While money and debt have existed as far back as we have written records, the stock market is a recent human invention.

The Amsterdam Stock Exchange was the first market for tradable stocks in 1602. The principle of tradable stock shares has unlocked trillions of dollars in value and paved the way for complex financial instruments.

For example, the US stock market capitalization is roughly 170% of US GDP. That means that the US stock market represents more value than the entire output of the US economy!

Other countries, such as Switzerland and Denmark, have also achieved this level of disproportionate market cap. It’s a fascinating outcome of what an equities market is capable of doing for productivity and wealth creation.

That’s before you even get to the professions of trading and investing. In this article, we’ll cover the history of short-term trading—a fascinating industry that blends technology, psychology, and advanced economics.

Table of Contents

Early Days and the Birth of Stock Markets

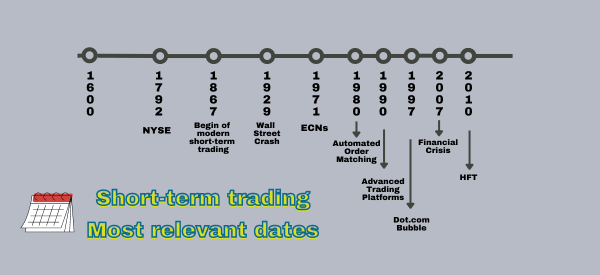

Although you can find hints of joint-stock corporations as far back as Roman times, the earliest joint-stock company was the English East India Company, which earned a Royal Charter in 1600 but was privately held for its entire existence.

Two years later, the Dutch East India Company issued the first tradable shares on the Amsterdam Stock Exchange.

Both of these corporations were designed to defray the risk of funding merchant voyages to the East Indies. At this time, trading stock happened in person, through the physical exchange of certificates.

In 1792, the New York Stock Exchange (NYSE) was founded. Two dozen brokers and merchants created a set of rules for trading securities, known as the Buttonwood Agreement.

Up to this point, it was possible for individuals to take part in risky ventures as investors, but the process wasn’t formal, repeatable, or accessible to the wider public. Nowadays, this is all clearly stipulated, and the aim is still the same: buying, owning, and selling stock in a company allows companies to raise capital, and reduce the burden of risk for those ventures.

Suddenly, ordinary people could use small amounts of seed money to generate lucrative returns without setting foot on a merchant ship or knowing anything about building a business.

Due to the physical nature of stock certificates and the trading floors, most buying and selling was done over long periods.

In a very real sense, stock markets move at the speed of communication—a dynamic that eventually gave birth to short-term trading.

In fact, short-term trading (sometimes called “day” trading) started in 1867 with the advent of the modern telegraph network and ticker tape communications between traders and brokers.

Technological Advancements and Regulatory Changes

In the 1920s and 1930s, the NYSE became a global hub for daily stock trading and long-term investments.

While the speed of telegraph communication and paper ticker tapes had unlocked the ability to execute trades faster than ever, it showed its limitations in the Wall Street Crash of 1929.

As investors hurried to offload their shares, many trades were conducted in a short period, and the ticker tape didn’t finish printing transactions until 152 minutes after it was supposed to. This delay might have exacerbated the panic of the crash, as traders couldn’t access timely information.

Some forty years later, two massive changes transformed the world of short-term trading.

In 1971, the National Association of Securities Dealers Automated Quotations (now called Nasdaq) created a new way to communicate prices and orders. They called it an electronic communication network, or ECN. These computerized transactions opened the stock market to a wide audience of investors rather than just stock brokers.

Then, in 1975, the Securities and Exchange Commission (founded in 1934, during the Great Depression) overturned 180 years of fixed commission on stock trades. This launched a new era in which trading fees became subject to competitive pressure.

In the space of a few short years, technology and deregulation brought short-term trading within reach of even more people. Perhaps counterintuitively, the deregulation of broker fees actually triggered a wave of new brokers seeking to fill the demand from investors.

By the late 1990s, ECNs were superseded in many ways by online trading platforms that lowered the barriers to entry even farther.

At every step along this journey, communication bottlenecks triggered technological innovations to speed up transactions and reach a wider audience of potential investors. In turn, these changes have transformed the market itself as new strategies and methods of investing become mainstream.

The Rise of the Modern Short-Term Trading

Although it was technically possible to trade assets within a single day prior to the 1980s and 1990s, the expansion of the internet into more homes made intra-day trading convenient. This was especially true after the release of automated order-matching systems in the 1980s, which helped systematize transactions even more.

In 1984, the SEC created the Small Order Execution System (SOES), which prioritized settling orders of 1,000 shares or less. This helped even the playing field between institutional investors and amateur or sole traders.

