There are two main types of orders you can place in the market: market execution and pending orders. Market execution is where your trade is executed immediately at the present prices. Pending orders are when you instruct a broker to open a buy or sell order at a certain period when the asset reaches a certain price.

The pending order is further divided into several subtypes:

- Limit order: it can either be a buy limit order or a sell limit order. A buy limit order is placed so that the asset is purchased at/below the set price. Similarly, a sell limit order instructs the broker to sell the asset at/above the specified price.

- Stop order: it can be a buy stop order or sell stop order. With a buy stop order, the trade will be executed above the market price. The execution will only happen once the price hits the stipulated buy stop price.

On the other hand, the sell stop order will be executed below the market price; once the price of the asset reaches the stipulated point. - Stop limit order: it can be a sell/buy stop limit order. The trader sets a stop price and limit price. The sell stop limit order is executed at/above the limit price while the buy stop limit order is executed at/below the stipulated limit price.

In this post we want to go deep into stop limit orders.

Table of Contents

What is a stop-limit order?

A stop-limit order is a popular type of limit order that directs a broker to buy or sell a financial asset when it moves to a certain price and then execute the trade at a limit price.

The initial trade is known as a stop price. A limit price is defined as the minimum price you are willing to accept when selling or the maximum you are willing to pay when buying the asset.

To put this clear. A limit order is used to state the price you want to buy or sell while a stop-limit order is used to specify the price you want to trigger a trade and the exact price.

Let us use this example to explain how a buy stop-limit order works.

Assume that an asset is trading at $300 and you hope that the price will continue rising. But, you believe that the uptrend will be confirmed if the price moves above $305. In this case, you can open a buy stop-limit order at $305 and then a limit price at $315.

Stop limit vs stop and limit orders

A stop-limit order combines the stop and limit orders. A stop order is an order to buy an asset at a price above the current level or sell at a price below the current level.

If an asset is trading at $20, a buy-stop at $21 will execute a bullish trade at $21. A sell-stop at $19 will execute a bearish trade at $19.

A buy limit order is also an order to buy an asset below the current level while a sell limit is an order to sell above the current level.

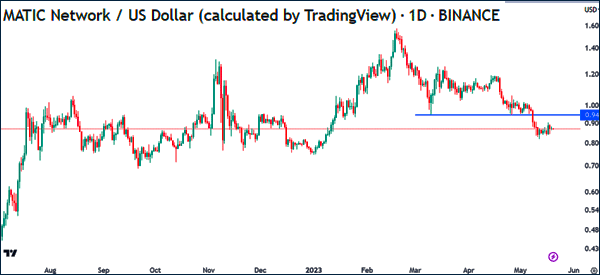

A good example of this is shown below. In this case, if you believe that the MATIC network price will rise to $0.94 and then resume the bearish trend, you can set a sell limit at that level.

Stop loss v. stop limit order

Both the stop loss and stop limit order are used as a risk management strategy in trading. While they are both utilized in reducing losses, they have a subtle difference.

A stop loss is not influenced by changes in the stock price. The stop loss will convert into a market order as soon as the price hits the set price. If you purchase a company’s share and its value begins to fall, the stop loss will be executed as soon as the stock price reaches the stipulated point.

On the other hand, the stop limit order has a bit of predictability. When the stock hits the set stop loss, it triggers a limit order as opposed to a market order.

With the limit order, the broker will sell or purchase the stock at the stated price or at a better one. With the stop limit order, the broker will sell the share at/above the stipulated price and buy it at/below the set price.

How does a stop limit order works?

Traders use stop limit orders as a control in their trades. To do so, one sets two prices: the limit price and the stop price. The stop price is the price point at which the stop limit order will be executed. On the other hand, the limit price is the maximum/minimum price that the stock will be sold or purchased.

Buy limit order

For the buy stop limit order, a limit order will be executed once the stock reaches the stop price. Subsequently, the stock will be purchased at/below the set limit price. This type of limit order is common among traders who intend to short sell shares.

