Day trading is a practice that is becoming highly common among people from around the world.

While demand for day trading has always been rising, the trend jumped during the Covid pandemic as stocks and cryptocurrency prices jumped.

A very common question about this business is: “How long a day should I trade?”. Not all businesses are the same, and day trading gives you a lot of flexibility. Both in terms of assets and in the amount of time to invest.

Let’s go through how much time per day you will need to spend on these various market approaches.

Table of Contents

Day trader workday

In a past article, we wrote about the typical workday of a day trader. In it, we wrote that day traders spend different amounts of time every day. Some people open tens of trades per day, meaning that they work even for more than eight hours.

On the other hand, there are those who spend less than an hour trading. They do this by opening a few trades every day and letting them run.

This approach is mostly common among traders who do it on a part-time basis. These traders typically set their positions in the morning and then wait for their outcome during the day.

The benefit of day trading is its flexibility. This means that people can trade as much as they want or as little as they want. Also, at times, people who trade the least tend to outperform those who trade for more hours per day.

What determines the trading time?

There are several factors that determine the typical workday of a trader. Let us look at some of these factors.

Assets you are trading

First, it depends on the assets that they focus on. The most popular assets in the market are:

- Stocks

- Commodities

- Exchange-traded funds (ETF)

- Cryptocurrencies

- Forex.

Stocks are typically open every Monday to Friday for a few hours. The forex market, on the other hand, is open every Monday to Friday for 24 hours. Further, cryptocurrencies are open on a 24/7 basis.

Therefore, as a day trader, your typical workday will depend on the asset that you are trading. For the forex market, it is possible to trade for more than ten hours per day.

On the other hand, if you are a stock trader, you can only trade for a shorter period every day (6.5 hoursiIf you base your trading in the U.S., from 9.30 AM to 4 PM).

Cryptocurrency traders have a longer trading window since they can open trades for an unlimited period.

Trading strategy

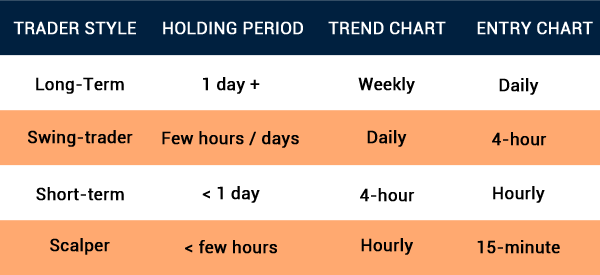

Second, it depends on your overall trading strategy in the market. Some of the most popular trading strategies in the market are scalping, swing trading, algorithmic trading, and copy trading among others.

These strategies demand different timelines. For example, scalpers will typically spend more time trading since they focus on opening and closing hundreds of trades every day within a very short time frame. These traders can stay in the market for more than eight hours per day,

Swing traders, on the other hand, typically open trades and hold them for a few days. As such, these traders can open a few trades in a week and spend just a few hours.

Long-term investors, on the other hand, don’t need to open trades every day. Some investors like Warren Buffett open a few investments every year.

Where you work

Another thing that affects the time is where you work. If you trade in your retail account, it means that you can trade as you wish since you have more flexibility.

On the other hand, if you are employed, the time you spend trading will depend on the management. In this case, your schedule will depend on your contract.

Market conditions

At times, the underlying market conditions will determine the times you spend trading.

Just to give an example, when the market is trending, it is possible to trade for more hours. On the other hand, when the market is in a consolidation phase, spending more time trading may not be ideal.

Assets available

Further, the broker you are using will be important in determining the time you will be using. For example, at Real Trading, our traders have more assets since our platform has stocks from around the world.

In this case, they can trade stocks from Asia, Europe, and then the US. If your broker has only American stocks, you are limited to the stocks that you can trade.

Average time used by most traders

The average time that many full-time traders spend is between five to six hours. In this time, they will do their analysis and allocate their resources accordingly. Research can be divided into technical and fundamental analysis.

Technical analysis is where they identify indicators like moving averages and the Relative Strength Index (RSI). Fundamental analysis, on the other hand, involves looking at key issues like news and economic data when trading.

At the same time, in the US, traders have access to trade stocks for more time because of extended hours. After-hours is a period that happens after the regular session closes. In many cases, companies tend to publish their earnings during this period.

The pre-market session starts very early in the morning before the regular sessions. This session usually sets the tone in the market.

Also, traders do several things when they complete their trading day. First, they take time to look at their trading journal. A journal is a document where they write all the happenings in the market.

Second, they look at the economic and earnings calendar to determine the key events to expect the following day. Some of the top events to watch are interest rate decisions, inflation, and employment.

Also, knowing the companies that will publish their results the next day will help you know what to expect.

Summary

Day trading is one of the best ways of making money in the market. For one, successful traders are judged by their performance and not the time they spend trading.

Some highly-successful traders only spend a few hours per day working. What is needed is a good trading strategy, consistency, and good time management.