By 1997, the dot-com boom revealed how much the market had changed in 70 years. The high number of what we now call “retail” investors and democratized access to markets allowed mass psychology to influence prices like never before.

The dot-com bubble burst in early 2000, not long after the SOES was upgraded to allow single transactions of 999,999 shares rather than the previous 1,000. This effectively removed the SOES advantage for solo short-term traders.

Online brokerages continued to develop and provide the tools that traders needed to rapidly buy and sell assets from home computers. The estimated number of active short-term traders was less than 10,000, but online brokerages boasted more than 5 million subscribers. Interest was at an all-time high, even if activity was less than it seemed.

In the 2000s, the demand for short-term trading tools and platforms increased. Traders across the world had access to rapid communication tools and real-time information at a level that was unimaginable just decades earlier.

This shift opened the doors to even more traders and created increased complexity and competition in financial markets. Derivatives, such as credit-default swaps, were growing more popular as the US housing market surged.

Financial Crisis and New Regulations

In 2007, the US subprime mortgage crisis hit Wall Street, causing the collapse—or bailout—of multiple investment banks. The fallout from this crisis put the world of high finance in the public’s eye and the US government’s crosshairs.

The Dodd-Frank Wall Street Reform and Consumer Protection Act laid the groundwork for a more stable, resilient financial system. The Basel III rules created an international shift in bank capital requirements, leverage ratios, and liquidity and helped strengthen large banks’ balance sheets.

Although these regulatory changes were designed to tackle problems with institutional investing practices, they also had knock-on effects, such as reducing market liquidity and the availability of leverage.

Although short-term investing wasn’t responsible for triggering or exacerbating the Great Recession, short-term traders definitely felt the increased friction in many types of trading.

In the big picture, systemic stability in the financial system is better for nations and their citizens. While the regulatory changes from this historical period might have muted some opportunities for short-term traders, it illustrated a vital lesson about the importance of risk management and studying interdependencies in the financial system.

Recent Trends and High-Frequency Trading

The 2010s were marked by a sophisticated technological development known as high-frequency trading (HFT). Driven by algorithms and quantitative trading strategies, HFT allows traders and institutions to hold positions for extremely short durations.

Retail traders gained access to new interfaces that enhanced their intra-day trading abilities. The invention of the smartphone promised to pave the way for unprecedented visibility (stock prices in the palm of your hand) and control (the ability to make changes from anywhere).

The phenomenon of trading with computers has only accelerated as artificial intelligence and machine learning have embedded deeply within trading platforms and investing tools.

Today, social media platforms such as Facebook, X, and YouTube have exposed new audiences to the opportunity of short-term trading via the expertise of self-made expert traders—sparking speculation and cynicism along the way.

The collapse of Silicon Valley Bank, Silvergate Bank, and Signature Bank in 2023 put bank stability back in the regulatory spotlight. Years of persistent inflation—beginning during the COVID-19 pandemic—and high interest rates have pinched credit markets and caused many companies to tighten their belts.

One of the most recent regulatory changes came in January 2024, when the SEC implemented a final rule to shorten the standard settlement time for most broker-dealer transactions from two days to one day after the trade. This effort is designed to reduce multiple risks associated with securities transactions.

The Future of Short-Term Trading

Meanwhile, the tools and training for short-term traders keep improving. Even the requirement to use specific hardware to run high-powered trading platforms is weakening. Short-term traders worldwide have access to global asset markets like never before.

Over the years, short-term trading has cycled in and out of public favor. At the lowest points, it has been misunderstood and associated with individuals whose actions were out of step with the rest of the industry.

Internet and financial technology have breathed new life into short-term trading. With diligence and commitment, short-term trading can unlock financial freedom for men and women across the globe—no trading floor or specialized terminal is required.

Artificial intelligence promises to usher in another era of change in global markets, as new applications for AI are being discovered and tested every day.

But it’s not just technology: the role of intelligent humans capitalizing on trading opportunities has never been more viable, as seen in the rise of proprietary (“prop”) trading firms. These firms provide training, technology, and buying power to people who want to make a career out of short-term trading.

No magical or technological solution removes risk entirely from short-term trading. Instead, a prop firm sets people up to succeed and hone their professional money-making skills. It’s not about getting rich quickly—it’s about building long-term success.

An Opportunity To Become the Master of Your Career

It’s in vogue for people to speculate about the ways AI will make humans obsolete. The truth is that there has never been a better time for people to learn the skills and master the tools of short-term trading.

Markets rise and fall, but the fortunes of a short-term trader aren’t tied to those cycles the way they are for long-term investors.

The strongest investment you can make is on yourself. And the smartest way to make that investment is to give yourself every advantage through learning, resources, and community. Partnering with a prop trading firm like Real Trading is one of the best moves you can make to sway the odds in your favor.