Sell stop limit

On the other hand, a sell stop limit order is helpful when the trader’s intention is to protect the gains or limit the losses on the owned stocks. Once the share price reaches the stipulated stop price, the broker will execute the limit order. As such, the share will be sold at/above the set limit price.

Example of a Stop Limit Orders

Consider the following scenario; a trader purchases the shares of company X at the price of $10 per share. He uses $2,000 hence ends up with 200 shares.

The market is expecting certain news that is likely to affect the company negatively. However, the trader has a situation that he has to attend to thus making it difficult for him to monitor his trade.

In such a scenario, a stop limit order will be a suitable risk management strategy. So let’s assume that the trader places a stop limit order at a stop price of $7 and a limit price of $5.

True to the market’s expectations, the price of the company’s stock falls to $7 hence triggering the set limit order. As more traders sell off their shares, the price drops further. The limit order is executed at $8. The trade in question is now worth $1,600.

By the time the trader gets back to his trade, the price has reached $4. If he had not placed the stop limit order, his trade would now be worth $800 – a loss of $1,200 from the initial amount.

Stop limit order strategies

Volatility

Volatility is defined as how quickly an asset is moving up or down in a certain period. Consider the volatility of the stock when determining your limit price: if the stock is more volatile, you should have a wider limit. In a volatile market, a small limit is likely to result in low gains while an extremely wide limit may cause hefty losses.

For example, if a stock is trading at $35 and is highly volatile, setting a limit order too tight means that the order will be triggered when you don’t want. Therefore, we recommend that you set buy and sell limit orders when the market is trending.

Buy stop and sell stop strategies

Another strategy you can consider is the one we have talked about above. A buy-stop is an order to buy an asset when it moves to a certain price above the current level. For example, if a stock is trading at $10, you can place a buy stop trade at $11. In this case, the trade will be executed when it moves to this level.

A sell-stop is the opposite of a buy stop. It is a trade to sell an asset when it moves below a cerrtain level. In this case, you can place a sell-stop at $9. This trade will be triggered if the price moves to this level.

Analyze Charts

Analyze stock charts: It is advisable to place your stop limit order around the levels where other traders are expected to buy or sell their assets. This is because such levels often indicate prior swing lows/highs or support/resistance levels.

Liquidity is likely to increase as the price nears these levels. A horizontal line on the stock chart is one of the tools that can help you identify these points.

Liquidity and Trading Volume

Analyze the stock’s liquidity and trading volume: The trading volume will help you determine whether you need the stop limit order and at what point you should place it.

Besides, a stock with high liquidity may not require such an order. If the shares are highly illiquid, consider lowering the size of your position as a risk management approach.

Potential risks of stop limit orders

Limit order not filled

The stop limit order may not be filled. Consider a scenario where a trader places an order at the stop price of $20 and a limit price of $18. The stock goes below the $20 mark, triggering the stop. However, the market does not have buyers willing to purchase the shares thus pushing the price down to $17.

In such a scenario, you will be trading at a price that is lower than your set limit price but will still be holding a losing position.

Partial fill

You may end up with a partial fill: using the scenario created in the previous point, lack of liquidity may result in a trader only selling a portion of his position after the stop has been triggered.

This will occur if you sell part of the shares at the stop price, but then the price quickly falls below your limit level. In such a case, you may incur hefty losses.

Paying higher commission

You can end up paying a higher commission: depending on the commission placed by your broker, your fees will be higher if there is no liquidity and the stop limit order ends up being filled in several parts.

If you chose a market execution order, you would only pay the commission once.

Advantages of a stop limit order

There are several benefits of a stop-limit order. First, it makes you avoid placing a market order, which is seen as a riskier trade.

Second, it allows customization in that it makes it possible for you to specify the trigger prices. Third, it is a good one for risk management.

Final thoughts

Most brokers avail the option of a stop limit order. It is an effective risk management approach in trading. However, just like any other trading strategy, it has certain potential risks. As such, it is crucial to conduct detailed research to determine whether you need to place such an order and at what point.

External Useful Resources

- Investor Bulletin: Stop, Stop-Limit, and Trailing Stop Orders – SEC