To thrive in the complex foreign exchange markets, it is vital to possess an in-depth knowledge of exchange rate volatility.

Utilizing charts with modern technological developments and abundant data at traders’ disposal can give them an edge in both forex and cryptocurrency trading.

In 2023, let us explore all of the tools and resources you can utilize to interpret exchange rate volatility accurately while making charts work to your advantage.

Table of Contents

Locating the causes of volatility

Foreign exchange market prices are volatile. To effectively leverage it, traders need a deep knowledge of all factors contributing to fluctuations in exchange rates; geopolitical events, economic indicators, and central bank decisions are just some examples of factors that may cause fluctuations.

Staying abreast of current events allows traders to anticipate potential market shifts more accurately and develop strategies that consider them.

1. MetaTrader 4: Every trader’s best ally

MetaTrader 4 — better known as MT4 — will remain popular despite competition from other trading platforms in 2023.

Due to the advanced charting tools and automation features MetaTrader 4 offers, many traders prefer using it to conduct their business. Furthermore, users of MT4 can create personalized technical indicators, which can prove essential when creating unique trading strategies.

2. Employ the right technical indicators

Technical indicators will serve as your compass when entering the turbulent waters of forex trading. Many different indicators are available; let’s focus on just a few for this discussion.

The Average Directional Index (ADX) can be a precious tool in gauging the strength of an existing trend. At the same time, the Relative Strength Index (RSI), more commonly referred to as RSI, can help identify whether markets have become overbought or oversold.

Bollinger Bands can also help traders understand levels of volatility more thoroughly. To achieve maximum effectiveness, however, traders should use multiple indicators simultaneously to complement one another.

3. Deciphering chart patterns

Chart patterns can provide invaluable insight into how investors feel about a market. Long-standing patterns like Head and Shoulders, Double Tops and Bottoms, and various Triangle formations are constructive in discerning whether a trend will reverse or continue.

For cryptocurrency markets specifically, Cup and Handle patterns have shown up with increasing frequency, and having the knowledge and tools available can make all the difference in determining how a market moves forward.

4. Utilize candlestick patterns effectively

Candlestick patterns provide insight into the ongoing conflict between buyers and sellers over a shorter timeframe than chart patterns, which give a broader perspective.

Specific formations of patterns like Hammer, Engulfing, and Doji provide essential data regarding possible price reversals, which is necessary when determining entry and exit points for executing trades.

5. Acknowledging volume

A trader’s daily transaction volume can be an invaluable resource. Utilizing volume indicators such as the On Balance Volume (OBV) or Chaikin Money Flow can provide insight into the magnitude of force behind price movements.

A lack of volume could indicate false breakouts, while significant price movements accompanied by substantial volumes may signal more decisive moves.

6. Correlation and confluence

Investigating correlations among various currency pairs or cryptocurrencies can be immensely useful when seeking valuable insights.

Hedge strategies could use two assets having an inverse relationship; similarly, increasing reliability by looking for confluence or agreement among various technical indicators or chart patterns is also possible.

7. Understanding market cycles

A fundamental understanding of how markets move is necessary for effective trading strategies, whether following bullish trends, bearish phases, or accumulation periods.

Understanding which stages the market is in can help adapt trading strategies accordingly, and tools such as the Detrended Price Oscillator can aid in finding patterns present within it.

8. Currency pair dynamics

Understanding the dynamics between different currency pairs is as crucial to successful trading as knowing how to analyze exchange rates.

Every currency pair exhibits unique idiosyncrasies and responses to market events; for instance, USD/JPY can often indicate global risk sentiment, while the AUD/USD pair usually moves along with commodity prices.

Being aware of these dynamics can help traders develop more effective trading strategies.

9. Examining implied volatility

Options markets offer investors and traders alike an abundance of data. By evaluating implied volatility derived from option prices, traders can gain insights into market expectations.

Indices like the CBOE’s VIX can help traders assess general sentiment in the market and plan trades accordingly.

10. Utilizing economic calendars

Economic calendars are essential for staying abreast of market events that could influence trading strategies, from central bank meetings and employment data releases to monitoring any other significant events that might impact them.

Their use can determine how effectively your short-term and long-term strategies function.

11. Customizing charts to promote clarity

An overly cluttered chart can often become more of a source of distraction than assistance.

When tailored to display only relevant data, charts showing only relevant details can help improve clarity and make decisions based on accurate information easier. De-clutter your chart by emphasizing trend indicators instead, for instance.

12. Utilize multiple timeframes

Conducting currency exchange rate research across different time frames is one way to get a complete market picture.

An hourly chart may reveal signs of a short-term trend reversal. In contrast, a daily chart might suggest an uptrend, giving traders more informed decision-making capabilities when integrating multiple timeframes into analysis processes

13. Exploiting social sentiment analysis

2023 has demonstrated the immense influence that social media can have over various markets.

One way you could gain an edge from using tools that analyze sentiment analysis on social media is by monitoring positive tweets about a cryptocurrency, which could increase its value significantly.

14. Backtesting strategies

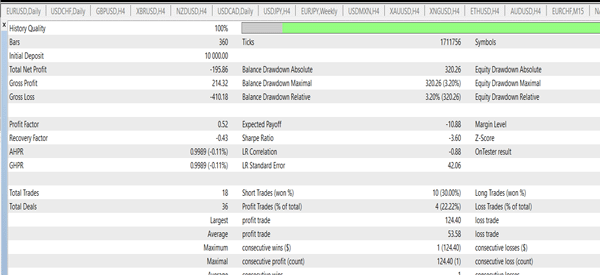

Backtesting is an integral step in determining whether a trading strategy will be successful. By testing a trading plan against historical data and observing results, traders can gain insights into its strengths and weaknesses before applying it to live markets.

Before applying any strategy live, it must first pass this phase.

15. Building a trading plan

An organized trading plan can be a valuable guide through turbulent trading waters. A well-crafted trading plan should include rules for risk management, entry and exit strategies, and alternative methods designed to handle different market conditions.

Final thoughts

By 2023, successful forex and cryptocurrency traders will have an arsenal of trading tools and methods available.

Traders can take advantage of opportunities presented by fluctuating exchange rates by employing an approach incorporating fundamental and technical analysis and disciplined risk management.

Your ability to remain adaptable and continually learn is the cornerstone of trading success in these volatile markets.

Business can be a huge and complex arena; you must equip yourself with appropriate navigational tools to successfully navigate it and find financial success.