On a daily basis, traders exchange more than $5 trillion in the currencies market alone and they use day trading tools. In equities and commodities, hundreds of billions worth of deals are exchanged on a daily basis. This makes the financial market the most lucrative industries worldwide even for sell-side analysts, software developers and other middle-men.

Research companies such as Evercore charge thousands of dollars for their research papers. Software firms such as Bloomberg charge $20,000 per user per month to access information. Brokerage firms like Charles Schwab’s charge clients huge amount of money in terms of commissions to transact.

In the recent past, industries have been disrupted. For instance, Tesla motors which offers quality electric vehicles has disrupted the automotive industry while Uber has disrupted the auto industry.

The investing and trading industry has also been disrupted. Technological innovations have allowed many more players to enter markets partly due to the development of increasingly accessible technologies. If not even free.

The following free day trading tools will help you make better financial decisions and become a better trader.

Table of Contents

What Are Trading Tools?

Day trading is an activity that many people want to start, but they are afraid to do so. This may be because they have heard stories from friends who have tried day trading and were unsuccessful.

The problem may have been the fact that these people did not have the right trading tools. To be successful in any field, you need a number of day trading tools which help you make good decisions:

- Graphic designers need tools like Adobe Photoshop

- Search engine optimization expert need tools such as Google Analytics

- Project manager need tools like Asana

In trading, you need a number of tools which will help you make the best decisions to enter or exit the trades. These trading tools need to be accurate which is achieved through backtesting. They also need to be affordable to the traders.

Why use free tools in trading?

There are several reasons why you should consider using free trading tools in the market. First, some free platforms work just fine and there is no need to pay a premium version.

A good example of this is Investing.com, which provides several ad-supported tools like an economic calendar, an earnings calendar, and a news portal.

It also introduced a subscription package that has additional fees. However a look at these premium features shows that a trader can do without them.

Second, at times, premium tools are usually expensive and not affordable to most people. For example, in most cases, unless you are really rich, it does not make sense to subscribe to a platform like Bloomberg Terminal or Reuters Eikon that costs thousands of dollars per month. Instead, you can use free platforms that offer equally good solutions.

Third, some free platforms have a larger community that provides important information. For example, a platform like Reddit or StockTwits are free and have millions of users globally who keep them vibrant.

Finally, being free does not mean that a platform is bad. In some cases, these free platforms simply have a different revenue model, where they make money using subscriptions.

Platforms are just an aid

Start day trading is easy. You don’t have to be a special type of person, and you don’t have to have a lot of money. The truth is that it’s possible to become a prosperous day trader if you have the right trading tools and software before you begin. However, these alone are not enough; you also need a lot of passion, commitment and hard work.

The tools are used to simplify and automate some processes, and you need to know how to choose them among the multitude that is presented to us even with a simple Google search.

There is one very important thing that you will need before you begin, and it is sound judgmental. Sometimes, irrational people can trade and do it well, but there aren’t very many of these people in this industry. Most traders need to have the right state of mind to be successful and again the right trading tools.

Tools for trading: Platforms

MetaTrader

MetaTrader, also known as MT4/MT5 is the leading trading platforms in the world. It is offered by most online brokers.

The software which can be downloaded for free allows traders to learn to trade using a practice account. It also allows traders to trade a real account using real money which is first deposited through the broker.

New traders can use the Metatrader to learn how to trade using real-time data. They can also learn how to use Expert Advisors and also to create their personal trading algorithms. Other tools offered by the MetaTrader include hundreds of technical indicators, a news feed, and various charting tools.

Real Trading also provides a system like that.

Charting Tools

To make better trading decisions, traders need excellent tools to produce charts. These charts help them know when to enter and when to exit a trade.

Some traders find common trading tools and platforms such as Metatrader difficult to use. There are other free tools that can help them create better and easy-to-predict charts. Yahoo Finance offers a platform where one can apply technical indicators and compare different instruments. Money.net is a Bloomberg alternative that charges $150 a month. One can create a free account and use the day trading tool to produce charts and read from other investors.

Other charting tools that you can use are Net Dania, Stock Charts and Tradingview. To get started we suggest the latter.

Oanda Currency Correlation

Correlation is a very important strategy for traders who use arbitrage and hedging techniques. The idea of this technique is to buy and sell instruments that move either in the opposite or in the similar direction. To identify these instruments, you need to calculate their correlation.

Correlation is a complex mathematical calculation that can take a trader a lot of time. It involves finding the data and entering it in Excel or SPSS and then calculating. Worse is that it changes with time.

This is where the Oanda Currency Correlation tool comes in: All you have to do is to visit the website and check out the correlations.

Tools for trading: News sources

Financial Social Media

To become successful, it’s very important for traders to have a reliable source of news. In the past, TV and newspapers were the best tools to use. Today, most news break first in social media before hitting the TV.

