Price and volume data move so quickly in the area of day trading that traders may capitalize on price and volume swings within seconds or minutes.

In order to obtain a sense of the market’s direction for the day, day traders wake up early and read the news, scan the market, and watch channels like CNBC and Bloomberg before the markets open. There is a predetermined list of stocks, options, and currencies that day traders focus on when the opening bell rings.

This cycle will repeat itself over and over again, as traders try to become one of the few who can benefit from the unpredictable flux of the markets. For those who find the idea of a job in the financial markets fascinating, we’ll go through the types of degrees need to succeed in this high-paying but high-risk field.

Table of Contents

How Does Day Trading Work?

Intraday currency trading on shorter-term charts is known as forex day trading (for example, 15-minute charts). With the use of trading strategies and technical tools, traders can keep an eye on their positions for many minutes or even hours at a time. Focus and discipline are required in fast-moving markets while using this kind of trading.

» Related: The Intriguing Impact of Patience for a Day Trader

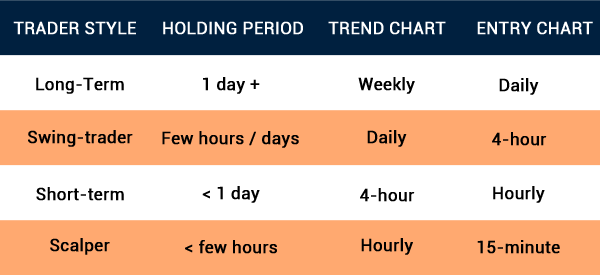

Different styles, different charts

For a day trader, the window of opportunity is less than that of a position or swing trader, who may have a position open for months or even years. However, it takes longer to exit a transaction than a scalper, who may do it in a matter of seconds.

People who want to begin day trading forex, as it’s written here, must first realize that this is a difficult effort that demands thorough planning. Traders must be knowledgeable of the fundamental and technical drivers of currency markets in order to have a chance of profitability.

Capital

They must, however, begin with enough cash in order to avoid going into debt. All investors are not suited to Forex trading.

While a few hundred dollars may be adequate for a person to only explore with a real money account, a high account size may provide a greater chance that is suitably compensated for the time spent.

Investors should make certain that they can view the charts for as long as they want to trade each day. Even a brief excursion away from the computer or mobile device may have a significant impact on the price of a stock.

Useful stuffs

Traders need to be aware of the dangers and ensure that they have a risk management plan in place to protect themselves as much as possible. Not trading more than 1 or 2 percent of their available money each day, beginning small, implementing well-thought-out stop and limit orders, and adhering to a plan are all part of this approach.

Identifying the market circumstances in which a strategy will be implemented is vital before opening a position, as several timeframe research may provide the larger picture of price activity.

Useful Degrees To Become A Professional Day Trader

Since the world of computerized trading has made the trading game more sophisticated and competitive, corporations are under pressure to acquire the finest brains from the most prestigious colleges.

Finance and business administration

Employers value finance and business administration degrees because they cover many of the basic topics that traders would come across throughout their careers. Accounting statements, derivatives, fixed income instruments, and corporate finance should be familiar to students who have completed a finance degree program.

It’s very uncommon for institutions to establish high GPA requirements for admission to finance programs, and those who meet such criteria may participate in real portfolio management situations with real money as a practice for the kinds of investment choices they’ll face in the future.

Economy

Ray Dalio and Jim Rogers are two of the most well-known macroeconomic traders in the world. As a student of economics, you’ll be exposed to a wide range of topics related to business cycles, economic indicators, currencies, interest rates, and macroeconomic policy.

Graduates of the economics program would have gained an understanding of how policy choices, economic shocks, and the effects of crises on a global scale are affected. Economic intuition also helps day traders better grasp the news and current events that may influence their trading choices.

Regression and statistical analysis are two of the tools used in futures trading that should be taught in economics degrees.

Computer science and statistics

Entrepreneurial traders should learn how electronic information flows function as trading becomes more automated. High-frequency trading, statistical arbitrage, or market-making necessitates the involvement of a large number of computer scientists and statisticians in risk management or algorithm development.

As a quantitative trader who is fine letting your programs make all of the choices (many thousands of times a day), computer science would be a good major for your future job path.

Others

In the world of derivatives, trading may be a highly complex endeavor involving the use of mathematics, engineering, and physics principles.

Students who study math, engineering, and physics are sought after by recruiters because of their ability to grasp complex mathematical ideas while also understanding how to apply them in novel and innovative ways.