As a day trader, there are many asset classes you can use to make money and grow your portfolio. For starters, stocks, commodities and currencies give traders the best opportunities.

Later on, traders can decide to venture in futures and options trading.

Currencies, commodities, and stocks give traders a good opportunity because they are easy to understand and implement.

As a rule, We advise traders to perfect their art of trading in one or two asset classes. For instance, if they are good at currency trading, then they should focus on it. The same way, if they are perfect at commodity trading, we always recommend that they stick to commodities.

The beauty of this is that they are able to study and understand the market and then make sound trading decisions. If they try to focus on so many asset classes, then it will be difficult for them to invest soundly.

Table of Contents

Focus on few commodities

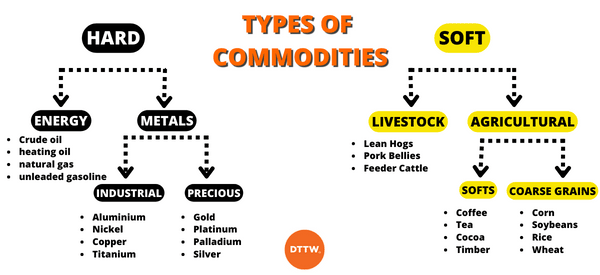

There are 20 and more commodities available for traders today. They include: gold, silver, tin, soy beans, corn and palladium among others. To trade just one of these commodities, you need to take time to study its dynamics. This, for beginners, can take more than one month.

Therefore, We recommend that you pick one or two commodities and study them completely before making your first trade. Ideally, you want the commodity that you identify to have a few characteristics.

One, it should have enough liquidity. This means that it should be in high demand. Selecting such a commodity will help you to enter and exit a trade at any time.

Second, the commodity should be followed in the media. Such a commodity helps you in terms of getting the relevant news.

Safe Havens

The first way of using the commodity is to understand the value of certain commodities. For many years, many countries used gold as the main currency.

In the United States, gold was fixed at a price of $35 per ounce before 1971 when president Richard Nixon removed the gold standard. After the end of the gold standard, the price of gold started going up.

Today, the inverse relationship between gold and the dollar remains evident. In many cases, when the price of gold moves up, the dollar on the other hand goes down. This is because investors move their cash to gold which is now regarded as a safe haven.

Related » Which Safe Haven Assets are best to Own?

Correlation between commodities and other assets

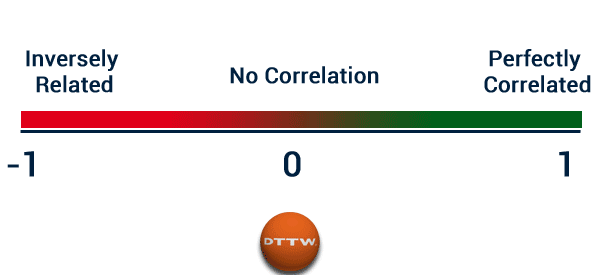

An important thing you need to know is the correlation between commodity prices and other assets. Some commodities have a close or inverted relationship with other assets.

For example, gold has an inverse correlation with the US dollar. In most periods, gold price drops when the US dollar rises. This happens because the two assets react differently to the actions of the Fed. The dollar rises in a high-interest rate environment while gold thrives in a low interest rate environment.

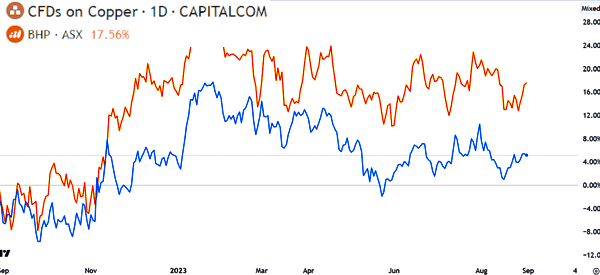

Similarly, mining stocks move in the same direction as the commodities they produce. As shown below, copper and BHP prices tend to move in the same direction.

Demand and supply

After identifying the commodity, you should understand its demand and supply. The price of any commodity is affected by the demand and supply. The higher the demand results in a higher price in the commodity while a low supply leads to a lower price.

As a trader, you need to identify the demand and supply of the commodities. Understanding this will help you know when to buy or when to sell a commodity.

For instance, if you are an oil trader, you need to know about the leading oil producers. You also need to know about the state of supply in the commodity. Fortunately, sources about all this are available on the internet.

Seasonality

It is always important to consider the concept of seasonality when thinking about commodities. This situation is most important when you are focusing on agricultural commodities like orange juice, corn, soybeans, and cotton.

For example, for orange juice, you should mostly focus on the hurricane season in the United States. This is an important period since Florida is the most important producer of citrus plants.

Further, you should focus on the planting and harvesting season. Fortunately, the agricultural department in the US publishes a report known as WASDE that provides estimates about demand and supply. It also releases other reports on acreages.

Understand the macro

As a currency trader, it is important to understand the macro environment. This is because the commodity prices will always move according to the macro themes of the moment.

