Futures are an important part of the financial market. They refer to contracts that make it possible for people to agree the price of an asset presently and for the asset to be exchanged in the future.

The buyer (or seller) must buy (or sell) the underlying asset at the set price, regardless of the current market price on the maturity date.

The concept was originally used in the grains industry but has now expanded to other assets like stocks and cryptocurrencies.

Table of Contents

Understand futures: How do futures work?

What is futures trading?

The concept of futures is relatively easy to understand. Assume that you are a corn farmer who sells products to a corn factory. The price for corn per bushel presently is $10. In this case, the factory can agree to buy all your harvest for $12 per bushel.

As a farmer, you will be pleased since the factory has agreed to buy your products at a profit. At the same time, the factory will be happy for having enough supplies. Therefore, if corn prices fall to $9, the farmer will be pleased because they will sell their products at a profit.

The futures market works in the same way. However, things are highly automated now, such that you can buy a futures contract without following all that process.

What is a margin in futures trading?

An important concept in futures trading is known as margin. It refers to the use of leverage to maximize profits in the futures market.

Leverage is borrowed money that a broker extends to you to execute trades. Margin, on the other hand, is the balance that is needed to maintain the account open.

For example, if you have $10,000 in your account, the broker may need you to have a $3,000 margin. In this case, if your account has a major loss, the broker will automatically stop it when it reaches $3,000.

Before closing the trade, the broker can do a margin call, where it asks you to add more funds to your account.

Do I have to choose leverage if I do futures trading?

Leverage, as We explained above, is the loan that a broker extends to a trader in the financial market. The loan is usually expressed in terms of a ratio. For example, a leverage ratio of 1:10 means that your trade account will be expanded by 10x. If you have $50,000, it means that you can transact with $500,000.

However, it is not mandatory to have leverage when doing futures trading. In most cases, many investors prefer trading without any leverage in their accounts. However, leverage is mandatory for a margin account.

What is and how does a futures contract work?

A futures contract has several important parts, including:

- The financial asset – This asset could be a commodity, currency, shares, cryptocurrency, or even an index. You should check the ticker symbol for the asset as offered by the broker.

- Expiration date – This is the time when the contract will expire. For example, there are futures contracts that expire per month and those that expire per week.

- Strike price – This is the price where you have agreed to buy and sell the financial asset.

Therefore, to summarize, the futures market works in a simple way, especially now that trading is fully automated.

If the price of crude oil is trading at $50, you can place a futures trade that expires in a week’s time. In it, you can have the strike price of $55, if you believe that prices will rise during this period. In this case, you will have the right and not the obligation to buy oil at that price.

It is important to note that a new type of futures contract in the crypto market has come up. It is known as a perpetual futures contract because it does not have an expiry period.

How long do futures contract last?

The expiration of futures contracts is not standard. However, in most cases, stock and indices futures contracts happens on the third Friday of the month.

At times, there could be a futures contract rollover, where the expiry period is extended. This rollover helps the trader maintain the same position beyond the initial expiry of the trade.

Futures vs forward contracts

As explained above, futures is a trade contract where members agree on a price of an asset for a future date. A forward contract works in the same way. However, this is a private agreement that is highly customizable, and one that settles at the end of the agreement.

Forward agreements are popular in the over-the-counter market. As such, these forward contracts are not as popular and are not regulated by the Commodity Futures Trading Commission.

Assets traded in the futures market

What are index futures?

An index future is a financial asset that makes it possible for people to trade an index. Examples of popular indexes or indices are the Dow Jones, DAX, CAC 40, Nasdaq 100, and S&P 500.

Underneath these major indices, there are many more indexes. For example, there are indices that focus on sectors like energy, finance, and technology.

As traders, we interact with index futures every Monday to Friday. Before the market opens, traders can trade index futures, which are good predictors of how the market will open.

What are currency futures?

Currency futures are those tied to forex pairs. Examples of popular forex pairs are the EUR/USD, GBP/USD, and the USD/JPY pairs. In this case, if the EUR/USD price is trading at 1.1200, you can trade a futures trade where you predict that the pair will trade at 1.1250 before its expiry.

In most cases, forex futures expire every week. The chart below shows how a futures expiration calendar for the EUR/USD pair looks like.

Interest rate futures

Another type of futures contract is known as interest rate contract. This is a futures product for a financial asset that bears interest like a mortgage, government bonds, corporate bonds, and municipal bonds.

Interest rate futures prices move inverse to interest rates. The chart below shows how the expiration calendar of the 10-year government bond looks like.

What are commodity futures?

Commodity futures are financial assets that focus on key global commodities. Examples of popular commodity futures are livestock, crude oil, natural gas, and copper.

A good example of a futures contract is what happens in the airline industry. Companies in the sector use futures contracts to hedge against risks. As such, well-hedged companies don’t suffer dramatic losses when the prices of jet fuel goes parabolic.

What time does futures market opens and closes?

The two biggest companies in the futures market in the US are CME Group and CBOE. These companies set the standard time for buying and selling futures.

The CME and CBOT products open on Sunday 5pm eastern time and close on Friday at 5 pm.

How does futures trading work?

