We already looked at the important concept of pre-market trading, which is an important part of a trader’s day that happens mostly in US equities. In this report, we will look at another concept that goes hand in hand with the pre-market trading strategies: morning gappers.

The morning gappers is the concept where stocks and other assets open sharply higher or lower, thus forming a gap when the market opens.

Table of Contents

What is a morning gap?

A morning gap is a situation where a stock opens significantly higher or lower than where it closed in the previous day. For example, assume that a stock closed at $20 on Monday and then published strong earnings in the after-hours market.

In this period, the stock can open at $25 as investors cheer these results. This situation is known as a gap. In other periods, the stock can open at $15, which is also a down-gap. A good example of a down and up-gap is shown in the chart below.

Types of gaps in stocks

There are several types of gaps in the market. Some of the top types are:

- Exhaustion gap – This is a type of gap that happens when a company that has been in a strong sell-off gets oversold. In such a period, the asset can jump as investors buy the dip.

- Runaway gap – This is a type of gap that happens after an asset remains in a consolidation phase in a long time. In such a situation, the stock can jump as it makes a breakout.

- Overnight gap – This is a situation where a gap happens in the overnight session as We described above.

Why Morning Gappers Happen

There are several reasons why morning gappers happen in the financial market.

Earnings

First, a gap can happen because of earnings. For example, many companies tend to release their earnings before the market happens. If they do, traders tend to move heavily in accordance to the earnings release.

For example, if a company releases upbeat news, the stock will move higher in the premarket and also when the market opens. Similarly, if the company releases weak earnings, the stock will form a sharp downward morning gap.

News Report

A morning gap can also happen because of a news report that a company releases. A good example is when Moderna, a pharmaceutical company announced that it was moving to the second phase of its coronavirus vaccine.

In response to this, the company’s stock rose by more than 5% in premarket trading.

M&A

A merger and acquisition is also another reason why a morning gapper happens. In most cases, the stock price of the company being acquired tends to jump while that of the acquirer tends to fall. This process is known as a merger arbitrage.

Some of the other reasons why a morning gapper happens are resignation of a CEO, a major disaster, a negative news, and a new investment by a major and well-respected investor.

Tools to help you in morning gappers

There are several tools that we believe will help you when trading morning gappers. First, there is Investing.com, which has an excellent premarket trading tool. Essentially, this page shows you the top movers in premarket trading.

Second, there is Reuters Eikon, which also has a premarket tool. However, this package is usually expensive and not worth it for most small traders.

Third, there is Market Chameleon, which is better because it shows you the market cap of the firms.

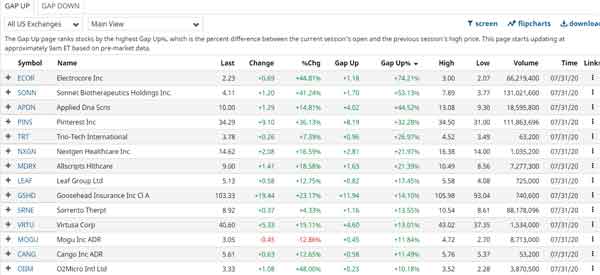

Last but not least, there is Barchart, which is a new but excellent tool. The figure below shows the premarket page at Barchart.com.

How to trade morning gappers

There are several things you need to do to trade morning gappers well:

- The first thing is what we have done in the previous part: use some good tool.

- You need to check out the reason why the price has made such movement. In other words, research on the news that moved the stock.

- Third, look at the volume. If the price has moved in very limited volume, be careful.

- Finally, use the trading techniques we have talked about before to see whether the trend will continue.

Example of a morning gapper

The chart below shows the four-hour chart of Spotify, the music streaming giant. In May 2020, the company announced that it was signing up comedian Joe Rogan. In response, the stock jumped because of his huge following in the podcasting community.

Related » Our list of Day Trading Podcast

After a few hours in the green, the stock made a bullish pennant pattern as investors reflected on the news. A few days later, the firm announced that it would also bring Kim Kardashian. In response, the upward trend continued.

Gap trading strategies

There are several gap trading strategies that you can use. Some of these strategies are:

Gap and Go

This is a strategy that looks to take advantage of the direction of the gap. In this, you want to buy an asset that has just gapped higher or short one that has just made a down gap.

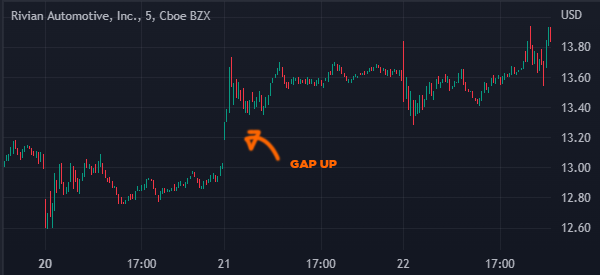

A good example of this is shown in the chart below. As you can see below, the stock made a good gap and then continued rising. A good way to trade a gap and go is to set a buy-stop above the intraday high and a stop-loss inside the gap.

Fill the gap

The other strategy to use is known as filing the gap. This is where you attempt to fill the down or up gap. A good example of this is shown in the chart below.

As shown, the stock made a down-gap after the company published weak earnings and then attempted to fill the gap. As such, you can take advantage of this price action.

The challenge for these strategies is that it is often difficult to know whether a gap will be filled or whether it will continue in the original trend. In most cases, you should look at the catalyst and find out how impactful it will have on the stock.

Final thoughts

Morning gappers is an excellent concept you can use in the financial market. But, like most strategies, it can make you a lot of money or lose you a fortune.

For example, there are people who buy an asset that has gapped upwards without knowing the reason for that. Since the upward trend is not supported by volume, they lose money when the stock starts coming down.

External useful resources

- Stock Premarket Trading Report – Market Chameleon