The stock market is a place where investors and traders buy and sell shares of publicly traded companies. The market works by simply matching buyers and sellers of securities through a complex process that is typically managed by market-makers.

But the path is not always so smooth. In this article, we will focus on a situation known as trade imbalance and how you can trade it successfully.

Table of Contents

What is a trade imbalance?

Most online brokers use companies like Citadel and Virtu Finance to execute orders. These firms are known as market-makers and are some of the most important players in the industry. For example, they are responsible for making it possible for commission-free trading in platforms like Robinhood and Schwab.

Market-makers work by matching buyers and sellers in the market. However, at times, there is usually a situation where there are significantly higher sellers than buyers. In other periods, there could be more buyers than sellers in the market.

In extreme cases, an order imbalance can lead to a trading halt, where trading is paused temporarily.

What are trading halts?

An important concept when it comes to trading imbalances is known as halts. A halt is a situation where an exchange pauses certain stocks from being traded due to their price action.

A company can also request that its stock be halted in the market as it prepares to make a major news. For example, a stock can be halted when there are regulatory news and an important news.

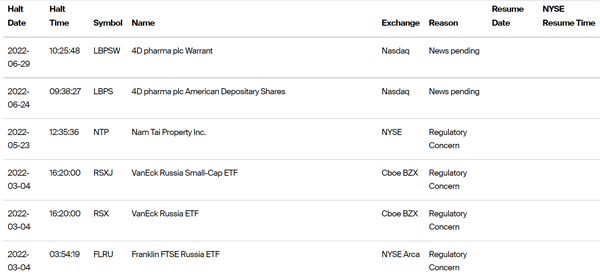

It is relatively easy to find companies that have halted their stocks. For example, you can use the NYSE trading halts tool that is shown below.

Causes of trade imbalances

There are several factors that cause trade imbalances in the stock market.

FED decisions

First, the actions by the Federal Reserve could have an impact on demand and supply of stocks. Ideally, when the Fed turns extremely hawkish, investors tend to be worried about the market.

As a result, this could lead to an imbalance between supply and demand of certain equities.

Earnings

Second, corporate earnings is another popular cause of imbalance. Investors love companies that publish strong earnings and guidance. However, at times, a company could deliver a weak report. When this happens, it increases the possibility that there are more sellers than buyers.

At times, an extremely positive quarterly release can lead to substantial demand for a stock. In this case, there could be significantly more buyers than there are sellers.

Major announcements

Third, major corporate announcements could lead to trade imbalances. Examples of popular causes of this imbalance are bankruptcy rumors, acquisition, management change, and a market rumor.

Further, major geopolitical issues like wars could have an imbalance challenge. For example, when Russia invaded Ukraine, there was an imbalance between sellers and buyers of Russian stocks. Natural situations like earthquakes and pandemics could lead to imbalances.

Using the imbalance locator tool

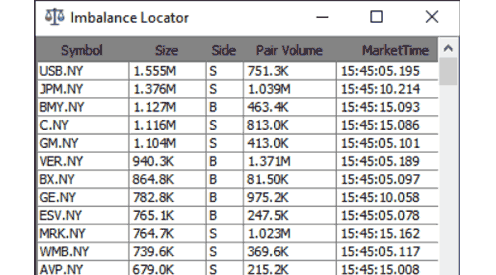

Ideally, the best way to trade imbalances is to use a tool known as imbalance locator. This is a tool that is usually provided specifically by brokers. For example, at Real Trading, we provide a free imbalance tool to all our traders.

As such, you should verify with your broker if they provide the tool. A good example of this tool is shown below.

This indicator has five key sections: symbol, size, side, volume, and market time. The side can be S, B, or N. In this case, S is for sell, B for buy, and N for neutral.

Check pre-market data

The other important strategy to trade imbalance is to know companies that are making strong moves before the market opens. In most cases, these are companies that will have imbalances during that market session.

Related » Everything to know about Premarket Trading

There are several simple approaches to find these companies. The simplest one of them is to use websites like WeBull, Investing, and Market Chameleon to see companies that are showing strong moves before the open.

Another strategy is to use a watchlist that lists the most actove stocks in the market and why they are moving. At Real Trading, we have a highly popular watchlist that you can subscribe to for free.

Related » How to Get the Most Out of a Stock Watchlist

Check the imbalance

Finally, you need to use the imbalance locator tool to do more analysis. For example, you can use it to compare volume and pared volume. Volume is the total amount of shares that are either being bought or sold. Pared volume refers to those that have been allocated.

For example, in the chart above, we see that GM has a volume of 1.1 million shares and a pared value of 413k. As a result, it means that the company has an imbalance of 1.5 million shares. Most importantly, you should compare this volume with the company’s typical volume.

Tips for trading imbalances

There are several tips that you should use when trading imbalances.

Check the volume

First, in most cases, the imbalance will not have an impact on stocks. It will only have these impacts when the imbalance is significantly larger than usual. Therefore, if there are significant sell volume, then you should place a sell trade and vice versa.

Level 2 data

Second, in addition to trading imbalances, you should use level 2 data to see how other traders are navigating the situation. Level 2 and time and sales data is important because it gives you a clear picture about the state of the market.

Other analysis

Finally, combine all this with technical and price action analysis. In technical analysis, you will use technical indicators to determine whether an asset’s price will rise or fall.

In price action analysis, you will use chart patterns like head and shoulders and rising wedge to determine this.

Summary

In this article, we have looked at what a trading imbalance is and how you can use it well in the market. We have also touched on the important indicator known as the imbalance locator and how to use it.

We believe that these tools are so important when you are making decisions on whether to buy or sell a stock.

External useful resources

- Trade imbalances and the rise of protectionism – Voxeu