Technical analysis is the most important method that Wall Street and other professional traders use to gauge the movement of financial assets. It is the same model that has helped create the biggest algorithmic trading companies like Renaissance Technologies, the hedge fund ran by Jim Simmons!

In the past few weeks, we have continued our emphasis on technical analysis. We have looked at popular indicators like moving averages and those that are relatively unpopular like the Relative Volatility Index.

In this report we will look at Donchian Channel, an indicator that is not very well known.

Table of Contents

What is the Donchian Channel?

The Donchian Channel is an indicator that is not provided as a default of most trading platforms like the MetaTrader. It is an oscillator that was developed by Richard Donchian, who is widely known as the father of trend following. When applied, the indicator looks like the Relative Strength Index. This is because it has three lines.

The Donchian channels are relatively easy to derive. To create it, you just need to identify the period you want to track. This commonly used period when calculating it is 20 but you can tweak it to suit your trading strategy.

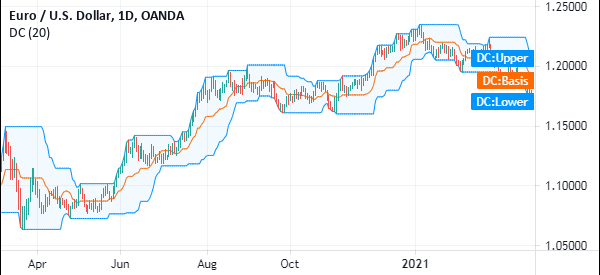

To get the upper side, you take the highest figure during the period. The lower line is the lowest level during this period while the middle line is the average of the two. The chart below shows a daily chart of the EUR/USD pair with a 20-day Donchian channels.

Ideally, if there is substantial volatility in a certain period, the Donchian Channels will be substantially wide. Similarly, if there is minimal volatility in a certain period, the Donchian channels will be relatively narrow.

»How to trade stock volatility«

Traders use the indicator to measure volatility and identify potential breakouts and reversal areas.

How do Donchian channel work?

Using the Donchian trading system is relatively easy. There are two things you need to know.

First, you need to conduct a visual look of the chart you are trading. This can be a stocks, forex, commodities, or crypto charts. Looking at the chart will make you see whether the Donchian Channel is ideal to be used there.

Ideally, the channel should be used when the asset you are trading on is trending and not what it is consolidating. When used in a consolidating asset, the signal may not be accurate.

Second, you need to tweak the period that is provided. The default period is usually 20 but you can change it based on your trading strategy.

Donchian Channel Trading Strategy

As mentioned above, the Donchian Channel has three lines. The two outer lines are probably the most important. The strength of a trend is usually seen by considering these two lines.

For example, as shown in the chart below, in a strong upward trend, the upper shadows of the price usually touch the upper line of the Donchian Channel. The opposite is true. In a downward trend, the price usually test the lower line of the Channel.

Therefore, this beats the convectional logic that says that you should short when the upper channel is tested.

Another thing you need to observe is the flattening of the upper and higher lines during a trend. When this flattening happens, it is usually a sign that the reversal is coming. The reversal is usually confirmed when the price of an asset moves above or below the middle line.

Double Channel Trading Strategy

Another common way is to combine the Donchian Channels. This is a strategy that is similar to a double moving averages strategy. The idea is to have two DC indicator with different periods. You can have one with the 20 default option and another one with a shorter option like 10.

When you apply it, the chart will look a bit cluttered because of the six lines. You can sort this out by tweaking the colours of these lines.

When doing this, a buy signal is usually generated when the price of an asset moves above the upper line of the longer-dated period.

Your exit should come when the exit price declines below the lower line of the band. The opposite is correct. A sell signal is made when the price falls slightly above the lower band of the longer-dated line.

»How to understand when to enter and exit a trade«

An example of this is shown below.

Donchian Channel vs Bollinger Bands

Another popular way We use the Donchian Channel is to combine it with the Bollinger Bands. The two indicators are usually relatively similar in appearance.

The difference is on how the two indicators are calculated. While the Donchian Channels look at the high, low, and the average, calculating the Bollinger Bands is relatively long.

It is calculated by first identifying a moving average of a certain period. After that, you calculate the positive and negative standard deviation of this average.

The reason for combining the two is to confirm when a signal is formed. The chart below shows a 20-period Bollinger Bands (shown in red) and the Donchian Channel (shown in black).

As you can see, an uptrend happens when the price is along the upper lines of the Donchian and Bollinger Bands.

Trading the middle band

Another strategy to use when using the Donchian channels is to trade the middle band in trend following. The idea is relatively simple. If the price is rising, it should remain above the middle line of the band. As such, if it moves below this line, it is a signal that the price is about to retreat.

Similarly, if the price is falling and it moves above the middle line, it is a signal to exit. This is a strategy similar to how many people use the Bollinger Bands.

Summary

The Donchian Channel is not a popular trading indicator. However, We know many leading traders who swear by it. In this article we have looked at who developed and how you can use the indicator in the forex, stocks, and crypto market.

We recommend that you take time to read more about the indicator. Also, you should try it using your market style and see how it works.

External useful Resources

- Donchian Channels in Tradingview Wiki

- [VIDEO] 4 EXPLOSIVE Tips for Trading with the Donchian Channel – Rayner Teo