Alexander Elder is one of the most legendary traders of our time. He has authored a number of best-sellers such as Trading for a living, Come into my trading room, Entries and Exits, and Straying from the flock among others.

In his first book, Elder highlighted a number of steps that traders need to follow when starting to trade. While the book was written before the current trading craze, his ideas are relevant to this day.

In this article, We highlight 6 key steps to start trading the financial market for new traders.

Table of Contents

Who is Dr. Alexander Elder?

Dr. Alexander Elder is a renowned day trader who has written several books on day trading. Most of his books are now top-sellers that have generated millions of dollars in revenue. They have also been translated into 17 languages.

Today, in addition to writing books and day trading, Elder is a highly-sought public speaker. He is also a trained psychiatrist.

We cannot forget about his contribution in technical analysis through the Elder’s Force Index.

Elder’s teachings

#1 – Decide

This is the step where you decide that trading is what you need to do. You have probably read about traders who make a killing in the financial market. Perhaps, you have just read a book on traders that you feel compelled to enter the market.

This is a step that all traders go through, you therefore decide to try your hand in the financial market.

Remember that trading is a complicated process and many people who enter the market fail. You must therefore be prepared to take the risk.

You must also have a long-term view. This means that you must be focus on being a trader for the next 40 years.

Related » What is your Trading Style?

#2 – Learn as much as you can

In the next step, you should try your best to learn as much as you can. You will not become a successful trader by using the trial and error method. You must be committed to spend a lot of time learning from experienced professionals (TraderTv.live can be a good solution).

Related » Why Practice Day Trading?

Also, You must listen to experts who have been in the industry for a long time. However, you must always keep a healthy skepticism on what they say.

Most importantly, you must ensure that you have a mentor. This should be someone who has been in the business for a number of years. His advice will help you achieve success in all times.

Related » Investment Gurus: 10 People to Follow

#3 – Don’t be Greedy to Rush to trade

“An astute trader aims to enter the market during quiet times and take profits during wild times.”

The next thing Elder advices traders is to avoid being in a rush to trade. This is a bit similar to the previous point. However, as you start trading, you will be tempted to start trading without doing any analysis.

This is wrong and will probably cost you a lot of money.

Related » Other Mistakes to avoid

Most traders believe that trading is like gambling (it isn’t!) where they can make money by making simple bets. The truth is that trading is a bit complex.

You should never trade without proper analysis.

#4 – Define your method of Analysis

In this step, you should learn how to define your method of analysis. Here, you should take time to create a strategy which will help you make the best decision. This involves creating a good strategy which combines technical and fundamental analysis.

The idea is to have a strategy that states that IF A happens, THEN B will happen. This will help you make sound trading decisions on every trade you start. You should create a system and backtest it to ensure that you are successful.

Related » Day Trading Strategies You Should Try

#5 – Create a Money Management Plan

The next step is to create a money management plan. A money management plan will help you make informed decision on how to use the money you make and the amount of money to invest.

The three goals of this should be:

- Have a long term view

- A steady growth of capital

- Making high profits

You will be successful if you learn how to incorporate this plan in your daily trading.

#6 – Realize the weak link

The trader is the weakest link in any trading system. This is because the system has already been programed to do something and the trader is the only person with the ability to make decisions to alter the system.

Therefore, you should ensure that you master the art of trading. You should also have excellent risk management strategies to help you mitigate risks in your trading.

#7 – Don’t feel invincible

“When a beginner wins he feels brilliant and invincible Then he takes wild risks and loses everything.”

This quote best defines the cognitive bias known as overconfidence. And no, it doesn’t just affect beginners.

As cyclical as the market is, it is not easy to predict its movements (we wouldn’t have so many traders losing money otherwise). Putting three or four winning trades in a row is not a reason to feel invincible and trade on instinct by neglecting our analysis (or, even worse, basic risk management strategies).

The Triple screen model

It is widely known that no single indicator can provide reliable signals on its own. Therefore, he recommended that traders should focus on using a few technical indicators to make your decision.

He advocated using a trend following indicator like the moving average, Bollinger Bands, or the Ichimoku Kinko Hyo. You should then combine this indicator with an oscillator like Stochastic, Relative Strength Index (RSI), and Relative Vigor Index. Finally, the third screen should have volume indicators.

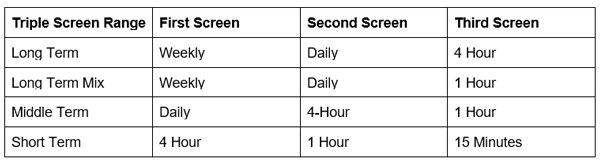

Another triple screen model that he promoted was on multi-timeframe analysis. This is a type of analysis where you analyze an asset across multiple timeframes. A good example of this is shown in the chart below.

External resources to know better Alexander Elder

- Visit the Alexander Elder official website on Elder