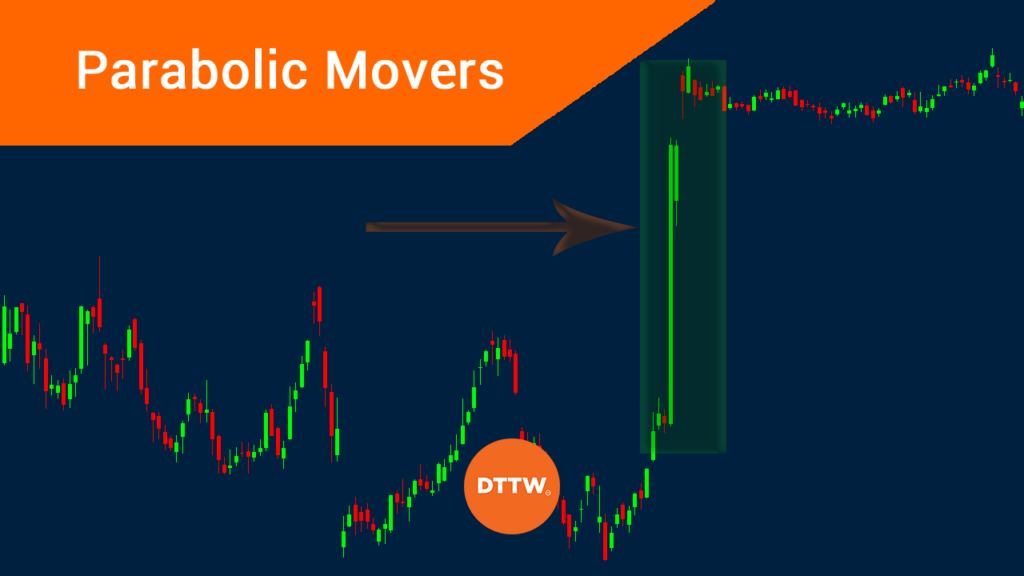

Parabolic movers in the financial market refer to a situation where a stock moves sharply higher than how it moves on average.

For example, if a stock trades within a range of between $10 and $12, a parabolic move will be a situation where it moves sharply to $30 in a single day. These moves are most popular in penny and small-cap stocks.

In this article, we will look at some of the strategies to use when trading these moves.

Table of Contents

What is a parabolic move?

On an average day, stocks tend to move within a certain range. It is relatively uncommon to see shares of companies like Apple and Microsoft rise by more than 10% a day. It has not happened in recent times.

Yet, a closer look at the small-cap and penny stock industries reveals that it is relatively common for shares to jump or fall by more than 100%.

A good example is what happened in early 2021, when the stock prices of companies like GameStop and AMC Entertainment more than doubled within a few days. These are known as parabolic moves.

The moves happen, in most cases, when there is significant demand for a company’s shares than the available free float.

What happens when stocks go parabolic?

A stock that goes parabolic has numerous consequences. The most common of these consequences is known as a short-squeeze, which is described as a situation where short-sellers make substantial losses when a stock soars.

A short-seller is a person who bets that a company’s stock will drop in a certain duration. Shorting a stock is riskier than buying it because shorting can lead to unlimited losses in the market. This happens since the lowest price that a stock can fall to is zero while there is no maximum price where it can move to.

Market sentiment and speculation

A common question is on the importance of market sentiment and parabolic moves. In most periods, many parabolic moves happens when there is excitement in the financial market and when interest rates are low. For example, the meme stock era happened when the Fed moved interest rates to zero during the Covid-19 pandemic.

Also, parabolic moves also happen more during the earnings season. For example, a stock can go vertical when a company publishes strong financial results and provides good guidance.

Why Parabolic moves happen

There are several reasons why parabolic moves happen in the stock market.

Recent News

First, they happen because of recent news. For example, if a relatively small biopharmaceutical company announces progress in its clinical trials, chances are that many people will rush to buy the stock.

This will see the company’s shares jump as they start pricing-in the potential for the company.

Earnings

Second, earnings are important causes of these moves. In the United States, companies must publish their earnings every quarter. If a company reports better-than-expected earnings results and forward guidance, there is a probability that the share price will rise sharply.

While this price action happens for all companies, it tends to be pronounced for small-cap stocks.

M&A

Third, mergers and acquisition leads to significant parabolic moves because in most cases, an acquirer needs to pay a premium for shareholders of the other company to approve the deal.

