In any business that you decide to venture in, it is very important to have a good understanding of how it works. You should understand carefully the broad market and then dissect it into small units. Having this type of understanding will help you create a good and profitable business.

For instance, if you are an oil trader, you should break down the oil into several parts such as the source, transportation, supply, currency, and demand.

Here. As a trader, you absolutely cannot overlook the importance of the US Dollar in any asset type.

The US dollar is the world’s best-known currency. It is used around the world for trade and most governments hold it as a reserve currency. It is also one of the most stable currencies in the world.

In this report, we will look at how you can trade the US dollar as a currency. We will also look at the Dollar index, which is an important benchmark that tracks the performance of the greenback.

Table of Contents

What is the US dollar index?

The US dollar index (DXY) is a popular benchmark that measures the performance of the dollar. It does this by comparing the dollar’s performance against a basket of currencies like the euro, pound, and yen.

Most of the weight is in the euro, which makes up about 57.6% of the index. It is followed by the Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. As such, if the dollar gains against the euro by a large margin, the index will rise and vice versa.

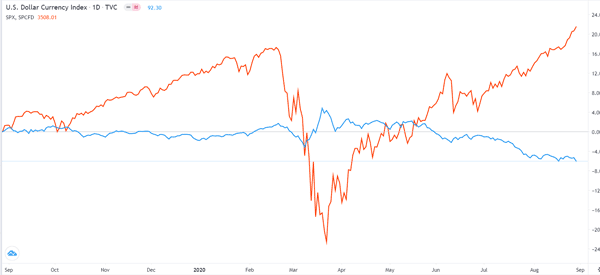

The US dollar index rose sharply in March 2020, when the World Health Organisation (WHO) named the coronavirus a global pandemic. It rose sharply because, at the time, investors, traders, and businesses were rushing to the safety provided by the dollar.

As the number of cases fell and as the probability of a vaccine increased, the US dollar index started to drop.

This drop didn’t last long, and by mid-2021 it was back on the rise, hitting highs in late 2022 like we haven’t seen in 20 years.

Policy makers and investors constantly refer to the dollar index when making decisions. Therefore, no matter what asset you are trading, you should always have a keen look at the dollar index.

The importance of the Greenback

Today, 90%+ of All Currency Trades Involve the Dollar, so it is the most important currency worldwide. The dollar is not only the main currency of the United States but it’s also the global benchmark. Most countries measure their economic performance in terms of the dollar strength or weakness.

Also, a number of countries such as Zimbabwe use the dollar as their local currency. Also, today, the financial system has gone global with traders in China being able to sell their products globally.

Can You guess? The currency used for these transactions is the dollar.

In addition, most countries especially those in the emerging markets peg their currencies to the dollar. What does it mean? Pegging a currency against the dollar is when a government maintains the U.S dollar as a reserve currency.

What moves the US dollar?

A common question is what determines the strength or weakness of the US dollar. Unlike most currencies, there are several reasons why the dollar becomes strong.

Global Crisis

First, like during the coronavirus pandemic, the dollar gets strong in times of a global crisis. Indeed, the currency strengthened during the dot com bubble, the Global Financial Crisis, and during the coronavirus pandemic.

It also rose when Russia invaded Ukraine. This happens because the USD is often seen as a safe haven where people run to in times of crisis.

The FED

Second, it strengthens because of the Federal Reserve. A hawkish Fed tends to lead to a stronger dollar while a dovish Fed tends to lead to a weaker greenback.

A good example of this is what happened during the Covid-19 pandemic. At the time, the Fed lowered interest rates and embraced a more dovish tone. As a result, the US dollar index plunged. It then turned around when the Fed started hiking interest rates after the pandemic.

Other Currencies

Third, the dollar index gains because of the economy of its constituent currencies. For example if the dollar has declined, it could be because of the perception that the European economy will have a faster recovery than in the US.

Consequences of a strong or weaker dollar?

There are two main aspects of a weaker or stronger dollar. First, a weaker dollar is usually a positive thing for American companies that do a lot of exporting. This is because it makes their products and services cheaper to their international markets.

As shown in the chart below, the S&P 500 tends to fall when the dollar gains.

Second, a weaker US dollar tends to be beneficial to assets like precious metals and cryptocurrencies. That is because these assets are usually priced in dollars. Therefore, when the dollar rises, their prices fall as well.

Influence on commodities

Another key characteristic is that most commodities are quoted in dollar terms. For instance, the price of crude oil and corn is always quoted in dollar terms. Therefore, the strength of the dollar will lead to significant decline in the commodity.

For instance, in 2015 oil had the strongest loss while the greenback had the highest movement. Also, other commodities as evidenced by the Bloomberg Commodities Index had the biggest loss which was attributed in part by the strengthening dollar.

How to trade the US dollar

As mentioned above, there are two primary ways of trading the american dollar. First, you can trade the Dollar index, which is usually offered by most trading platforms. Second, you can trade currency pairs that have the dollar.

Among the most popular pairs to trade the dollar are:

- EUR/USD – This is the most popular and most liquid currency pairs in the world.

- GBP/USD – The sterling to dollar pair is among the oldest currency pairs.

- USD/JPY – The USD/JPY pair is also very liquid because of the size of the US and Japan economy.

Other popular currency pairs to trade the Greenback are USD/SEK, USD/TRY, and AUD/USD.

Inverse correlation

For traders, correlation is a very important mathematical aspect that should not be overlooked. Correlation shows the relationship between two items. Two items can be perfectly, inversely, or not correlated. The dollar is inversely correlated with a number of items.

For instance, the dollar moves in the opposite direction with gold. This is because investors tend to move to gold when there is weakness in the financial market. When the market is strong or resilient, investors will hold gold. This results to an inverse relationship between the two.

Also, there is an inverse relationship between the dollar and the US treasuries for the same reasons. On the other hand, the dollar tends to move in the same direction with the US key indices such as S&P and Nasdaq.

Where to find relevant news about the US dollar

To trade the US dollar, it is usually important to have relevant and most recent news. This includes the most recent political news and economic data. Some of the most prominent news sources are usually premium, meaning that you need to pay for them.

These include Bloomberg Terminal and Reuters Eikon. As a basic trader, there is no need to pay for these platforms, which cost more than $1,800 per month. As a trader, popular sources of good Dollar related news are Investing.com, Market Chameleon, and Benzinga, among others.

Related » Top Free Sources to Find Quality Financial News

Final thoughts

The US dollar is the world’s most important currency. It is used as the world’s reserve currency and it is also the most popular currency in cross-border transactions. Therefore, as a trader, it is important for you to understand how the currency works, what makes it move, and how to trade it.

External Useful Resources

- Why the US Dollar Is the Global Currency – The Balance

- Dollar Is Trading at a Discount for First Time Since March Chaos – Bloomberg