A good example of a futures trade is in the cheese market. If a cash-settled cheese futures specify a quantity of 20,000 pounds of cheese at $0.001 per pound. In this case, the value of the contract rises by $20 whenever the price of cheese rises by $0.001.

Therefore, if a buyer and seller have agreed a price of $1.675 per pound and the price rises by $0.001 to $1.676, then the seller has a loss of $20 while the buyer wins $20.

This is a very basic example, but it gives a good idea of how futures trading works.

The 3 stages

There are three important parts of preparing for futures trading: before, during, and after trading. Before you start trading, find a good broker that provides futures trading.

In the United States, many traditional brokers like Schwab, Fidelity, and TD Ameritrade provides these futures assets. Identify a broker that provides a good price for these assets.

Second, there is a consideration during the trading process. In most cases, you will need to find the ideal leverage to use. We recommend that you focus on a small amount of leverage, especially if you are a new trader. A big leverage exposes you to substantial losses

Finally, it is important for you to avoid the physical delivery of the item. You do this by simply closing the trade before the expiry period.

How to pick the futures market to trade

There are several things to consider when selecting the futures market to trade. Some of the top things to consider are:

- Liquidity of the asset – It is always important to consider the liquidity aspect of the contract you want to trade. Some of the most liquid futures contracts are currencies, commodities, stocks, and indices.

- News catalyst – Another thing to consider is a news catalyst for the financial asset. If you are buying crude oil futures, it is important to think about the news catalyst that will push the price higher or lower in the same period. Some examples of catalysts in the oil market are the EIA and OPEC reports.

- Futures pricing – Some futures contracts tend to be more expensive than other ones. For example, thinly traded futures contracts like orange juice are more expensive than corn.

- Your experience – Always select futures contracts that you know well. For example, if you are a commodity trader, always focus on commodities. Specializing can play an important role in your success.

News and data to focus on in futures trading

News are an important part of the futures market. As a trader, you should focus on important news and data. Some of the most important in the futures market are:

- Earnings – Corporate earnings are important catalysts in the spot and futures market. You can buy a stock future if you expect that the shares will soar after earnings. As such, it is important to use the earnings calendar.

- CoT report – The CoT report is published by the CFTC every week to show positioning among various participants in the market.

- Interest rate decisions – Monetary policy meetings by key central banks tends to have important outcomes in the broad market. Therefore, you should always know when a central bank will meet and what to expect.

- OPEC meetings – OPEC+ meetings are important in the oil market since they influence demand and supply. You should be aware of when OPEC will meet and what to expect.

- Geopolitics – Geopolitics, such as Russia’s invasion of Ukraine, has an impact on financial assets like oil, wheat, and corn.

There are other important news to consider when looking at the futures market. Some of these news events are weather, supply chains, labor strikes, and the overall market momentum.

Futures vs options

As mentioned above, a futures contract is an agreement between the buyer and seller on a certain financial asset. In this case, the seller has the obligation to deliver the asset at or before the expiry period.

The options market works in the same way. However, in it, the seller does not have the obligation to deliver. This is the main difference between the two.

What happens if you hold after expiration?

A common question is what happens when you hold an asset until expiration. In this case, the broker will close the trade immediately and you will either make a loss or a profit.

If you are dealing with physical products like gold or silver, the assets will be delivered to you. Common examples of futures that are settled physically are cotton, corn, copper, and oil.

Futures trading strategies

How can you make money in the futures market? The futures market serves three important purposes:

- Hedging – This is a process where investors hedge their risks in the market. A good example is what happens in the airline industry. Since jet fuel is the biggest cost in the market, companies typically use futures contracts to hedge risks.

- Speculating – The other way of making money in the futures market is to speculate. They are easy to speculate since futures contracts can be bought and sold up to the point of expiration. For example, if you believe that oil prices will rise, you could place a buy trade.

- Diversifying – You could trade futures as a way of diversifying your income. For example, you can trade different types of futures at the same time.

Can you day trade futures?

Yes, it is possible to day trade futures. In fact, most people day trade futures since they can be bought and sold at any time. Many day traders prefer futures because they trade for more hours than the spot market.

What timeframes are recommended for day trading futures

Traders use different timeframes to make decisions. Long-term traders and investors use long-term charts. In this case, if you are buying futures contracts with a three-month expiry, it does not make sense to use a one-minute chart. In this case, traders use longer charts like 12-hour and daily charts.

For day trading, it is recommended to use shorter-term charts like 5-minute, 15-minute, and even 1-minute chart. As a day trader, your goal is to ensure that all your trades are closed within the day.

Still, we recommend using a multi-timeframe analysis that involves looking at numerous chart durations before making a trading decision. Looking at multiple charts will help you determine the direction of an asset.

Best futures trading strategies

There are many futures trading strategies that you can use in the market. Let’s dive into some of the most popular ones.

Arbitrage

This is a trading strategy that involves buying an asset and short a similar asset at the same time. For example, in case of crude oil, you can place a long trade of Brent and a short trade of the West Texas Intermediate (WTI).