For instance, the upcoming rate hike will lead to the reduction of commodity prices. This is because the total cost of borrowing the money to buy commodities will rise.

Another example is when there is an increased supply of agricultural commodities such as corn. If there is an oversupply, then the prices will go down.

Trade agreements and tariffs

The other important catalyst for commodity prices is trade agreements and tariffs. Commodities have become an important part in geopolitics.

For example, Russia produces the most wheat in the world. Similarly, the United States is a major producer of corn and soybeans, with China being the biggest consumer.

Therefore, trade agreements and tariffs can lead to short-term volatility. This is happening more commonly now that geopolitical issues have become more common.

Export and Import Driven countries

Countries in the developed world release their import and export numbers on a regular basis. This information can be found on the economic calendar. Traders should carefully assess these releases because they bring forward major movements in the market.

For instance, Canada and Saudi Arabia are major oil exporters. If the price of oil keeps on going down, then the currencies in these countries will be under pressure.

On the other hand, Japan is a net importer of oil. Therefore, if the oil prices head down, Japan will spend less Yen importing oil. This will lead to a stronger Yen.

Different countries produce different types of commodities to sustain their economies. As stated, The Middle East countries are primarily supported by oil while many countries in Africa are supported by agriculture.

In South Africa, gold is the main revenue earner while Nigeria depends on oil. Brazil is a key producer of coffee while New Zealand is renowned by the production of dairy products. Some of these commodities are influenced by seasonality.

Therefore, as a trader, it is very important for you to correlate the price of commodities and use them to trade the respective currencies.

Set-up your Strategy

You need to come up with a model, a set of parameters which when met will make you buy or sell the commodity. A good way to start is to identify the technical indicators that are great at analyzing a certain commodity.

The Commodity Channel Index is a good way to start. It is one of the most common commodity indicators in the market.

You should not create this model in a hurry. Instead, you should strive to test and backtest it using data that is available in your trading platform. As you test, you should make the necessary amendments.

→ Here you can find more Indicators useful when trading commodities.

To invest in these commodities, there are four main ways of doing so:

- Buy the physical commodities and store them.

- Buy the futures that are listed in main commodity exchanges.

- Trade in the underlying companies that mine or produce the commodities.

- Trade the ETFs of these commodities.

The second option is the most preferred method because it is easy to enter and exit trades.

Research News and relate the commodity to other markets

Before you start day trading a certain commodity, it is important for you to conduct intensive research. This research should aim at identifying the key trends or factors that lead to the movements of the commodity, up and down.

The correlation between the commodity and other instruments is of key importance. In many cases, a commodity has a negative or a strong correlation with various currencies.

As stated above, gold and the dollar have been identified as having a strong negative correlation. This means that when the dollar strengthens, gold reacts by weakening. However, as a trader, you need to constantly calculate the correlations between the instruments.

Another good example of correlation is Brent and WTI which have a correlation of close to one meaning that when Brent falls, WTI falls too.

As a day trader, it is important to be on the lookout for a number of economic data which have an influence on the commodities. For instance, in the United States, the crude oil inventory data is released on a monthly basis.

OPEC (Organization of Petroleum Exporting Countries) also released economic data on oil production. Therefore, for any trader focusing on oil, these numbers can indicate whether there is an increased or reduced demand.

Market sentiment

Like other assets, commodity prices are impacted by the overall market sentiment. The two main sentiments are risk-on and risk-off.

Risk-on refers to a period when investors are willing to embrace risk in the market. In such a period, assets like gold and silver tend to do well.

Risk-off is when investors are fearful about the economy. When this happens, industrial commodities like copper and iron ore tend to retreat.

Learn how to Edge: Link commodities and companies

Commodities are extracted or mined by companies. For instance, companies such as BP and Chevron are the leaders in the oil and gas sector. As a result, a decline in the oil price will lead to a decline in the oil and gas companies because investors will expect less returns from the companies.

Therefore, as a day trader, it is possible to correlate the prices of the oil and those of the oil and gas company and come up with a good trading strategy.

The same is true for other commodities such as gold, silver, and zinc.

As a day trader, you can benefit from small price changes when trading with commodities, because this market is also predictable and easy to study. It also has a significant level of liquidity benefits where you can buy and sell within seconds.

Trade with the short term

As a day trader, you should avoid holding commodities for a long period of time. This is simply because the price of commodities will always go up and down. For this reason, the trend is your friend when making financial decisions.

The challenge comes when you have to identify a trend. We usually suggest using a 20-day high or low when identifying a trend. In addition, We advise that you stay away from a market that is in consolidation mode because of the risks involved.

There are a number of instruments you can use to identify the trend: Technical indicators such as market sentiments, MACD, and moving averages can help you identify a trend.

Tip – Watch TraderTv.Live

If you want to follow some experts, we suggest watching live shows like TraderTv.Live. Best of all, here you can ask for some trading tips.

We believe that by following these strategies, you will be in a good position to make good trading decisions, buying or selling when it is appropriate. Thus, you will make a lot of money in trading commodities.