Volatility is an important concept in day trading. It is important simply because many day traders prefer a period with high volatility. For example, many traders made strong results during the dot com bubble, global financial crisis, and during the Covid-19 pandemic.

This is because more instability in the markets offers many more opportunities for a day trader (and scalper) to be able to enter, make a profit and exit than in standard situations.

In this article, we will look briefly at what volatility is and some of the best volatility indicators you can use today. With practical examples!

Table of Contents

What is volatility?

Volatility refers to the degree of movements of an asset within a certain period. For example, if a stock opened at $20 and then rose to $23 and ended the day at $18, it can be said to be highly volatile.

The opposite of a volatile market is consolidation. For example, if the stock opened at $20 and then oscillated between $20.5 and $19.5, it can be said to be in a consolidation phase.

How to identify volatility in the market

There are several ways in which traders look at volatility in the financial market. The most common gauge used to measure volatility in the market is the CBOE Volatility Index (VIX). This figure looks at how the options market is pricing-in future movements in the S&P 500 index.

The chart below shows that the VIX index jumped sharply on November 26th 2021. On this day, South African countries reported another dangerous variant of Covid-19.

Another way of identifying volatility is to just look at charts. With your eyes, you can get a clear picture of whether the market is getting volatile or not. Meanwhile, you can use technical indicators to identify whether the market is volatile or not. Let us look at some of the most popular volatility indicators.

The most accurate volatility indicators to choose from

Bollinger Bands

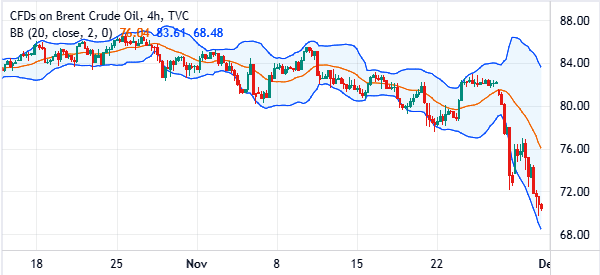

Bollinger Bands is a popular trend and volatility indicator. It is also one of the best indicators in the market today. It is made up of three lines.

The middle line of Bollinger Bands is a certain period’s moving average. The upper and lower bands refer to the standard deviations of that moving average. The most common standard deviation is usually about 0.5.

In a high volatile market, the gap between the moving average and the upper and lower bands will be substantial. That is simply because in a highly volatile market, the gap between the average price and the standard deviations will always be wide.

The chart below shows the Bollinger Bands applied in crude oil.

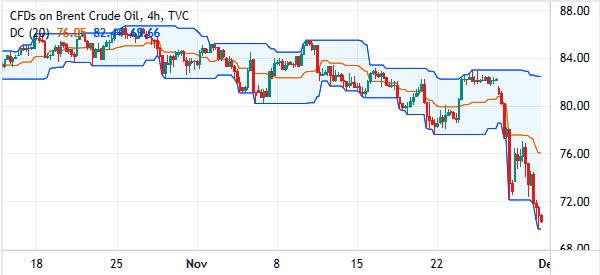

Donchian channels

The Donchian channels indicator has a close resemblance to the Bollinger Bands. The indicator is made up of three lines. Like the Bollinger bands, the middle line of this indicator is the period’s moving average.

The difference comes up when you look at the two outer bands. The upper band is usually the highest price in the period being studied while the lower band is the lowest price in that period.

Therefore, when the three lines are closer together, it sends a sign that there is no volatility. When the gap between the three is narrow, it sends a picture that there is no volatility. The chart below shows the Donchian channels indicator added in the crude oil chart.

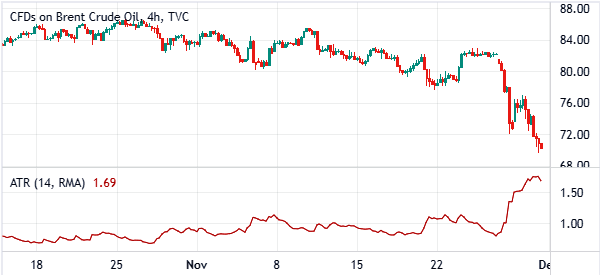

Average True Range (ATR)

The Average True Range (ATR) is another indicator that provides a good measurement of volatility in the market. It was developed by Welles Wilder, a popular figure who also came up with other indicators like the Parabolic SAR and the Average Directional Index (ADX).