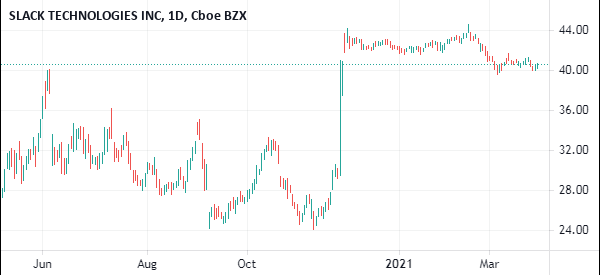

It is therefore common for the stock price to experience a sharp move. For example, in early 2021, Slack shares rose sharply after Salesforce announced its plan to acquire the firm.

Other popular reasons why stocks experience these moves are management changes, social media buzz, and a major event.

Sector/industry trend

Another thing to know about parabolic moves is that they could be correlated with a sector or industry. For example, a parabolic move in an energy stock like ExxonMobil and Chevron can trigger similar moves in companies in the industry.

These moves happen because companies in the same sector tend to have similar characteristics. For example, firms like Chevron and Exxon are usually moved by the same factors.

Therefore, it is always important to look at the top catalysts for the move and whether there is a relationship.

Behavioral finance factors

Behavioral finance explores how investor psychology and biases drive market actions. Parabolic price moves, characterized by sudden surges, can be explained by behavioral concepts like the fear of missing out (FOMO) and herd mentality.

FOMO pushes investors to ignore rational analysis and join buying frenzies to avoid missing potential gains. Herd mentality prompts individuals to mimic the actions of a larger group, assuming collective wisdom.

Both are fueled by biases like anchoring, confirmation bias, and social proof. In essence, the interplay of FOMO and herd mentality showcases how psychological factors contribute to irrational price surges, offering insight into market behavior.

Examples of parabolic movers

There are many examples of parabolic movers in the stock market. A good example is the price action of SPI Energy in September 2020. After spending in a range of below $1.5 for months, the stock surged by more than 4,000% within a day, as shown below.

A dig deeper into this price action shows that the company has announced its launch of its electric vehicle subsidiary. At the time, stocks of all electric vehicle companies were rising as investors price-in the future of mobility.

»How to Trade Electric Vehicle Industry«

Similarly, as shown above, the stock of Slack Technologies rose by more than 83% within a few days after the acquisition news by Salesforce.

How to trade parabolic moves

There are a few strategies to use when trading parabolic movers.

Identify them in charts

First, you need to identify the companies showing parabolic moves. A good approach to doing this is to first identify the firms showing these moves.

You can do this by checking the latest premarket movers or having a stock watchlist to use.

As you will find out, you will always miss the first move since they tend to happen within seconds. Therefore, the right approach is to trade the following moves.

Analyze the news

Second, you should try and dig deeper into the news. A simple Google search of the company’s name will show you some of the reasons.

For example, as shown above, in the case of an acquisition, there are no major moves after the news comes out. That’s because, unless there is uncertainty or a bidding war, the stock will remain at the acquisition level until the deal closes.

However, in the case of other news like management changes and earnings, the stock could have some significant fluctuations.

Therefore, always look at the reasons before you trade the stock. If the reasons are valid, the stock could continue rising. If the reasons are minor, it could decline, which makes it easier to bet against the firm.

Identify Support and Resistance Levels

Third, since technical indicators are useless when this happens, it is important that you use your eyes to identify potential support and resistance levels. You can also include tools like the Fibonacci retracement to identify areas where the stock will move to next.

Look at the Volume

Finally, always look at the volume and use risk management tools like stop loss and take profits.

The volume will guide you to understand the demand and supply of the stock. If there is high volume, chances are the upward trend will continue. A stop loss is important to prevent your account from losing a substantial amount.

Buy and short a parabolic stock

A common question is whether it is recommended to buy or short a parabolic stock. We recommend that traders should wait before making a move. This waiting process will help you assess the reason for the movement.

In most periods, buying a stock that has gone parabolic will see you lose money when the move becomes short-lived. Also, at times, a parabolic stock can remain at a higher level without much action.

At times, it can make sense to short a parabolic stock. One way to do this is to first check the reason behind the move. If it is not a very important move, you can go against the jump and short it.

A good example of this is a small cap and unprofitable company that sends a press release committing to share buybacks. In most cases, that buyback will not happen, meaning that the stock will ultimately retreat.

Final thoughts

Parabolic moves are relatively common events in the premarket. They refer to a situation where a company’s share price jumps significantly from its normal range. In this article, we have looked at why these moves happen and some of the strategies to use when trading them.

What is your best strategy to make profits from these situations?

External Useful Resources

- Parabolic Moves Always Have Their Reasons – Financial Sense