In the fast-paced world of forex trading, where time is of the essence, scalping emerges as a popular and dynamic strategy. With its focus on quick trades executed within minutes or even seconds, scalping offers traders the opportunity to capitalize on short-term price movements.

Opportunities abound here in the 24-hour global market, and scalping stands out as a dynamic approach that can be pursued by traders of all types, including part-time enthusiasts.

In this article, we will briefly explain what scalping is and how you can use it to navigate the forex market with confidence.

Table of Contents

What is a scalping strategy?

Scalping is a trading strategy that is extremely short-term in nature. The approach makes it possible for day traders to open and close trades within a few minutes with a profit. When this happens, the trader can move on and open new trades using the same approach.

Here is a good example of how the scalping strategy works. Assume that you have a $10,000 account. In this case, you can open a small trade and make $10 within a few minutes. If you repeat this process 20 times per day, then you will have a profit of $200. In a month, the profits could be $4,000, which is a 40% return.

Of course, this example assumes that the trader makes no losses using the strategy. In reality, scalpers makes some losses. Therefore, you need to have a good risk management strategy to ensure that this works.

How scalping works in forex

To understand how scalping in forex works, we need to look at what forex trading is. Forex, which stands for foreign exchange, is the process of buying and selling currencies with the goal of making a profit.

For example, assume that the USD/JPY pair is trading at 138 and you have 1,000 in dollars. In this case, you can change the funds to Japanese yen and get ¥138,000.

If the dollar strengthens and the USD/JPY rises to 145, it means that your initial $1,000 will be worth $145,000. This means that you have made a ¥9,000 profit.

Forex trading involves doing research about currencies and then predicting whether they will rise or fall. After doing this research, traders execute trades betting on what will happen. If they are correct, their trades become profitable.

Unlike other trading strategies, scalping is extremely short-term in that traders typically hold their trades for less than 5 minutes.

As such, these traders don’t use long-term charts. Instead, they use extremely short charts that range between 1 minute and 5 minutes.

Best forex pairs to scalp

Companies offer many forex pairs. These pairs are divided into three: majors, minors, and exotics. Majors are currencies of developed countries that have the US dollar. They include EUR/USD, GBP/USD, and USD/JPY among others.

Minor currency pairs are made up of developed countries that lack the US dollar. Examples are the EUR/GBP, AUD/USD, and GBP/AUD among others.

Exotics are currency pairs that have emerging market currencies. Examples of these are EUR/TRY and GBP/ZAR.

In most cases, scalpers focus on forex majors because of their deep liquidity and low transaction costs. Scalping exotics can be highly expensive because of their wide spreads.

Therefore, the best currency pairs to consider are:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- AUD/USD

among others. Forex minors are also the second tier of this.

Scalping trading strategies

A common question is on some of the best scalping trading strategies. There are four primary scalping strategies that you can use in forex: trend-following, reversals, news trading, and arbitrage.

Trend-Following

Trend-following is a trading strategy where a trader simply buys an asset that is rising and shorts the one that is falling. People using this strategy believe in following the trend to the end or when it hits a resistance level.

Trend-following also involves using trend technical indicators like moving averages, Bollinger Bands, VWAP, and Ichimoku. These indicators will give you a signal on when to exit a trade. A good example of a scalping trade is shown below.

Reversals

The opposite of trend-following is reversals. A reversal is a situation where a forex pair changes its direction and starts a new trade.

A good example of a reversal is shown below. The chart shows that the pair was in a downward trend when it reached a low of 34.1. It then started a new bullish trade.

Therefore, reversal traders hunt for trading opportunities when reversals are about to happen and then ride the new trends.

Traders use several approaches to trade reversals, including chart patterns, candlestick patterns, and indicators. The most popular reversal chart patterns are head and shoulders, double and triple tops and bottoms, and rising and falling wedges.

The most popular reversal candlestick patterns are morning and evening star, shooting star, hammer, and hanging man among others.

News trading

This is a trading strategy that focuses on news that come up on a daily basis. The most popular forex news are:

- interest rates and economic data on inflation

- employment

- manufacturing

- industrial production

- consumer confidence

Speeches by influential leaders like presidents and central bank officials can also move currency pairs.

Best times to scalp forex

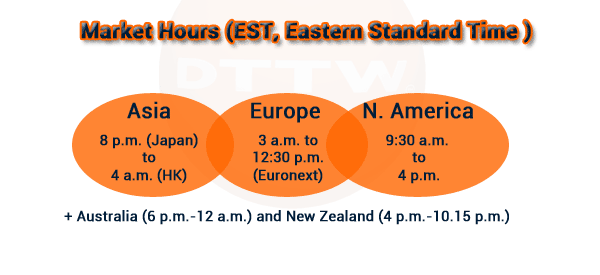

An important part of forex trading is that currency pairs are usually live for 24 hours, five days a week. Therefore, you can day trade forex at any time that you want. However, history shows that the best time to day trade forex is during the European and American sessions.

The European session starts at 7:00 GMT and closes at 4:00 pm GMT. On the other hand, the American session starts from noon to 8pm GMT.

Many traders love to trade when there are intersections between the Asian and European sessions and between the European and American sessions. The Asian session is the worst one to trade because of the low volume and low volatility.

How to conduct your analysis in scalping

We recommend a situation where you use three approaches when using the scalping strategy. First, look at the overall news of the day. The economic calendar will help you know what to expect during the session.

Second, conduct a multi-timeframe analysis, where you look at three charts before you execute the trade. In this case, you can look at the hourly, 15-minute, and 5-minute charts.

Using this approach will help you to identify support and resistance levels. It will also help you identify key chart and candlestick patterns.

Finally, go to the short-term chart, do the analysis, and then execute the trade.

Related » More tips to exploit exchange rates

Best broker for forex scalping

There are several things to consider when looking for a good forex broker for the scalping strategy. The most important ones are liquidity, low fees, stable, and access to many markets.

A broker with deep liquidity will make it easy for you to enter and exit trades. One with low fees will save you a lot of money in transaction fees.

Stick with a tested strategy for long enough so you can see consistent results then adjust as needed. To get started have a look at the fbs broker.

Summary: Is scalping a profitable strategy for Forex?

Like with all strategies, the profitability of scalping depends on the skills of the trader (this is true for any asset). While many people make a living scalping, others don’t. In fact, many people who start scalping don’t succeed in it.

The secret to success is having a good scalping strategy, learning more about how it works, and having a good risk management strategy.

External useful resources

- How to Apply Forex Signals for Scalping? – FX Leaders