Market timing is a controversial topic in trading and investing. There are many passive investors like Warren Buffett who advise strongly against timing the market. Other active money managers believe strongly in market timing.

In the past few years, James Simmons, a quantitative hedge fund manager has achieved the best returns in the market thanks to this practice.

So.. what is the truth? It depends, every case is different. That’s why we want to give you the knowledge you need to analyze independently. This article will look at what timing the market is and how you can do it well.

Table of Contents

What is timing the market?

Timing the market refers to the process of using fundamental, technical, and price action strategies to identify potential entry and exit points. This process is mostly used by day traders and active money managers, who want to buy an asset low and exit high. They also look at opportunities to short the asset high and wait for the price to drop.

Timing the market differs from the other method of allocating money and holding it for its price to rise. Warren Buffett is a good example of an investor who doesn’t time the market.

After doing intensive research, the Oracle of Omaha holds his investments for years. For example, he has held shares of companies like Coca-Cola for more than three decades. By so doing, he does not sell the stock when it drops substantially because he has a long-term view.

How market timing works

There are many approaches to timing the market. In fact, many market timers use different strategies to time entry and exit points.

Buying the dip

A good and most controversial market timing method is known as buying the dip. Buying a dip is the process of rushing to buy a stock or other asset when its price drops. Most novice traders rush to buy an asset’s price when its price crashes since they want to take advantage of it when it rises.

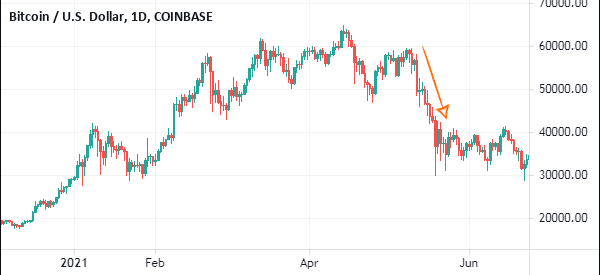

A good example of this is what happened in 2021 as the price of Bitcoin crashed. As shown below, many traders who bought the initial dip lost a lot of money when the losses accelerated.

While buying the dip often works, it is a risky approach to day trading. To buy the dip well, we recommend that you first study the reasons why it happened.

For example, in 2021, the Afterpay stock price dropped by more than 10% when Apple announced that it was working with Goldman Sachs to launch a buy now pay later financial product. Traders sold their AfterPay shares because of the dominance of Apple.

However, in reality, the decline was unwarranted since AfterPay has a strong brand in Australia and the US. As such, Apple’s impact will be muted.

In the past, investors sold shares of Netflix when Apple launched Apple TV+ and Spotify when the company launched Apple Music.

Price Pops

The opposite of buying the dip is buying when the price of an asset pops. For example, a trader can buy shares of a company that have risen by 10% or 15% in a session. This type was so popular during the Wall Street Bets volatility. The risk is that the stock can jump sharply and then erase the gains within minutes.

Technical analysis and price action analysis

The next strategies of timing the market is known as technical analysis and fundamental analysis. We have already covered some of these strategies before.

Technical analysis refers to the process of using indicators like moving average and the Relative Strength Index (RSI) to identify market opportunities. When used well, it is possible to identify quality entry and exit strategies when using technical indicators. Indeed, at Real Trading, we are highly supportive of indicators like the Volume-Weighted Average Price (VWAP) and MACD indicators.

Price action, on the other hand, is the process of looking at the overall price of an asset and predicting how it will move. The best approach of doing this is to use chart patterns like the head and shoulders, bullish flag and pennant, rising and falling wedge, and cup and handle patterns to predict the future price of an asset.

You can also use candlestick patterns like hammer, bullish and bearish engulfing, and doji patterns in price action.

Pros and cons of timing the market

There are several advantages (but also some cons) of market timing for traders and investors. Let us look the advantages first.

- It works – When used well, timing the market works. In fact, We have seen many traders achieve excellent returns over the years.

- Easy to use – For traders who know how to time the market well, it is an easy-to-use strategy. For example, if you have a good understanding of patterns like triangles, it is a relatively easy-to-use strategy.

- Volatility – Market timing is an excellent way to make money during periods of high volatility.

While timing the market is a useful concept, it is also accompanied by several risks. Some of the top risks associated with the strategy are:

- Higher costs – If your broker charges commissions, opening more trades will lead to higher costs.

- Risky – While the strategy works, it is also risky, as demonstrated in the Bitcoin example above.

- Taxes – Depending on your country, selling profitable stocks attracts higher taxes. This is why people like Warren Buffet pays little in taxes.

- Takes time – Market timing requires more time to work.

Is market timing a good idea?

With this in mind, it is easy to answer whether timing the market is a good or bad idea. The correct answer is that it depends.

If you have excellent trading skills, then the strategy will work out well. On the other hand, if you don’t have time to trade, we recommend that you embrace the buy and hold or passive investing approach. Furthermore, people like Buffett and Bill Ackman have made a fortune using the passive approach.

Related » How to Trade Part-Time When You Have a Full-Time Job

Summary

Market timing is the process of seeing the price action and them moving with the flow. In this, you can benefit when the price is rising and when it is falling. Still, there are some risks associated with the strategy, so, it is wise that you take time to learn more about it first.

External Useful Resources

- 6 Reasons Why Market Timing Is For Suckers – Forbes

- Market timing and life after lockdown: Q1 report – James Hambro