At some point, every aspiring trader has believed that trading is a straightforward endeavor. You make your analysis through indicators or by looking for chart patterns, execute trades, and then simply wait for profits to roll in. And once you understand that cycle, repeat this workflow more and more. In a standardized way.

But here lies the critical truth: nothing could be further from reality.

That trade that once yielded you impressive profits (or helped a trader you follow to catch them), was a fleeting opportunity, possible just due to those specific market conditions.

That is a fundamental lesson you absolutely must keep in mind: market conditions are not always the same. One moment, a stock or cryptocurrency may surge with exhilarating volatility; the next, it could languish in a tight range, offering little chance for profit.

The good news? A short-term trader can trade during both a bear and a bull market and still generate an income.

Obviously different conditions require different approaches, both in terms of analysis and construction of a profitable strategy (for example, it would make little sense to use volatility indicators if we are in range bound).

In this article we are going to define what a market condition is, which kinds exist, and how we can use them to our advantage.

Table of Contents

What are Market conditions in trading

To create a trading strategy that works, it is crucial to start by identifying the prevailing market conditions in your chosen market. This is not just a minor step; misunderstanding these signals can undermine the entire foundation of your trading plan.

For example, imagine you have developed a trend trading strategy based on your analysis. If that trend has already exhausted itself, can you still execute your plan effectively?

Tools like MACD (Moving Average Convergence Divergence) are invaluable in trend trading, but they may lead you astray in range-bound market conditions.

So, what is ‘market conditions’? This is simply defined as the overall state of the financial market. In this case, it can be grouped individually in terms of assets. For example, when you hear the term market conditions, it mostly refers to key indices like the S&P 500 and the Dow Jones.

Similarly, one can refer to market conditions in terms of cryptocurrencies, commodities, and even currencies. For example, if you hear that cryptocurrencies are volatile, it means that most digital currencies are showing a certain degree of volatility.

At the same time, market conditions can refer to an individual asset. At times, a stock may remain in a tight range when key indices are showing significant volatility.

Related » How to Hold Your Trading Profits Longer

Types of market conditions

There are basically three types of market conditions that you will experience in the financial market. They include:

- Range-bound market – This is a market condition where an asset is moving sideways and making no major movements. Ideally, this is one of the toughest market conditions to trade. You can look at our strategies for trading these conditions here.

- Volatile market – This is a market condition where an asset is showing some degree of volatility. For example, if a stock gains by 1% today and then loses 2% tomorrow and gains by 3% the following day, it can be said to be volatile.

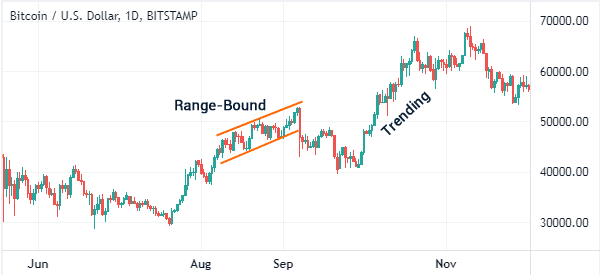

- Trending market – This is a situation characterized by sustained price movements in one direction, where a financial asset is moving in an upward or a downward trend. The chart below shows Bitcoin in a range-bound and trending market.

How to identify market conditions

There is no single way of identifying a market condition. Still, traders use several approaches to do so.

- Technical indicators – One way is to look at several volatility indicators. Tools like Bollinger Bands and the Average True Range (ATR) help assess market volatility. You can also use Trend indicators like the MACD to identify whether the market is trending upwards or downwards.

- Visual Inspection – Not all traders rely on tools to make their decisions. You can look at charts visually and use drawing tools to spot patterns to help you figure out if the market is trending or stalling.

- Analyze market sentiment – Understanding market sentiment through news events and economic indicators can provide insights into prevailing conditions. Positive news may lead to bullish trends, while negative news can create bearish sentiments.

