The premarket session is an important part of the US financial market. It allows investors and traders to access the market before the regular session happens. The premarket period is an extension of the extended hours that happen shortly after the market closes in New York.

The futures market is another essential part in the American financial system in that it helps investors buy and sell asset contracts for delivery at a later date.

A good example of the futures market at work is among US indices. Every weekday, traders are able to predict whether stocks will open higher or lower by looking at the performance of the futures market.

Table of Contents

How the premarket session works

In the US, the regular session of the market is usually relatively short, which inconveniences many people, especially those who work 8-5 jobs. Therefore, many US brokers decided to increase the amount of time that traders can access the market.

The premarket works in a different method to the regular session. For one, instead of having a direct market access, traders place their orders through an electronic communication network. The market also differs in that traders are only able to open pending orders, which can be implemented when the market finally opens.

The premarket session to be highly volatile among specific companies that have made headlines. This includes companies that have delivered their quarterly earnings reports and those that have made headlines.

Index futures

Index futures are an excellent financial asset that makes it possible for traders and investors to trade these assets before the regular session opens.

For example, European futures like the German DAX, French CAC, and Italy’s FTSE MIB help people participate in the market before the opening bell. In fact, many traders focus on these futures instead of the regular ones because they are usually open for a longer period.

The same is true for American futures that are usually open for more hours. As a result, it is possible for an Asian trader in Japan and Hong Kong to trade these assets during their regular sessions.

Most futures are offered by leading companies like CME. According to the company, the preopen for futures is usually 16:45 while the open happens at 17:00. After opening, these futures trade all night long.

» Related: Index Trading Strategies

How index futures influence regular session

Index futures have an impact on the regular session of the market in that if an index future is tilting downwards, then the main index will open lower. In most cases, the implied open shown in the futures market is usually the same that happens in the regular session.

However, at times, the situation can change shortly after the regular session opens. For example, while the Dow Jones futures can point to a 500-point drop, the Dow Jones could drop by that amount and then resume an upward trend.

Therefore, traders can use these futures to give them information on whether an index will rise when the market opens.

At the same time, looking at premarket moves can also give you a signal on whether stocks will rise or fall. For example, if a company delivers some bad news in the morning, you can use the premarket session to open a trade or track your portfolio.

The spread between futures and stock market

The futures market is usually open for a longer time than the regular session. This means that it opens for a longer period of time. Therefore, there is usually a spread between the price of the futures market and the spot.

For example, at the time of writing this (end of February 2022), the Dow Jones index is trading at $34,058 while futures are trading at $34,077. Similarly, the S&P 500 futures are trading at $4,386 while the main S&P 500 is at $4,384.

Therefore, there are traders who seek to take advantage of these price differentials to make money.

How earnings impact futures

Companies usually publish their results once per quarter. In this period, they tend to publish their real results and then offer forward guidance. They also deliver an earnings call with investors and analysts where they offer their views about the business.

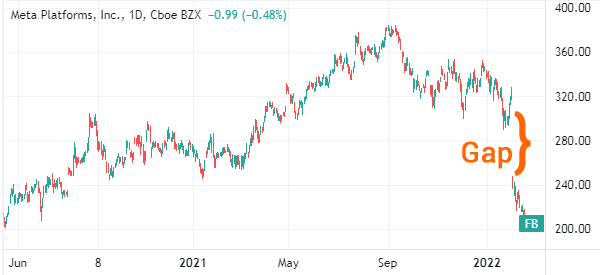

Company shares tend to react sharply to the earnings releases. For example, in February, Meta Platform stock price collapsed by more than 20% after the company published weak results. The management blamed Apple’s privacy updates for the slow business.

At times, some big names can have an impact on the performance of the futures market. The companies that tend to move these futures are firms like Meta Platforms, Alphabet, Amazon, and Apple. These firms are important because of their size, which has an impact on the financial market.

Therefore, it is not uncommon for indices like the S&P 500 and Dow Jones to drop or rise when companies publish their results.

How to use pre market and futures to trade

Traders can take advantage of the futures and premarket session to trade the stock market. For example, you can use premarket data to see the stocks that are the most active.

By so doing, you will be at a good position to allocate your funds well. You can use the free resources in platforms like Nasdaq, Investing, and Market Chameleon to identify stocks making significant moves in the premarket.

Further, you can use data in the futures market to position yourselves. For example, if the Nasdaq 100 index is falling at a faster pace than the S&P 500, you can be sure that there is a major issue in the technology division.

Summary

The futures and premarket sessions are important in the financial market. In this article, we have looked at what the futures market is and its difference with the premarket session. We have also identified the difference between the two markets and how you can use them to trade.

External Useful Resources

- Stock Futures: Check Premarket Prices On Dow Futures, S&P Futures, Nasdaq Futures – Investors