quant and prop trading.

Risk management

The other important similarity between prop trading and quant trading is known as risk management. This is a process where traders work to limit their risk exposure in the market while ensuring that they maximize returns. It is one of the most important pillars of day trading.

Both prop and quant traders use several strategies in risk management. Most quant models have risk management approaches in-built in them.

For example, a trend-following bot that buys when two moving averages cross each other can have a stop-loss when the MAs strength starts easing.

Most quant models use several risk management tools like stop-loss, trailing stop, and a take-profit. The same is true with prop trading, which relies heavily on risk management. In addition to the strategies mentioned above, it uses others approaches like position sizing, not leaving trades open overnight, and leverage sizing.

Backtesting and forward-testing

Backtesting is a process where traders run their strategies through historical data with the goal of measuring their performance. Most charting platforms like TradingView and MetaTrader have their in-built strategy testing tools.

Prop traders also use various approaches to backtest their strategies. Some of these approaches use hypotheticals and see how their trades would perform.

Forward-testing is an approach that mostly focuses on using a demo account to test whether a strategy works. A demo account has all the data that you need but one that has virtual cash.

Continuous learning

A key foundation for both prop and quant trading is continuous learning since the financial market is constantly changing. Traders who stop learning tend to either lose money in the long term or experience slow growth.

Learning will help you improve your trading approach, expand your horizons, and identify new markets. For example, if you have succeeded in trading stocks, learning can help you identify other assets like crypto and forex.

Learning will also help you to refine your strategies and improve your outcome in the long term.

Adaptability

The other similarity is that they have to contend with a changing market. In some days or weeks, the market will tend to move in an uptrend while in others, the market will often remain in a tight range.

Therefore, as a prop and quant trader, you should focus your life on being an expert trading all market conditions. This means that you should create a strategy that works well in ranging, trending, and volatile markets.

Be a quant prop trading

One approach that you might consider using is becoming a quant prop trader. This is a scenario where you first become a prop trader and then use the quant trading approach. It is a relatively common approach although the company that you decide to use should accept it.

The other challenge is that quant trading requires a combination of trading and software development. Most people don’t have this combination of skills. Therefore, you will need to do substantial learning and practice, especially on trading.

The alternative is where you buy a robot online and incorporate it in your trading. Fortunately, there are many websites that sell these robots online. There are other companies that do custom robots.

If you use this approach, your goal will be to conduct a thorough analysis before you start incorporating it in your prop trading account.