Time of the day is essential for all day traders because it can influence the amount of returns they generate. This applies to both stocks and forex traders.

In this article, we will look at the various periods of the day and how you can use them to your advantage.

Table of Contents

Forex is a 24-hour business

The forex market is usually a 24-hour business. This happens because, unlike stocks, forex does not have a centralized exchange like the New York Stock Exchange (NYSE) and the Nasdaq.

Instead, the forex market happens across global centers of trade like Shanghai, Tokyo, London, and New York.

Related » A Brief introduction to Trade Forex

Sessions are not all the same

While forex is a 24-hour business, in reality, these sessions are not all the same. For example, the Asian session tends to be a bit dull because of the limited volumes. Also, minimal vital economic data are released during the sessions. The most common are the Australian central bank decisions and China and Japan PMIs. There are usually no major movements during that session.

The amount of volatility and volumes start rising during the European and American sessions. That’s when the major market centers of New York and London starts to open, which brings volume with them.

Also, important market numbers are released during these sessions. These include the nonfarm payrolls, US and European central bank decisions, retail sales, and inflation, among others.

Related » How is a Day Trader’s Workday Divided?

Most importantly, volatility usually increases at the intersections of the Asian and European, European and the American, and the American and Asian sessions.

Cryptocurrencies is a 24/7 business

While forex is a 24-hour, five-day business, digital currencies don’t have opening and closing times. Instead, they run every day for 24 hours because of their disruptive nature. In general, the cryptocurrency industry is removing the barriers that existed in the past.

Volatility in the cryptocurrency industry happens virtually every day. However, in our experience, a lot of movements tend to happen during the weekend. This is in part due to the fact that traders are only focused on crypto when the other markets are closed.

Further volume increases on Monday morning when large investors are coming in and on Friday when they are leaving.

Premarket in stocks

In the stock market, especially in the United States, there are periods that are very vital. Let’s start with the premarket. This refers to a session when the stock market is closed but before the market opens fully at 09.30 am.

The session happens from 07:00 am to 09:30 am.

Some brokers give you access to trade during this session while others operate when the live sessions operate.

The pre-market is essential because it shows you how shares will open. For example, if Nio stock is up by 5% in premarket trading, it means that it will likely open up by about 5%. If it drops by about 6%, the same is true.

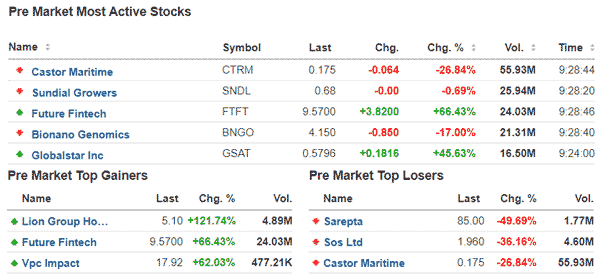

As a trader, we recommend that you focus a lot on the premarket session because of how important it is. To do this, we suggest that you have a good source of premarket data that will show you the biggest gainers and losers.

Some of the best sources of this are Investing.com and Webull. The chart below shows some of these numbers.

We also recommend that you have access to a watchlist. This is a document that shows you the top movers, their volumes, and the reasons why they are either rising or falling.

You can subscribe to our comprehensive market watchlist here.

After-hours session

US stocks close at 16:00 GMT. However, the party never stops at this time. Instead, there’s the after-hours session, which can be very useful as well. This session is between 04:00 pm and 08:30 pm.

In fact, stocks experience significant gains or losses during this session. That’s because many companies with vital information to share prefer releasing it after the market closes.

Also, during the earnings season, most companies publish their earnings after the market closes. Like with the pre-market, some brokers give you an opportunity to place orders during the after-hours. But these orders are usually opened when the market opens.

While trading in the pre-market and after-market is usually a good thing, it comes with several risks. These include low liquidity, high volatility, and wider bid and ask spread.

The market open

The market open is a vital period for the stock market. In fact, it is the most important since that’s when orders made in premarket and after-hours are executed. Also, it is important because of the high volume that is usually associated with it.

In fact, when you look at a chart, you will find a strong gap-up or gap-down during the market open. As the market session proceeds, this volatility tends to ease.

Therefore, as a trader, you should ensure that you are on your desk when the market opens. You should use the information in the premarket to find essential market opportunities.

The market close

Finally, there’s a period when the market closes. In the United States, this is usually at 4:30 pm. It is also an important period because many day traders are usually winding-down their positions for the day.

As such, there’s usually some increased volatility and market action during this period.

Final thoughts

In this article, we have looked at the concept of time in the financial market. For forex and cryptocurrencies, we have seen that they are usually open for 24 hours. But, we have seen that these sessions are not always the same.

Similarly, for stocks, we have seen the best periods to trade and the premarket and watchlist tools that you need to have.

External Useful Resources

- Best Time Of Day To Buy Stocks – DayTradingZ