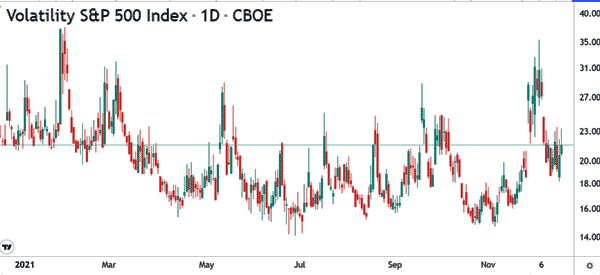

- Volatility tools – There are several tools that show whether the market is ranging or in a volatile situation. The most common is the CBOE volatility index that is shown below. The VIX rises in periods of high volatility and drops in times of low volatility.

Factors Affecting changes in market conditions

When we examine financial markets, we must keep in mind that so many factors come into play in defining a shift in market conditions. And these can vary depending on the asset as well. Let’s see what are the most relevant macro factors.

Macroeconomics

Governments wield considerable influence over financial markets, with fiscal and monetary policies acting as powerful tools to influence economic conditions.

Central banks, particularly the U.S. Federal Reserve (the Fed), play a pivotal role in this dynamic. By adjusting interest rates, the Fed can either stimulate growth or cool down an overheating economy, directly impacting market sentiment and investment strategies.

Consider the Fed’s decisions: when interest rates are lowered, borrowing becomes cheaper, encouraging consumer spending and business investment.

Conversely, raising rates can help rein in inflation but may also dampen economic activity. This delicate balancing act is vital for traders and investors who must stay attuned to these shifts.

In addition to monetary policy, fiscal policy is crucial for those focused on swing trading or long-term investments. Fiscal policy involves government spending and taxation decisions that can significantly affect economic indicators such as job creation and price stability.

An increase in government spending can boost aggregate demand, while tax cuts can enhance disposable income, both of which are essential for driving economic growth.

Supply and Demand

At the heart of every market lies the fundamental principle of supply and demand. This dynamic governs not just traditional goods and services but also currencies, stocks, and other investments.

The interplay between these two forces creates the price fluctuations that traders rely on:

- When demand for a product surges while supply shrink, prices inevitably rise.

- Conversely, if supply outpaces demand, prices will fall.

This simple yet powerful mechanism underscores the ongoing battle between bulls and bears in the market. The tension between buyers eager to push prices higher and sellers looking to capitalize on gains illustrates the constant balancing act at play in financial markets.

Understanding these concepts is essential for traders aiming to navigate the complexities of various asset classes—be it stocks, forex, futures, cryptocurrencies, or commodities. By recognizing how supply and demand influence price movements, traders can make more informed decisions and enhance their strategies in every market condition.

Market Sentiment

In the world of trading, every sale is matched by a purchase. For this exchange to happen, both buyers and sellers must have different views on the market’s conditions.

Understanding the overall market sentiment—essentially, how traders feel about the market—can be the key to making profitable trades.

There are two main approaches to market sentiment. The first is known as herd behavior. This is when traders follow the crowd, doing what most others are doing. While this can help drive trends—whether they are upward or downward—it doesn’t guarantee profits. Following the crowd can sometimes lead to losses if the market turns unexpectedly.

The second approach is called contrarian trading. This strategy involves making decisions that go against the prevailing sentiment after conducting thorough research.

Contrarian traders believe that when everyone else is overly optimistic or pessimistic, it may be time to take a different stance. By carefully analyzing market conditions and diverging from the majority, contrarian investors aim to capitalize on opportunities that others might overlook.

News Events

In today’s fast-paced trading environment, the rise of technology and social media means that news is available in real-time to anyone with an internet connection.

For professional traders, the ability to quickly read, analyze, and digest this news is crucial for identifying potential shifts in market conditions. However, it’s equally important to filter out irrelevant information—often referred to as “noise”—that can lead to confusion and analysis paralysis.

So, what news events should traders prioritize? Here are the key categories to focus on:

- Headlines: Major news headlines can significantly impact market sentiment and price movements. Traders should pay attention to breaking news that could influence economic conditions or investor psychology.

