The EUR/GBP pair is a popular forex cross in the market because of the strength of the British and European economies. Also called the chunnel, the pair offers huge opportunities to both day and position traders.

In this article, we will look at what the EUR to GBP is and then identify some of its top catalysts.

Table of Contents

What is the EUR/GBP pair?

EUR/GBP is a forex pair made up of the euro and the British pound. It is a popular pair because of the role that the UK and European Union play in the market. In most cases, it is one of the top traded forex minors in the industry.

In this pair, the euro is the base currency while the British pound is the quote currency. Therefore, if the EUR/GBP price is trading at 0.860, it means that 1 euro is equivalent to 86 pounds.

The EUR to GBP pair is highly liquid because of the large volume of trade that exists between the UK and the European Union.

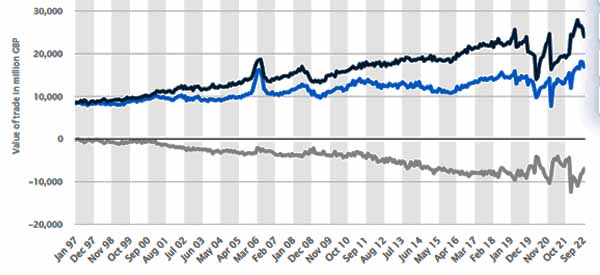

In 2020, more than 80% of all UK trade volume was with European countries like Germany and France. The chart below shows the trade flow between the two places in years.

EUR/GBP historical performance

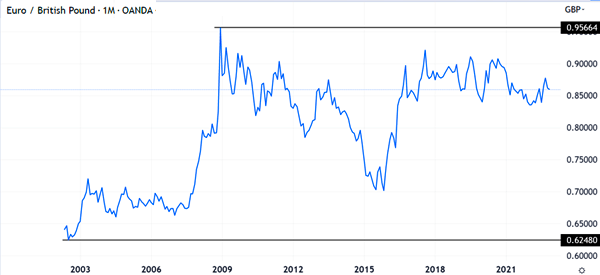

The EUR/GBP pair has had a mixed performance over the years. It surged to a high of 0.9566 in December 2008. Its all-time low was at 0.6248, which it reached in 2002.

Some of its biggest moves happened in 2008/9 during the global financial crisis and in 2016 after the Brexit vote. Between 2018 and 2022, the pair has been in a narrow range.

Unique characteristics of the EUR/GBP

Like other forex pairs, the chunnel has several unique characteristics. First, it is known for having some substantial volatility. This volatility happens because of the vast amount of news and economic data that exist between the European Union and the UK.

Second, the currency pair’s nickname is the chunnel. This name comes because of the chunnel that was built between the UK and France. It is 37km long, making it the longest undersea chunnel in the world.

Third, the EUR/GBP pair existed even when the UK was in the European Union. Like Sweden, the UK believed that having its separate currency was a good thing. With its currency, the Bank of England could take action in different macro environments.

Further, the EUR/GBP price has a close correlation with other currency pairs that have the euro as the base currency. As shown below, it has a relationship with the EUR/AUD and EUR/CHF.

What moves the EUR/GBP?

There are several key things that move the EUR/GBP. In this list we will focus only on the most important ones, which can be useful even for those who are approaching this pair for the first time.

ECB and BOE

The European Central Bank and the Bank of England are two of the most popular central banks in the world. They meet eight times per year and make important announcements. These banks are mandated to keep inflation and unemployment rate stable.

To do that, the two central banks meet eight times per year and adjust interest rates when needed. Like the Federal Reserve, they also implement quantitative easing and tightening when necessary.

These actions, together with the speeches of the two banks’ officials, tend to have an impact on the EUR/GBP pair.

Geopolitics

The UK and the European Union react to several geopolitical events in the region. The most important event was Brexit, which happened in 2016. It saw the UK move out of the EU, where it was a member for decades.

It was the second-biggest economy in the bloc after Germany, with a GDP of over $3.5 billion. Since 2016, relations between the EU and the UK have often been tense.

Related » Effective Fundamental Analysis in Forex Trading

At times, the political drama between the UK and European countries tends to have an impact on the EUR/GBP. For example, following Brexit, there were often tensions between the UK and the EU because of the North Ireland protocol.

Economic data

Like all forex pairs, the EUR/GBP pair is often affected by economic data between the two countries. Some of the most important economic data that move the currency pair are inflation, retail sales, industrial production, jobs, and consumer confidence.

In most cases, data from the UK tends to have more weight on the pair.

Trade flows

The EU and the UK have a substantial trade relationship. The UK sells most of its goods to the European Union countries.

As such, any trade disruptions and trade numbers tend to have an impact on the pair.

If you want to know why the pound is stronger than the dollar, you can check out this article.

EUR/GBP trading strategies

There are several trading strategies for trading the EUR/GBP cross. These strategies are the same ones that people use to trade other currency pairs like the EUR/USD and the GBP/AUD. Some of those strategies are:

- Pairs trading – This is the approach of trading two currency pairs that have a close or inverse relationship. In this case, you can trade the EUR/GBP with the EUR/CHF and EUR/SEK.

- Scalping – This strategy involves using a short-term chart like a 1-minute one to trade the pair. The goal is to open numerous trades and make a small profit on each.

- Algorithmic trading – This is a strategy of using robots or expert advisors to trade the EUR/GBP pair.

- Swing trading – This approach involves doing analysis and identifying short-term trends or reversals and holding them for a few days.

- Trend following – This strategy involves buying or selling the EUR/GBP pair when there is an existing trend.

FAQs on EUR/GBP

What is the best time to trade the EUR/GBP pair?

The best time to trade the EUR/GBP pair is during the European session. That’s when the UK and the EU publish most of their economic data.

What is the future of the EUR/GBP pair?

The pair’s future performance will be impacted by how well the UK and the EU experience growth in the next few years. The impact of Brexit will have a role to play on that.

What are the risk management strategies when trading the EUR/GBP pair?

Some of the top risk management strategies to use when trading the EUR/GBP pair are having a stop-loss and a take-profit and ensuring that you are using a small lot size and leverage.

External useful resources

- Tips On How To Trade The Currency Pair EUR/GBP – FxEmpire