The British pound was once the most important currency in the world. At its peak, it was used in most parts of the world as the British empire expanded.

Today, the currency has become the fourth most popular currency in the world after the US dollar, Euro, and the Japanese yen. In this article, we will highlight a brief history of the GBP and how to day trade it.

Table of Contents

History of the GBP

The British pound traces its roots to 1,707 when England and Scotland teamed up to form a single country. Before that, the country used the shilling, which was managed by the Bank of England (BoE).

Today, the British pound is used by the UK while places like the Guernsey Island, St Helena, and Gibraltar have pegged their currencies to the sterling.

Why the GBP lost its value

The British pound has consistently lost its value against the US dollar, Euro, and the Japanese yen. There are several reasons for this. First, sterling devalued because of the first and second world wars that made the US emerge as the world’ super power.

Third, the currency crashed after the collapse of the British empire. This collapse happened as countries declared their independence. As they did that, these countries created their local currencies and delinked from the pound. Over the years, the influence of the UK declined.

Further, the GBP lost its value following the Bretton Woods agreement that created the IMF and the International Bank for Reconstruction and Development (IBDR). These agreements made the USD the world’s reserve currency.

In addition, Brexit had a role in the value of the British pound. Brexit was a major event that separated the UK from the European Union, where it was a member for decades.

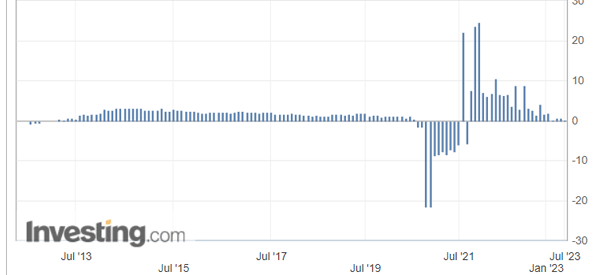

Brexit had an impact of slowing the country’s economy. As shown below, the British economy has been slowing in the past decade.

There are other reasons why the British Pound has deteriorated over time.

For example, the country’s trade deficit has jumped over the years as many manufacturers moved from the UK. There are now just a handful of automobile manufacturers in the country. In the past, the auto sector was one of the biggest employers in the UK.

Best currency pairs to trade the GBP with

Forex trading involves focusing on pairs since you can only exchange one currency with another one. While there are hundreds of currency pairs in the market, they are all not created the same.

For example, forex majors are known for their high liquidity in the market while exotics have lower volume. Here are some of the best currencies to trade the pound with:

The US dollar (GBP/USD)

The GBP/USD is the second-most popular pound pair in the world after the EUR/USD. It is a highly liquid pair that is traded by millions of traders every month. In addition to high liquidity, the pair is liquid for several reasons. First, the US dollar is the most popular currency in the world.

Second, the UK and the US are allies that do billions of dollars in trade volume every month. The UK exported goods worth $64 billion to the US in 2022 and imported goods valued at over 110 billion pounds.

Third, the Federal Reserve and the Bank of England (BoE) are highly influential central banks in the world. Finally, the two countries publish many economic numbers every month that move the pair.

Related » Why the British Pound Is Stronger Than the US Dollar

Euro (EUR/GBP)

The other popular GBP pairing is the euro. In this case, the standard format for the pair is EUR/GBP. It is a well-known forex cross because of the big trade volume that exists between the UK and the European Union.

The UK sells most of its goods and services to Europe. It also imports most of its goods from Europe.

One of the most interesting features of the del Chunnel (nickname of the pair) is the close correlation with other pairs that have the Euro as their base (EUR/AUD, for example).

Japanese yen (JPY)

The UK and Japan have a big trade relationship. In 2022, the two countries handled over 27.7 billion in trade volume. They are allies that form part of the G7 and are also democratic countries.

Most importantly, the ECB and the BoJ are some of the most important central banks in the world. The BoJ has over $8 trillion in assets.

Therefore, many people trade the GBP/JPY pair because of its liquidity and the fact that it is offered by most forex brokers.

Australian dollar

Australia is another major economy that has a good trading relationship with the UK. The two countries handle trade worth over 15 billion pounds every year. This trade is mostly skewed towards Australia, a country that is well-endowed with natural resources.

The AUD/GBP pair is a highly liquid pair that has many catalysts every month. These catalysts include the interest rate decisions by the BoE and the Reserve Bank of Australia (RBA) and key economic numbers.

Swiss franc

GBP/CHF is a currency pair representing the exchange rate between the British Pound and the Swiss Franc. The Swiss Franc is considered a safe-haven currency due to Switzerland’s economic stability, while the British Pound tends to be more volatile and influenced by Brexit developments.

Central bank policies, trade relations, and technical analysis also play significant roles in shaping the GBP/CHF exchange rate. Traders should stay informed and exercise caution when trading this currency pair.

What moves the GBP?

As we have seen, volatility is crucial when we decide to trade currency pairs. Therefore, the next step is to move on and analyze the most important factors that move the British Pound.

UK monetary policy

Monetary policy refers to the actions of a central bank. In most cases, these actions are interest rate hikes and quantitative easing and tightening.

The Bank of England meets eight times per year and its decisions tend to have a major impact on the pound. It tends to rally when the BoE is hawkish and vice versa.

It is worth noting that the pound’s price action also depends on the actions of other central banks. For example, the GBP/USD pair is impacted by the actions of the Federal Reserve. When the two banks are doing the same thing, the dollar is usually the key determinant.

UK economic data

The GBP currency is impacted by the country’s economic data, which tends to have implications for the BoE actions.

The most important economic numbers that impact the UK pound are:

- Employment

- Inflation

- Manufacturing

- Trade

- GDP

- Industrial production

Higher inflation numbers put the BoE under pressure to boost interest rates, which is a positive thing for the pound.

Fiscal policy

The other important mover for the GBP pair is fiscal policy, which refers to actions by the government. In this regard, the most important fiscal measures are those that increase or reduce government borrowing.

Other fiscal policies issues that affect the pound are budget and stimulus packages.

Geopolitics

The other thing that moves the British pound is geopolitics. The most recent major geopolitical issue was Brexit, when the UK voted to move from the European Union.

In most cases, the GBP/USD pair tends to drop when there are major geopolitical issues since the USD is seen as a safe haven.

FAQs about the GBP

What is the best time to day trade the GBP/USD pair?

The worst time to day trade the GBP/USD pair is during the Asian session because the market is usually muted during that time. On the other hand, the best time to trade the pair is during the European and American sessions (and overlaps).

Where to get the latest GBP news

There are many sources for GBP and other forex news. The best one is the economic calendar, which lists the schedule of key economic events like inflation and jobs numbers. Other good sources are financial platforms like the Financial Times, WSJ, and Bloomberg.

Can you use technical indicators to trade the GBP?

Yes, you can use indicators like moving averages, Relative Strength Index (RSI), Average Directional Index (ADX), and the VWAP.

External useful resources

Economic Reports That Affect the British Pound – Investopedia