The average true range is calculated by first getting the true range (TR). The true range is often calculated as the high minus low. The first 14-day ATR is the average of the daily TR for the last 14 days. It is then smoothed by incorporating the previous ATR.

When applied in a chart, the ATR indicator is usually seen as a line that moves up and down. The line will mostly rise in a period of high volatility and remain under pressure in a period of low volatility.

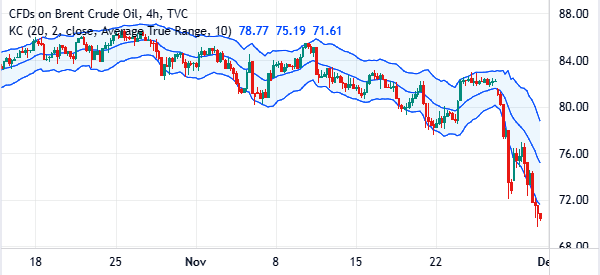

Keltner channel

The Keltner channel indicator also has a close resemblance to the Donchian channels and Bollinger Bands. It is made up of three lines, with the middle one being the exponential moving average (EMA). The two outer lines are two sets of the average true range (ATR) values.

The Keltner bands become wider (or contract) depending on whether the volatility, as measured by the ATR, is higher or lower.

There are three steps of calculating the Keltner channels. First, get the middle line by calculating the 20-day moving average. Next, calculate the upper channel line by getting the 20-day EMA + (2 x ATR(10)). Finally, the lower channel is calculated by getting the 20-day EMA minus the (2 x ATR(10)).

The chart below shows the keltner channels applied in oil chart.

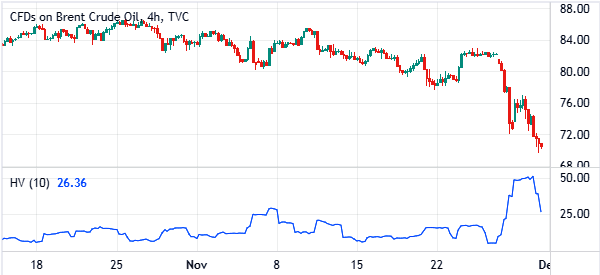

Historical volatility

The historical volatility indicator has a close visual resemblance to the ATR indicator. It is also a relatively popular volatility indicator in the market.

Its calculation is relatively long. First, you need to collect historical data of an asset, the compute the expected price of the historical prices.

Next, you calculate the difference between the average price and each prices in he series. In the next step, you square the differences and determine the sum of the squared differences. Finally, you find the square root of the variance.

The historical volatility indicator is usually lower when there is limited volatility.

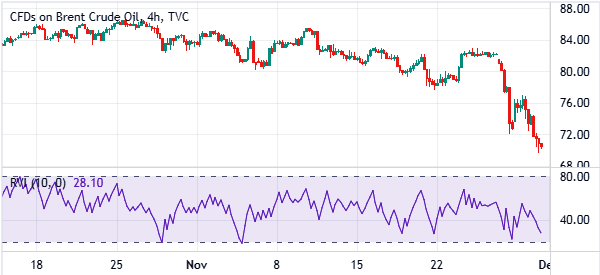

Relative Volatility Index (RVI)

The Relative Volatility Index is also a popular volatility indicator in the market. It was developed by Donald Dorsey and is slightly similar to the Relative Strength Index. It has a line and overbought and oversold levels.

RVI can take values ranging from 0 to 100 on a percentage basis. If the indicator is above 50, this is a sign of increasing volatility and therefore a potential opportunity to buy the asset. If instead the value is below 50, it can be understood as a drop in volatility and therefore a selling opportunity.

The chart below shows it applied to the same crude oil chart that is shown above.

Summary: Which volatility indicator should I choose?

In this article, we have looked at some of the most popular volatility indicators in the market.

We can’t recommend you a better one in an absolute sense, because they are all good. Our suggestion is to test them, possibly in demo mode, and see the one that best suits your needs.

Some of the others that we have not looked at are the Ichimoku cloud, TRIN, and standard deviation.

External Useful Resources

- The Best Volatility Indicators to Use in Your Forex Trading – Valutrades