Twitter is the most commonly used tool for social media. Twitter has ‘broken’ so many market-moving news. StockTwits is a financial social media where traders share their ideas on specific currencies, companies, and shares. That’s why it’s important to build your own newsfeed into the platform.

StockTwits

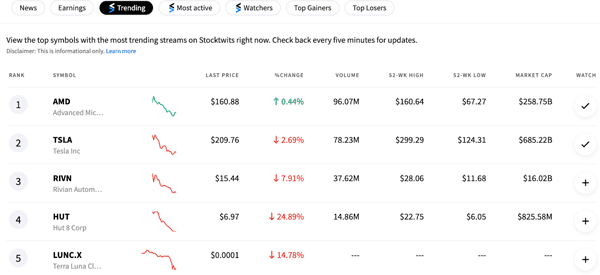

StockTwits is a social media platform that has a close resemblance to X and TruthSocial. It is a company that lets people discover trending assets and also interact with other traders on the platform. At times, it is easy to find out why an asset is having major market moves by just looking at the platform.

The chart below shows the trending section of the platform. On the top, you can see other important categories like most active, watchers, top gainers, and top losers.

Barchart

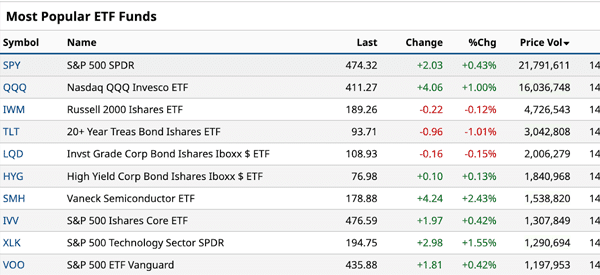

Barchart.com is another important free tool that will help you in both trading and investing. It has numerous products like insider activity tracker, stock screener, options market data, and ETF collection, among others.

For example, as shown below, if you are an ETF investor, looking at the most popular funds can help you in your decision making.

Watchlist

A watchlist is another free tool that will help you become a better trader. It is a tool that lists for you companies or cryptocurrencies that you are following.

It can help you make decisions faster in the market and know why some assets are either rising or falling. At Real Trading, our watchlist subscribers receive a free email every day on top assets and why they are moving.

Financial News Websites

Financial news websites play an important role in providing breaking news and analysis on various instruments.

Websites such as investing.com provide a platform where individual investors and other opinion makers share their opinions. Experts such as Kathy Lien who has written a number of top-selling financial books is a regular contributor. In addition, the website provides a platform where traders can produce charts and compare prices on different items at once. The platform also conducts minute to minute technical analysis which helps traders make prudent trading decisions.

Other websites that you can look at include: Bloomberg.com, fool.com, and SeekingAlpha.com (but you can find more here).

The Economic and Earnings Calendar

This calendar is a very important day trading tool for any trader. Though the earnings calendar is partly useful during the earnings season, the economic calendar is useful every day.

The calendars which can be found for free enable the trader to know when to expect certain data. Economic data from different parts of the world give investors an overview of economic progress.

Tools for trading: Technical and mathematical tools

Fibonacci Calculators

The concept of Fibonacci retracement is very common among technical traders. Traders use Fibonacci retracement to identify support and resistance points. When the chart hits the support, the traders know that it is the time to buy and when it hits the resistance they know it’s the time to sell.

Calculating the Fibonacci sequence is a relatively complex mathematics. Therefore, innovative Fibonacci calculators have been developed. All you need to enter is the high and low positions and then the calculator will work out the levels for you. A simple calculator can be found here.

Pip Value Calculator

A pip is the smallest value a currency can move. Understanding how to calculate the value of a pip is very complicated. Moreover, you don’t need to do the calculation because you can find a calculator to help you achieve this.

In a pip value calculator, all you need to do is enter the currency pair you want to calculate, the position size, ask price, and value in US dollar. After this, the value of the pip will be produced.

A pip value calculator can be found here.

Pivot Point Calculator

This is a tool used mostly by technical traders. As a technical trader, you need to be at a good position to identify the pivot point. This pivot point will help you identify the support and resistance points.

For starters, identifying these pivot points can be a really difficult thing. That’s where the pivot point calculator comes in. This calculator helps a person identify all the pivot points by just entering the high, low, and close prices.

An example of a pivot point calculator can be found here.

Drag and Drop Quant Tools

Quant trading involves coming up with a software or algorithm to help you open or close the positions. To be a pro in quantitative analysis, you need to be extremely good at software development languages such as MATLAB. Unfortunately, many traders don’t have these skills.

Therefore, many brokers such as FXPRO have developed a platform that allows anyone to create his own algorithms by dragging and dropping the day trading tools. This enables anyone without any experience to come up with algorithmic day trading tools that are of the best quality.

External Useful Resources

- Discover more about day trading tools on CNBC

- Read more about other free day trading tools on TheBalance