One of the top benefits for day trading and investing is that you can make money in all market conditions. You can buy or go long an asset when its price is rising or short when its price is falling.

This article explains what shorting is and then highlights some of the top strategies. We believe there is a need for this type of article, as the practice of short selling is quite risky because of the potential endless losses.

Table of Contents

What is short selling and how does it work?

A short trade is a situation where you place a bet that an asset’s price will start falling for a while. For traders and investors, shorting works by just clicking a sell button and letting the broker do the work.

Shorting works in a relatively different approach to buying. It works this way. You borrow shares from an exchange and then sell them or convert them into cash. When the stock falls, you buy it and return the shares you borrowed.

For example, assume that you have $10,000 and a stock was trading at $50. In this case, you can borrow 200 shares. If the stock drops to $30, you can buy it back. In this case, you will buy shares worth $6,000 and return to the exchange, giving you a profit of $4,000.

What is a short squeeze?

Shorting is a good strategy because it makes it possible for you to make money in all market conditions. But it is risky. In the example above, if the price rose to $70, you will need to buy shares worth $14,000, giving you a loss of $4,000.

The biggest risk for short trading is known as a short squeeze, which happens when the price of an asset shoots up. Since a stock has no upper limit, it means that shorting can expose you to unlimited losses.

In our example, if the stock jumped from $50 to $1,000, you will need to buy shares worth $200k, giving you a loss of over $190k.

While these situations are rare, they are possible. For example, people who shorted GameStop during the meme stock mania suffered a major short squeeze.

Short selling strategies

There are four main strategies to short a stock or any other financial asset. Let us look at some of these approaches.

Shorting a reversal

The first approach is a relatively contrarian one. It is a process where you short a stock that is starting to shift from an uptrend into a downtrend.

There are a few ways to go about this. For example, you can use technical indicators like moving averages and Bollinger Bands to predict when a reversal is about to happen.

One of the top approaches when using moving averages is known as a death cross, when a long and a shorter moving average make a crossover.

You can also use chart patterns like head and shoulders, rising wedges, and double tops to predict a bearish move in the market. Finally, you can use reversal candlestick patterns like an inverted hammer, evening star, and a bearish engulfing.

For example, in the chart below, we see that Tesla formed a triple-top pattern, opening a possibility that the price would have a bearish breakout.

Shorting an existing downtrend

The other shorting strategy is known as trend-following. This is a situation where you enter a short trade when an asset is already in a downtrend.

In this case, your goal is to benefit as the stock price continues its downward trend. Trend following assumes that an asset will continue moving in a certain direction to the end.

One of the best trend-following approaches is to use a moving average. The chart below shows that the Roku shares made a bearish breakout and moved below the 50-day moving average.

In this case, you can short and hold the stock as long as it is below this moving average. You should only exit it when it moves above the MA.

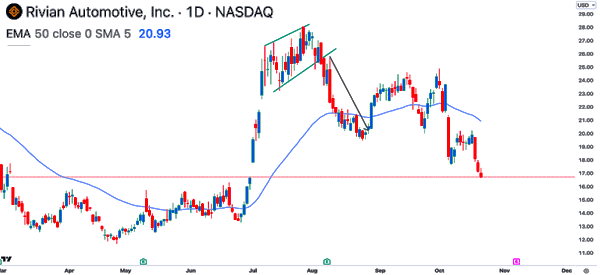

Shorting a breakdown after consolidation

The other strategy is where you enter a short trade when an asset is in a consolidation phase. When an asset is moving sideways, there is usually a possibility that it will have a bearish breakdown. In this case, you can decide to short it and benefit when it retreats.

One of the best ways to do this is to place a sell-stop below the strong support level. When you do this, the short trade will be executed and you will benefit as it continues moving downward.

The chart below shows that Rivian stock made a bearish breakout after consolidating for a while.

Shorting a pullback

The final step is a relatively riskier one since it is a bit contrarian. It is a process where you place short trades when an asset is in an uptrend. Your goal is to take advantage of the small pullbacks that happen. In this case, you will benefit from the short-term retreats.

The risk of shorting during an uptrend is that the trade can continue rising for an extended period. And at times, these pullbacks tend to be extremely short-term, meaning that the profit potential can be a bit limited.

How to short sell effectively? Shorting best practices

There are a few things that you need to do to short sell stocks and other financial assets effectively.

First, always be on the lookout for news that are moving the market. The news can be specific to a certain company or a broader market. For example, oil and gas stocks jumped after Russia invaded Ukraine since it led to a major bull run in the oil market.

Other news that moves stocks are earnings, mergers and acquisitions, an FDA approval or denial, management change, and even a product recall.

Some of the top places to get the news are social media platforms like Twitter and StockTwits, CNBC, Bloomberg, Wall Street Journal, and Financial Times.

Second, always focus on an asset’s volume. Volume is what confirms major trends in the market. By looking at the volume, you will be in a good position to predict the strength of the reversal.

Third, always protect your trades using a stop loss or a trailing stop. These stops will prevent you from making substantial losses in the market. For example, if an asset is trading at $20 and you place a short trade, having a stop-loss at $22 will stop it at that price.

Third, be ready to change your position when conditions change. A good example of this is what happened to Bill Ackman when he shorted Herbalife. His argument was that the company was a pyramid scheme.

After investigations, the regulators fined the company and ordered it to change its strategy. This was a big win for Herbalife and its stock recovered. In this case, it made sense for Bill Ackman to cut his losses as the stock jumped.

Additionally, if your goal is to hold your shorts for a long time, you can consider shorting hyped companies that are quite overvalued. For example, when there is a new hot sector – like EVs and ESG – you can identify these top stocks and short them at the top.

Summary

This article has looked at the whole idea of shorting and some of the top strategies to follow. We have also identified some of the best approaches and best practices to use.

You should always be careful when shorting since it can lead to a short squeeze that can make you lose more money than you have in your account.

External useful rsources

- How To Beat The Odds With A Short Only Investment Strategy – Neuravest