In this case, if oil prices rise, your Brent trade will be profitable while your short trade will make a loss. As a result, at the expiry time, your profit will be the spread between the profit and loss of the two.

Momentum trading

Momentum is a trading strategy that involves buying an asset that is already rising and shorting those that are falling.

For example, if the price of crude oil is in a strong bullish trend, then it means that you can buy oil futures. The benefit of momentum trading in futures is that you can buy a few hours before expiration.

Reversal strategy

The other popular momentum trading strategy is known as reversal. It involves buying an asset whose price is falling, hoping that a reversal will happen. A reversal trading strategy can be a bit risky especially when an asset has a strong momentum.

Still, traders use several approaches to predict when this trend will reverse, including chart patterns like head and shoulders, double-top, and bullish engulfing. They also use technical indicators like moving averages and the Relative Strength Index (RSI) to predict when the reversal will happen.

Bull calendar spread

This is a strategy where the trader buys and sells contracts on the same day but with different expirations.

In this case, a trader can go long the short-term contract and short the long-term contract. For example, if you expect that cotton price will rise in the next few months, you can buy January’s contracts and short March contracts. The exact opposite of this strategy is known as a bear calendar spread.

How do you swing trade futures contracts

A common question is on how swing trade futures works. For starters, swing trading is a trading approach where a trader buy or shorts financial assets and holds them for a few days. It differs from day trading, which involves buying and selling coins within a day.

Trend Following

There are several strategies that traders use to swing trade futures contracts. First, you can use a trend-following strategy that involves identifying an existing trend and following it.

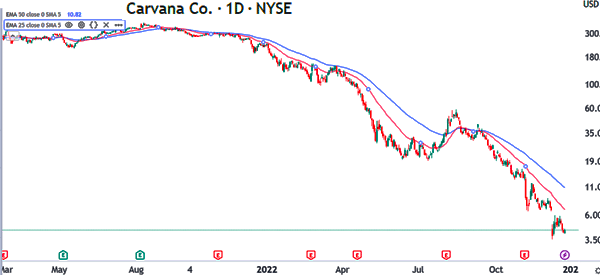

Trend followers use different approaches like using trend indicators like moving averages and Bollinger Bands. As such, traders can identify an existing trend and then place a futures trade based on it. The chart below shows that a swing trader would have shorted Carvana’s futures.

Reversal

Second, there is a strategy known as a reversal. Here, instead of following the trend, traders aim to do the opposite.

In it, they identify a trend and place a futures trade in the opposite direction. Some of the top reversal patterns are head and shoulders, rising and falling wedges, and double and triple top patterns,

Divergence

Third, another swing trading strategy is known as divergence. In this, traders use oscillators like the Relative Strength Index (RSI) and MACD to find out whether an asset is developing a divergence.

A bullish divergence happens when an asset’s price is falling while oscillators are falling. On the other hand, a bearish divergence happens when an asset’s price is rising while oscillators are rising.

Why trade futures? Pros and cons

There are several benefits of trading futures contracts, including:

- Futures are leveraged products. As mentioned, most futures brokers provide leverage which can help you maximize your returns.

- Hedging – Futures are an excellent way to hedge against risks in the market.

- Futures are highly liquid – The futures market is highly liquid, meaning you can buy and sell within a short period.

- Arbitrage trading – It is possible to use the arbitrage trading strategy, where you go long an asset and short its futures.

- Diversification – Futures can help you to diversify your income.

What are the risks involved in futures trading?

There are several risks involved in futures trading, including:

- Arbitrage gone wrong – At times, arbitraging between spot and futures can produce the wrong results if divergence happens.

- Margin call – At times, a margin call can happen when a loss extends to a certain level. In extreme cases, it is possible to lose more money than what is in the account.

- Loss risk – There is a risk that your trades will not be profitable in futures trading.

- Delivery risk – At times, depending on the asset you are trading, there is the risk that your asset will be delivered physically.

- Expensive – While trading stocks is free, brokers charge a fee for futures.

How profitable is futures trading?

Like other trading and investments, futures trading can be highly profitable. In most cases, however, most people tend to lose money when doing it.

Profits will typically depend on your trading strategy, experience, and how much money you are trading. Therefore, instead of thinking about profits, you should focus on coming up with a solid trading strategy to use.

What are the costs associated with futures trading?

The cost of futures trading have declined significantly in the past few years. In most cases, brokers like Schwab and Fidelity charge a small commission for futures. Schwab charges $2.25 per contract. This pricing is standard among brokers in the US.

FAQ

Is trading futures gambling?

No. Trading futures is not gambling. It is a process where a person does fundamental and technical analysis and then executes trades on all types of assets.

Why is futures trading a zero sum game?

A zero sum game is a process where one person’s gain is another person’s loss. Futures trading is seen, wrongly, as a zero sum game because profits come from other people’s losses. However, in reality, futures is not a zero sum game since all people in the industry make profit and losses.

Are futures a type of derivative?

Yes. Futures are a type of derivative because they involve a contract to buy or sell an asset at a later date and at a set price.

Can I lose more money than I invest in futures?

Yes. Since futures involve leverage, it is possible to lose more money than you invested. Many companies have a negative balance protection.