- Earnings Reports: Quarterly earnings announcements from companies are vital for stock traders. These reports provide insights into a company’s performance and future prospects, often leading to immediate price reactions based on whether results meet, exceed, or fall short of expectations.

- Geopolitical Developments: Events such as elections, international conflicts, or trade negotiations can create uncertainty in the markets. Traders need to stay informed about these developments as they can lead to rapid price fluctuations across various asset classes.

- Economic Data Releases: Key economic indicators—such as employment figures, inflation rates, and GDP growth—can have profound effects on market dynamics. Understanding these releases helps traders anticipate potential market movements and adjust their strategies accordingly.

By honing in on these relevant news events, traders can make more informed decisions and enhance their chances of success in the markets. The ability to discern which news is impactful and which is merely noise is a hallmark of a skilled trader.

Adapting to market conditions

As a trader, the ability to adapt to varying market conditions is paramount. Markets are inherently dynamic, often oscillating between bullish trends, bearish downturns, tight ranges, and periods of heightened volatility.

Understanding how to navigate these scenarios can significantly enhance your trading success.

Range-bound conditions

When faced with a range-bound market—where an asset’s price stagnates within a narrow band—trading can be challenging. Still, there are several strategies that can help you capitalize on these conditions:

- Explore Alternative Assets: If stocks are trading sideways, consider diversifying your focus. Look for assets exhibiting greater volatility, such as cryptocurrencies or commodities. These markets may present opportunities for profit even when traditional stocks are stagnant.

Or, remaining within the stocks galaxy, you can simply opt for a different sector. Are electric car stocks not offering attention-worthy swings? You can look to energy stocks, for example.

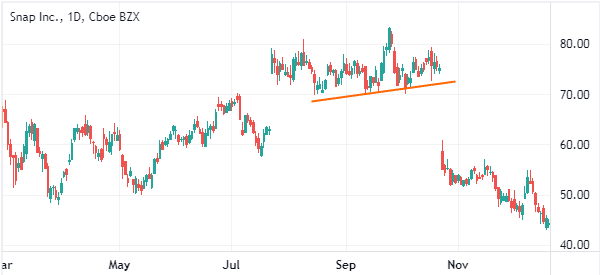

- Anticipate Breakouts: Patience is key in range-bound conditions. Historical patterns suggest that such markets often lead to significant breakouts—either bullish or bearish. By waiting for these moments, you can position yourself to capitalize on substantial price movements. For instance, observe a stock that has been trading within a tight range only to experience a strong bearish breakout, as illustrated in the chart below.

- Scalping Strategy: Another effective approach in a range-bound market is scalping. This technique involves executing multiple trades within a short timeframe to capture small price movements. By buying low and selling high repeatedly, you can accumulate profits even in stagnant conditions.

Trending market conditions

In trending markets, the strategy becomes simpler. As we have reiterated earlier as well, you can choose to follow the trend, or do contrarian trading.

Let’s say you want to choose the first option. Identify assets that are experiencing upward momentum and consider entering long positions to ride the bullish wave. Conversely, if an asset is on a downward trajectory, short selling can be an effective strategy until signs of reversal emerge.

Trading in Volatile Markets

Volatile markets present unique challenges but also significant opportunities. To be able to capitalize on these opportunities while avoiding falling into one of the tricky traps of volatility, the best option is to use pending orders.

This strategy allows you to set specific price levels at which you wish to buy or sell an asset. By doing so, you can capture price movements without constantly monitoring the market.

Final thoughts: do not be conditioned by market conditions

Some market conditions are very favorable for day traders (high volatility), while others are much less so (with small or no movement). But if you are a professional trader, and your profits depend on how you trade the markets, waiting for the most favorable conditions is not a good idea.

And, very often, these conditions are not unique but a mix of all types together. That’s why it’s important to know both how each condition works and how to move smoothly from one to the other.

If you want to master all market conditions and learn how to trade under all circumstances, join Real Trading and take advantage of the professional training provided to all our partners!