The European Union (EU) is an important part of the global economy. It has a combined GDP of over $16.6 trillion, making it the second-biggest economy in the world after the United States. Combined with non-EU members, Europe has a substantial GDP.

Its importance, however, is not limited to these numbers. In fact, the European trading session is of great relevance to all traders because it offers several opportunities.

In this article, we will look at how to trade the EU session and why it matters.

Table of Contents

EU trading session hours

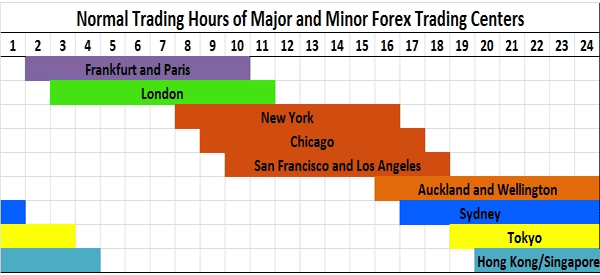

The European session is usually the second one to the Asian one. In Europe, most markets, including in Amsterdam, Paris, Lisbon, and Brussels open at 9 a.m to 5:30 pm GMT. These times are between 3 a.m and 11:30 am Eastern Standard Time.

In the United Kingdom, the markets start a bit early at 8 a.m and close at 4:30 pm. Meanwhile, in Moscow, the market opens at 9:30 and close at 7p,m. The chart below shows the European trading sessions.

Key European stock indexes

A stock market index is a financial asset that tracks the performance of the stock market. The most popular indices in the world are the Dow Jones, Nasdaq 100, and S&P 500. Europe also has some of the most popular indices, even though most of them are significantly smaller than their American counterparts.

The most popular European indices are:

- DAX index – The DAX is made up of the 40th biggest companies in Germany, including Volkswagen, SAP, and BMW. It has a combined market cap of about 1.25 trillion euros.

- FTSE MIB – This is an index made up of the biggest companies in Italy like Campari, Generali, and Intesa Sanpaolo.

- CAC 40 – This is an index made up of the biggest companies in France like LVMH, L’oreal, and BNB Paribas among others.

- AEX Index – This is the index for the biggest companies in the Amsterdam stock exchange. Some of the top companies in the index are Unilever, Heineken, Adyen, and ING Bank.

- IBEX 35 – This is an index that covers the biggest 35 companies in Spain. The biggest members are Inditex, Iberdrola, and Banco Santander among others.

Key events in the EU session

The European session is important because of the key events that happen during the period. For one, the EU has 28 member states, which publish their economic data on a regular basis.

In addition, Europe has an important role in global geopolitics since it has a close relationship with the United States. Some of the most important events in the EU session are:

- European Central Bank (ECB) – The ECB is the second most important central bank in the world after the Federal Reserve. It meets eight times per year and its decision tends to have an impact on European stocks and the euro.

- Inflation – The Eurostat publishes European inflation numbers two times per month. It usually publishes the preliminary figures for the current month and then the official ones in the coming month. Traders also watch for inflation data from key countries like Germany and France.

- Jobs data – The European Central Bank pays a lot of attention to the labor market in Europe. As such, it focuses on the monthly figure that is published by Eurostat.

Other key events that happen in the European session are Eurogroup meetings, OPEC meetings, and corporate earnings. Indeed, American companies that publish their result in the pre-market session usually do so during the European session.

Why the European session matters

There are several reasons why the European session matters in the market. First, the session is usually between Asian and American one. As such, it is possible to trade financial assets from Asia, Europe, and North America.

The European market usually overlaps with the Asian session for a number of hours since most Asian markets like in Hong Kong and Japan close at around 1 pm Eastern Standard Time. It then intersects with the American session, which usually opens at around 09:00 EST.

Second, the European session is important because of the key events we mentioned above. All these events move both European and global assets as well. For example, it is common for rates decision by the European Central Bank (ECB) to move American indices like the Dow Jones.

Third, the forex market tends to be highly volatile during the European trading session. This happens because of the role of the euro in global trade.

Related » How to Trade Profitably in Periods of High Volatility?

At the same time, many economic numbers from Canada and the United States come out during the European session. Some of the most important numbers that come out during the American session are jobs and inflation.

Benefits of investing or trading EU stocks

There are several reasons for trading and investing in European stocks. First, the biggest European countries make most of their money from outside its borders. This includes companies like LVMH and Porsche make most of their money abroad.

Related » Why you should trade from the EU

Second, European indices like CAC 40 offer investors an opportunity to invest in industries that are not available in the US. For example, the CAC exposes investors to the biggest luxury brands that are not available in the US.

Third, EU stocks are seen as being cheaper than their American counterparts due to the substantially weaker euro. For example, the DAX index has a PE ratio of 10x, which is much lower than the S&P 500 index 16x.

Cons of trading EU stocks

There are two important cons that happen with trading EU stocks. First, unlike in the United States, the EU is made up of countries speaking different languages. As an investor, it can be a bit difficult to study and interpret these companies. As such, most people focus on mainstream companies and ignore smaller ones.

Second, unless your broker gives you access to European stocks, it is highly difficult to trade and invest in European stocks.

Summary

The European trading session is an important one in the market. It is made up of some of the biggest companies in the world like BASF, BMW, and SAP among others. The bloc is also made of key institutions like the European Central Bank (ECB) and the International Energy Agency.

External useful resources

- International stocks: why bother? BlackRock